- The Warmup by Kaizen

- Posts

- Visa Pushes USDC

Visa Pushes USDC

PLUS: The Fed Chair Race Just Got Interesting

Welcome back to The Warmup.

That’s a wrap. Wednesday happened. We survived enough.

Here’s what we’re watching:

Market Snapshot

Visa Pushes USDC Settlements Onchain

Bitcoin Bear Flag Play

The Fed Chair Race Just Got Interesting

Market: Crypto leads risk-on. BTC above $90K, ETH back over $3K, SOL showing strength while equities lag.

Visa Pushes USDC Settlements Onchain

What’s going on:

Visa has rolled out USDC settlement for U.S. banks on Solana, with Cross River Bank and Lead Bank already live.

Instead of waiting days for traditional bank settlements, institutions can now move dollars 24/7 using stablecoin rails. Visa plans to expand the service across its network through 2026 as demand for faster, programmable payments grows.

This builds on Visa’s long-term stablecoin push.

The company has tested USDC since 2021, expanded stablecoin settlements globally, and recently launched a dedicated stablecoin advisory unit to help banks adopt digital dollars.

What it means:

Visa isn’t experimenting anymore. It’s operationalizing stablecoins.

As settlement moves onchain, stablecoins are becoming core financial infrastructure, not just a crypto use case.

For crypto, this is steady, structural adoption (not hype) and it’s happening inside the traditional banking system.

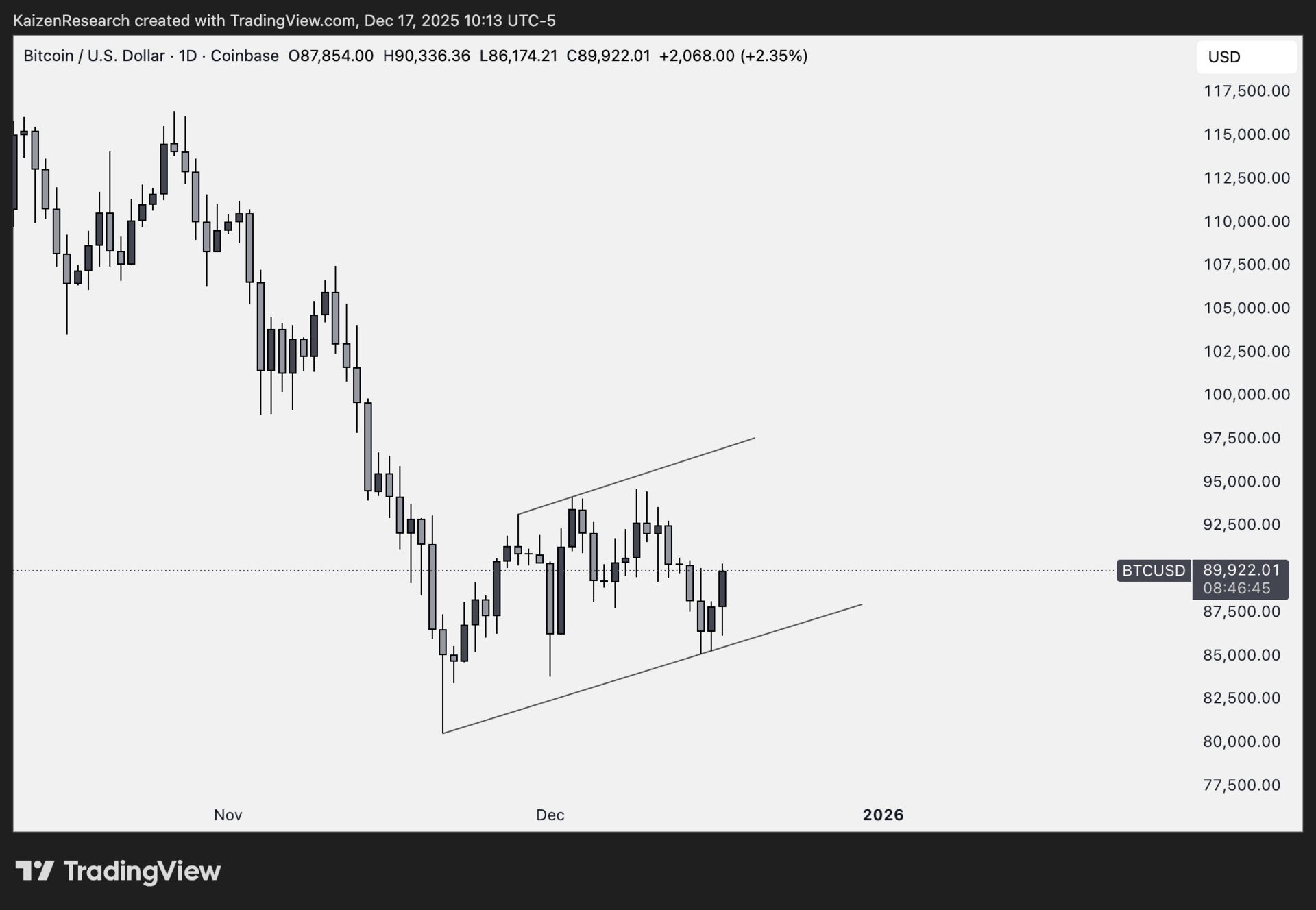

Bitcoin Bear Flag Play

What’s going on:

Bitcoin broke down from a rising wedge and is now consolidating into a bear flag. Instead of accelerating lower, price is compressing along flag support, creating a clear level-to-level setup.

This is a dynamic trade. Direction depends entirely on how price reacts at support.

