- The Warmup by Kaizen

- Posts

- UNIfication Is Live

UNIfication Is Live

PLUS: Polymarket Layer-2 Rumors Are Heating Up

Welcome back to The Warmup.

This market feels like my girlfriend looking at the rare NFT I got her for Christmas.

Here’s what we’re watching:

Market Snapshot

UNIfication Is Live

ETH Head & Shoulders Watch

Polymarket Layer-2 Rumors Are Heating Up

Market: Crypto is cooling off across majors while equities grind higher, gold rips on risk hedging, and a rising VIX hints that volatility isn’t done yet.

UNIfication Is Live

What’s going on:

Uniswap governance passed the UNIfication proposal with near-unanimous support, officially flipping the protocol fee switch.

A portion of trading fees will now be routed to the protocol and used to burn UNI on an ongoing basis.

The proposal also streamlines operations under Uniswap Labs, removes interface and API fees, and introduces a UNI-funded growth budget.

After a short timelock, Uniswap will burn 100M UNI, roughly what would’ve been burned if the fee switch had existed since day one.

What it means:

UNIfication fundamentally changes UNI’s economics. As protocol usage grows, supply shrinks.

With Uniswap generating over $1B in annual fees and regulatory pressure easing, UNI is being repositioned as a long-term value-accrual asset rather than just a governance token.

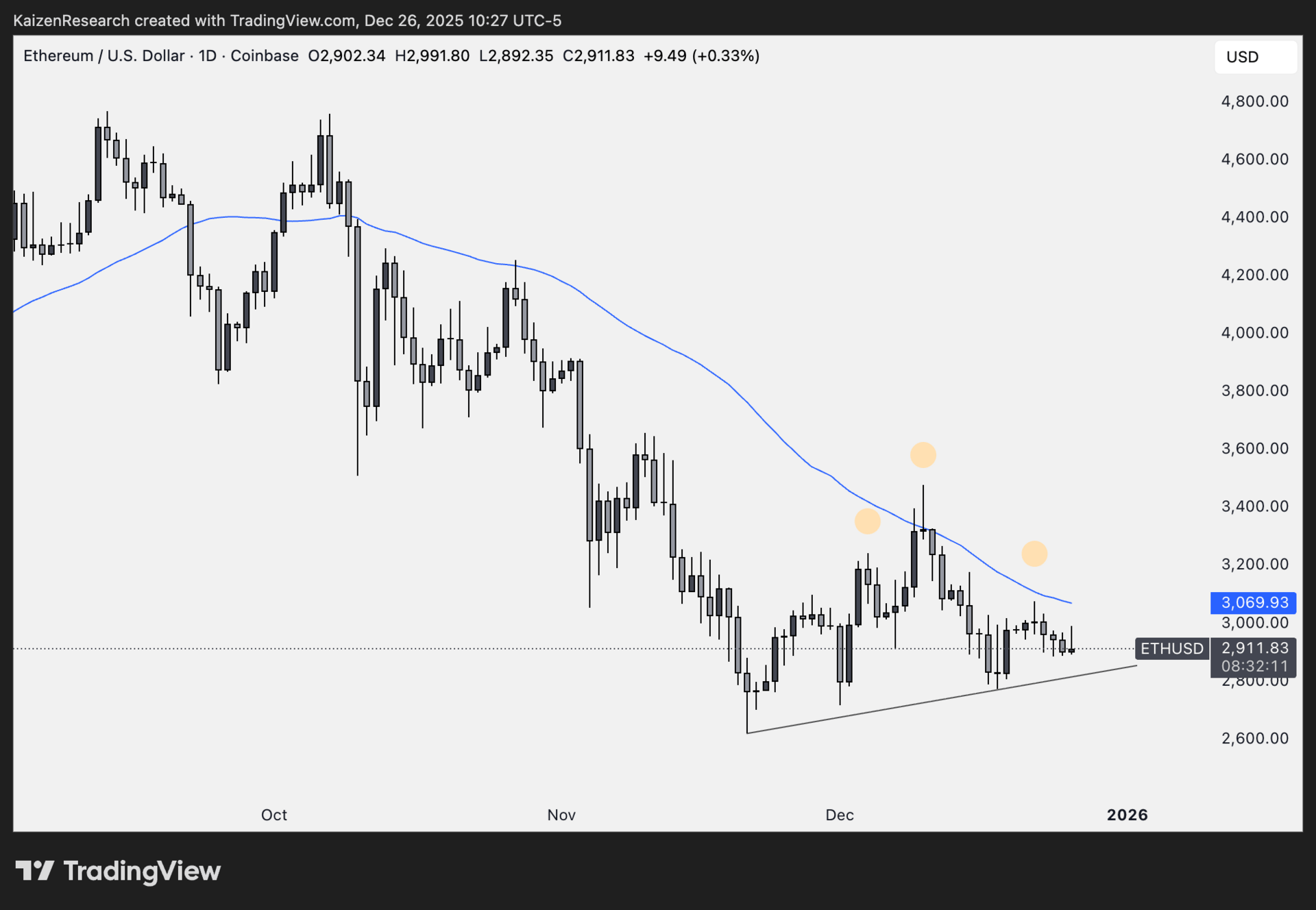

ETH Head & Shoulders Watch

What’s going on:

ETH has been in a downtrend since August, and a potential head and shoulders continuation pattern is forming. The left shoulder and head are in place, with the right shoulder developing as price rejects off the 50-day SMA.

A break below the neckline would signal bearish continuation.

Key levels we’re watching:

Support: Neckline → must hold to avoid downside

Resistance: 50-day SMA → rejection zone

Bearish target: $2,210 on breakdown

Invalidation: Holding the neckline

Directional Bias: Cautiously bearish

We’re letting structure confirm. The neckline break or hold will decide the next move.

Polymarket Layer-2 Rumors Are Heating Up

What’s going on:

Prediction markets are heating up, and Polymarket is right in the spotlight.

This week, speculation jumped after a developer suggested a Polymarket Ethereum Layer-2 is coming “very soon,” calling it a top priority following recent outages on Polygon.

Those reliability issues are fueling the case for a dedicated L2 that gives Polymarket tighter control over performance and uptime.

At the same time, user activity is picking up as traders increase volume in anticipation of a potential POLY token launch and airdrop, even though no official timeline has been announced.

What it means:

A Polymarket L2 would be a major infrastructure upgrade and a clear signal of long-term ambition.

If paired with a token launch, it could become a powerful catalyst for the prediction market narrative in crypto.

| SOL: |

| TWT: |

| GNO: |

| MOVE: |

Do you think Polymarket launches its own L2 in 2026? |

This drawdown was the price of liquidity leaving the system, not a failure of the crypto thesis.

With QT ending, rates cut, and reserves rising, the macro tide is quietly shifting back toward risk.

Crypto doesn’t move linearly, it compresses time, and the biggest gains tend to come when positioning feels uncomfortable.

Stay solvent, stay invested, and let liquidity and patience do what timing never will.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.