- The Warmup by Kaizen

- Posts

- UBS Is Eyeing Direct Crypto Trading

UBS Is Eyeing Direct Crypto Trading

PLUS: Trump just sued JPMorgan

Welcome back to The Warmup.

Happy Friday. This is how it feels knowing you could have picked ANY other asset instead of crypto and made more money.

Here’s what we’re watching:

Market Snapshot

UBS Is Eyeing Direct Crypto Trading

XMR Pullback Play

Trump just sued JPMorgan

Market: Stocks up, crypto slightly down. Feels like short-term consolidation, not panic, with BTC holding ~$89K while alts lag.

UBS Is Eyeing Direct Crypto Trading

What’s going on:

UBS is considering offering direct crypto trading to a select group of private banking clients, according to Bloomberg.

The world’s largest wealth manager, with ~$4.7T in client assets, has been quietly selecting partners for months, though no final decision or launch date has been set. If rolled out, the offering would be limited at first and focused on high-net-worth clients, not retail.

This would mark a step beyond UBS’s previous crypto exposure, which has mostly been tokenization projects and crypto-linked ETFs rather than spot trading.

What it means:

Private banking is slowly going onchain.

UBS joining the spot crypto party would be another signal that demand from wealthy clients is real and persistent. Big banks are no longer asking if they need crypto offerings, but how controlled and compliant they should be.

Quiet adoption, limited access, institutional rails first. That’s how crypto keeps creeping into traditional finance.

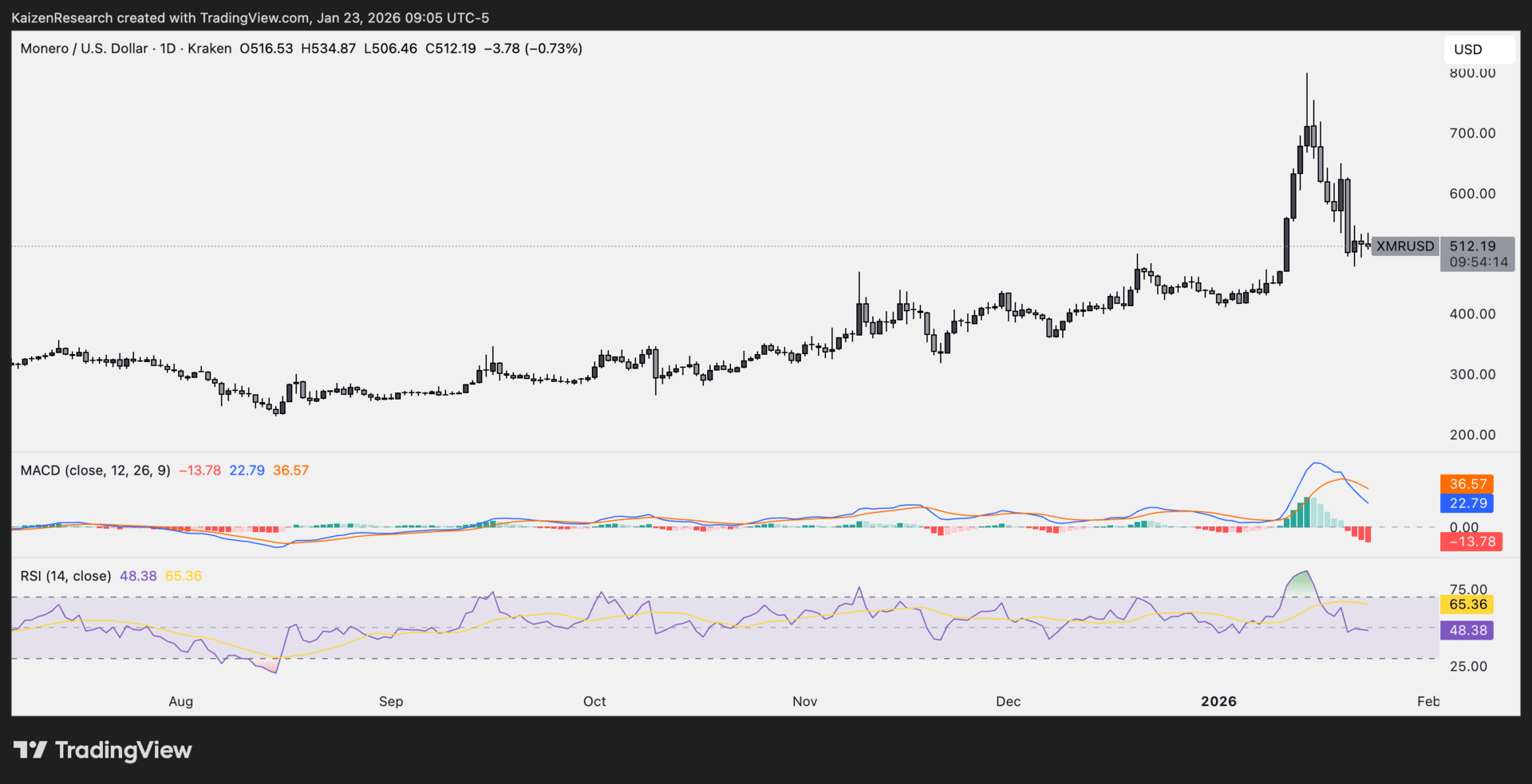

XMR Pullback Play

What’s going on:

Monero just put in a blow-off top near ~$800 and sharply rejected, rolling over into a pullback around ~$512. The move broke the short-term uptrend and cooled momentum.

RSI has reset toward its midpoint and MACD has turned bearish, pointing to distribution rather than continuation.

Key levels we’re watching:

Support: $440–$480 → potential base zone

Resistance: ~$600 → needs reclaim

Breakdown risk: Below $440 opens further downside

Directional Bias: Neutral, bullish only on a clean base

What we’re waiting for:

Price to stabilize in the $440–$480 range

Momentum and volume to flatten before entries

Trump just sued JPMorgan

What’s going on:

Trump sued JPMorgan and CEO Jamie Dimon, claiming the bank abruptly shut down several Trump-linked business accounts in 2021 for political reasons. JPMorgan denies this, saying accounts are only closed due to legal or regulatory risk.

The lawsuit has reignited the debanking debate, a long-standing issue in crypto where companies say banks quietly cut them off under vague “reputational risk” concerns. The industry has dubbed this trend “Operation Choke Point 2.0.”

What it means:

This pushes debanking into the political mainstream.

If pressure builds, banks may face tighter rules around when and how they can deny financial access.

For crypto, it reinforces the core thesis: permissionless systems exist because traditional banking access can disappear overnight.

| RAIL: |

| MEGA: |

| BTC: |

| BITGO: |

Does Trump’s JPMorgan lawsuit change anything about debanking? |

Bitcoin feels quiet not because it’s failing, but because speculation, leverage, and attention are being intentionally squeezed out.

While price chops sideways, institutions are building rails, regulation is taking shape, and distribution is quietly expanding.

This phase doesn’t reward excitement, it rewards conviction and patience. When Bitcoin finally moves again, it likely won’t feel obvious until it’s already too late.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.