- The Warmup by Kaizen

- Posts

- Zcash Jump Scare

Zcash Jump Scare

PLUS: The Strategy Scare That Almost Was

Welcome back to The Warmup.

It’s Friday, and leverage traders are learning they could just hold spot positions.

Here’s what we’re watching:

Market Snapshot

Zcash Jump Scare

BTC EMA200 Reclaim Play

The Strategy Scare That Almost Was

Market: SOL leads with strong momentum, BTC is steady, ETH lags slightly, while equities are mixed and a rising VIX signals underlying volatility.

Zcash Jump Scare

What’s going on:

Zcash saw a sharp sell-off after governance confusion sparked fears that its core dev team had abandoned the protocol.

Early Thursday, comments from the CEO of the Electric Coin Company were misread as the entire team walking away, triggering a fast 25% dump in ZEC.

Hours later, that narrative flipped.

The team clarified they’re still fully committed to building Zcash, but are reorganizing under a new for-profit structure after governance disputes with the Bootstrap board and ZCAM.

The protocol itself is unaffected, development is ongoing, and the same builders are still behind it.

ZEC bounced 10% on the clarification, though it remains below recent highs.

What it means:

This was more governance noise than fundamental damage.

In a market already sensitive around privacy coins, the initial headline caused panic, but the follow-up was closer to neutral-to-slightly bullish.

With privacy back in focus and comparisons constantly drawn against Monero, Zcash’s long-term outcome is still debated.

But one thing’s clearer now: the core team is aligned, active, and still pushing the privacy mission forward.