Key levels we’re watching:

Support: $87.5K → bear flag support where buyers are stepping in

Breakdown risk: Clean acceptance below $84.8K opens the door to lower prices

Directional Bias: Neutral → reactive

What we’re waiting for:

Longs: Spot or low-leverage longs while price holds above $87.5K

Flip short: Decisive break and acceptance below $84K

Confirmation: Follow-through and momentum expansion in either direction

Bitcoin isn’t offering a directional edge yet, but the risk/reward is clean. Trade the level, respect invalidation, and let price decide.

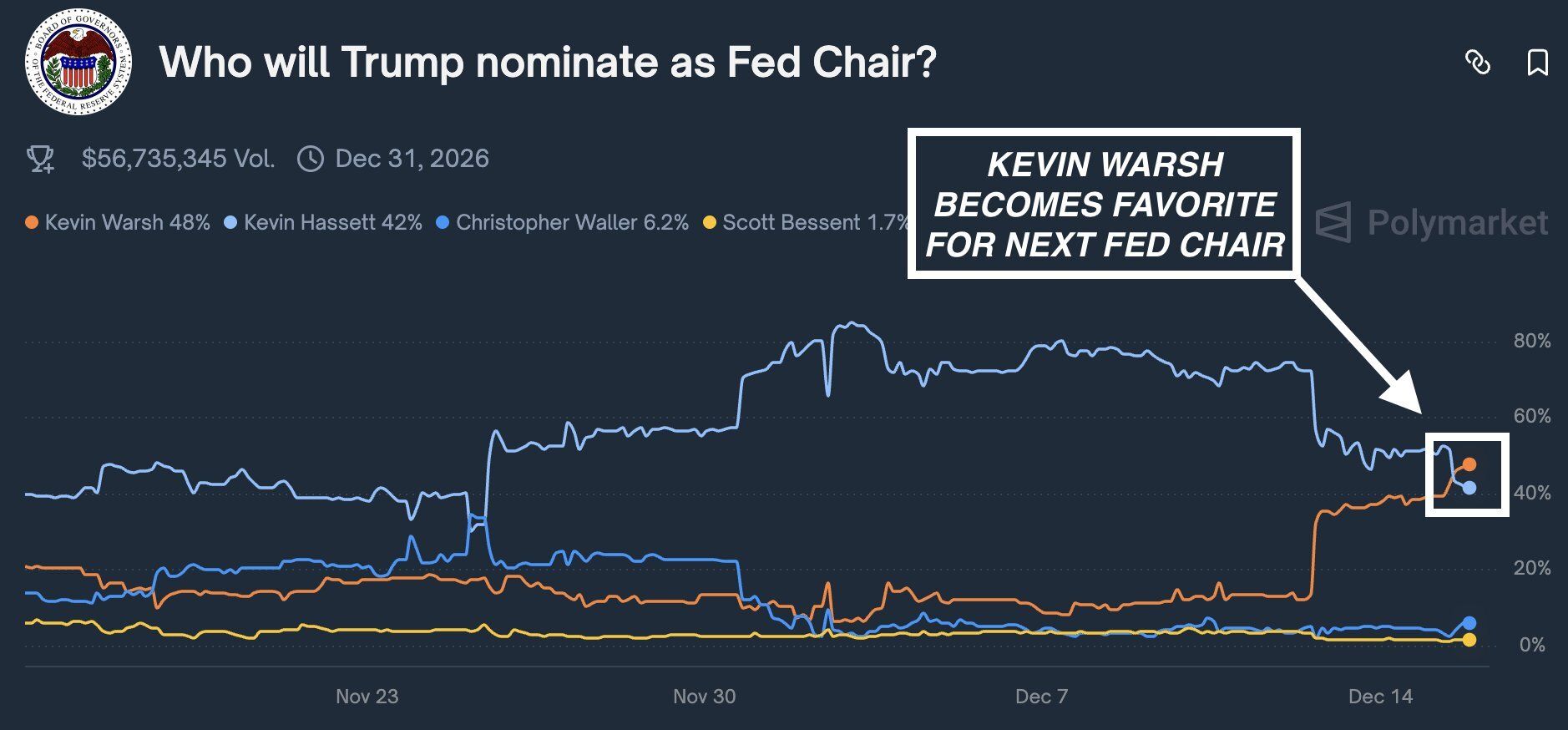

The Fed Chair Race Just Got Interesting

What’s going on:

The 2026 Fed Chair race flipped fast.

Kevin Hassett was the clear favorite. Ultra-dovish, close to Trump, and expected to cut rates aggressively. Markets weren’t thrilled. Treasury yields moved higher as investors worried about credibility and political pressure on the Fed.

Now Kevin Warsh is in the lead.

Former Fed Governor, ex-Morgan Stanley, and closely tied to Stanley Druckenmiller, Warsh is seen as the more market-friendly pick. Betting markets flipped in his favor after reports that Wall Street heavyweights pushed back hard against Hassett.

As Warsh gained momentum, Treasury yields cooled, signaling markets prefer a steadier hand.

Trump’s stance hasn’t changed. He still wants rates closer to 1% and expects the Fed Chair to listen to him.

What it means:

This isn’t about cutting rates or not. It’s about how.

Hassett means faster, riskier cuts. Warsh means slower, more controlled easing.

For markets and crypto, credibility matters. A cleaner path to lower rates is better than chaos.

| WLD: |

| Rainbow: |

| BNB: |

| HYPE: |

Who do you think becomes the next Fed Chair in 2026? |

Bitcoin isn’t breaking, but it is cooling off.

Demand has slowed, momentum has faded, and the market is being forced to reset expectations.

If weakness continues, $70K is the first line of defense, with $56K sitting below as the level where longer bear markets have historically found their footing.

The difference this time is the lack of blow-off euphoria, which suggests less chaos and more grinding price action.

Translation: patience matters here, and any rally should be treated as a test, not a victory lap.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.