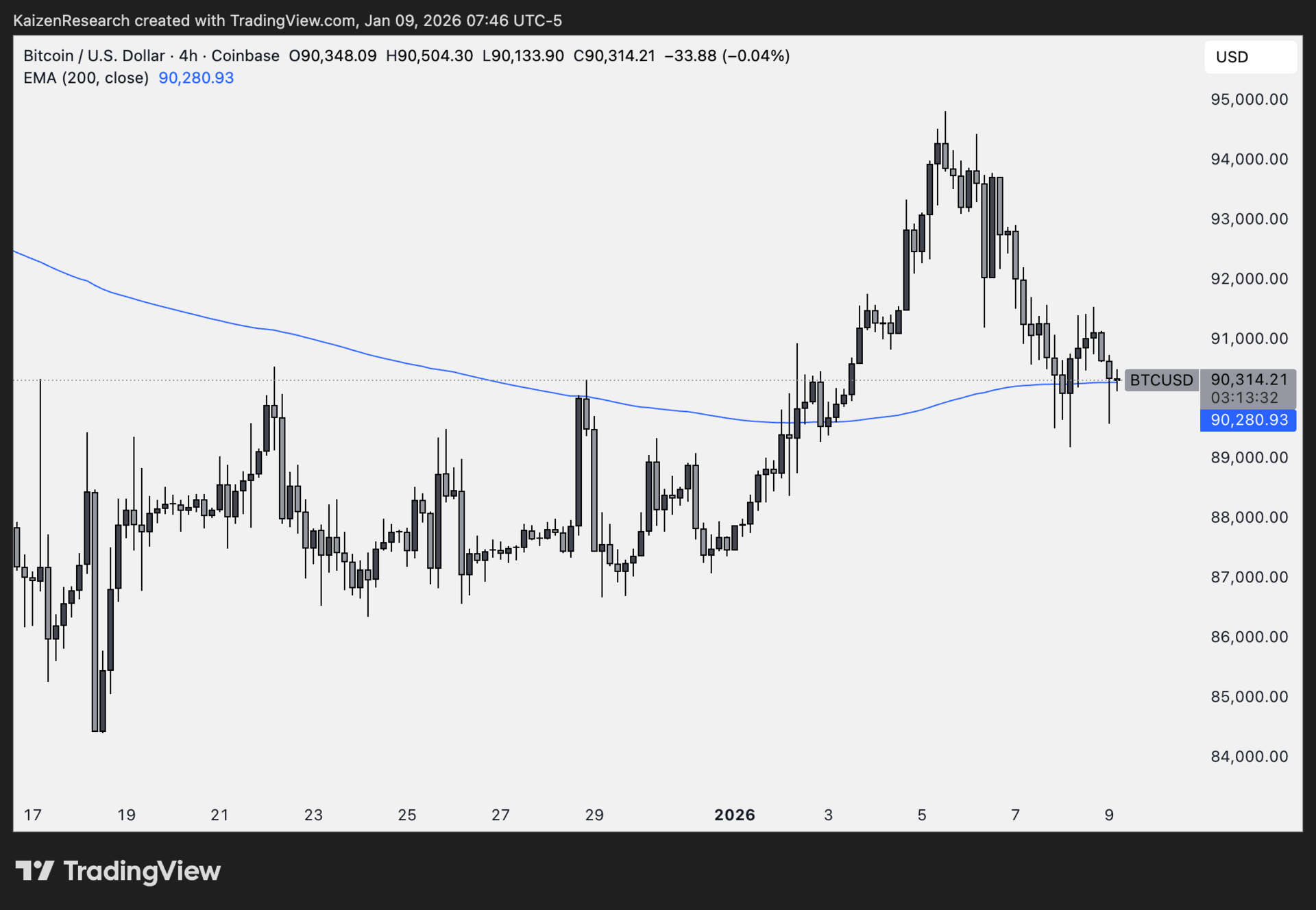

BTC EMA200 Reclaim Play

What’s going on:

BTC has reclaimed and is holding above the 4H EMA200 (blue), keeping the broader structure bullish despite the recent pullback.

The last two 4H candles closed bullish, suggesting short-term momentum is turning back in favor of the bulls.

Key levels we’re watching:

Support: 90,000 → EMA200 + demand zone

Resistance: 92,000 → first upside reaction level

Upside target: 95,000 → prior local highs

Invalidation: 4H close below 89,000 breaks structure

Directional Bias: Cautiously bullish

What we’re waiting for:

Acceptance above the EMA200

Follow-through strength into 92K

Risk reduced and stops moved to break-even after TP1

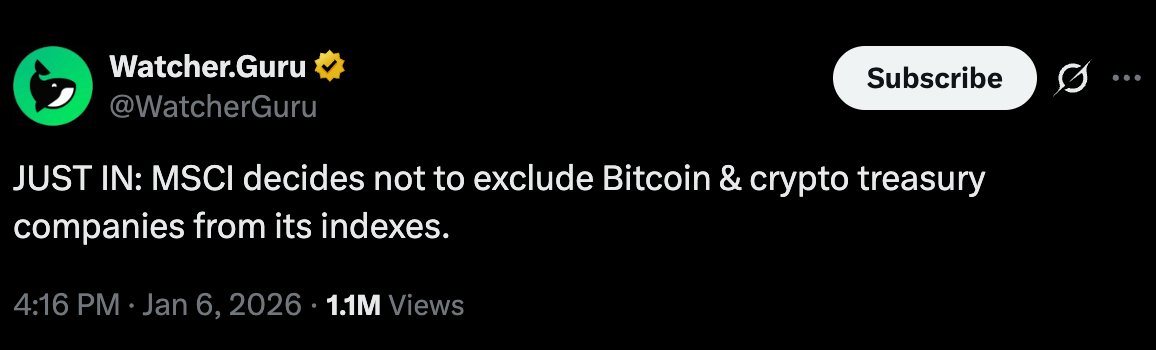

The Strategy Scare That Almost Was

What’s going on:

Last year’s BTC drawdown had a hidden scare behind it.

MSCI was debating whether companies like Strategy should stay in their indices or be treated more like funds. If Strategy got removed, massive passive funds would’ve been forced to sell, with knock-on risk to Bitcoin itself.

That worst-case scenario is now off the table. MSCI confirmed Strategy stays in the indices.

But there’s a trade-off.

MSCI won’t increase recommended allocations to these treasury-style companies as they grow. That breaks the feedback loop that helped push Strategy higher by combining share issuance, BTC buys, and rising passive inflows.

What it means:

The downside risk faded, but the easy upside did too. Strategy is still in the game, just without the automatic index-driven boost.

| SKR: |

| Polymarket: |

| POL: |

| FTT: |

Strategy (MSTR) after MSCI’s decision? |

Institutions aren’t chasing narratives or vibes, they’re buying infrastructure, liquidity, and things that actually work at scale.

Tokenization and private or permissioned rails are quietly winning because they solve real problems, not because they trend on CT.

Most altcoins struggle because there’s no sustained institutional bid, while the winners look boring, compliant, and revenue-driven.

The takeaway is simple: the next phase of crypto rewards execution and utility, not hype, and capital will keep flowing to whatever institutions can actually use tomorrow.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.