- The Warmup by Kaizen

- Posts

- Trump Picks Kevin Warsh as Fed Chair

Trump Picks Kevin Warsh as Fed Chair

PLUS: When Will the Fed Cut Rates Again?

Welcome back to The Warmup.

Happy Friday! Cheers to the ex-crypto bros hearing someone say “Bitcoin” at their new job.

Here’s what we’re watching:

Market Snapshot

Trump Picks Kevin Warsh as Fed Chair

BTC EMA200 Retest Play

When Will the Fed Cut Rates Again?

Market: Broad risk-off move. Crypto is leading the downside, stocks are slightly red, DXY and VIX are up, and gold is selling off.

Trump Picks Kevin Warsh as Fed Chair

What’s going on:

Trump officially named Kevin Warsh as his pick for the next Fed Chair, confirming what prediction markets had already priced in overnight.

Warsh is a former Fed governor, ex–Morgan Stanley banker, Stanford lecturer, and partner at Duquesne Family Office alongside Stanley Druckenmiller.

He’s widely seen as an inflation hawk, openly critical of QE, and supportive of reshaping the Fed’s framework.

He’s also relatively crypto-friendly.

Warsh has said Bitcoin doesn’t threaten the dollar and can act as a signal when monetary policy goes wrong, while still opposing unchecked financial excess.

With Powell set to leave in May, attention is already shifting away from the current chair.

What it means:

Powell is effectively sidelined.

Markets will start trading expectations around Warsh’s Fed before he even takes office. Despite his hawkish reputation, his credibility could allow him to cut rates if inflation rolls over, especially with AI-driven productivity acting as a disinflationary force.

The Fed pause just turned into a transition. And the shadow Fed Chair just became the main signal.

BTC EMA200 Retest Play

What’s going on:

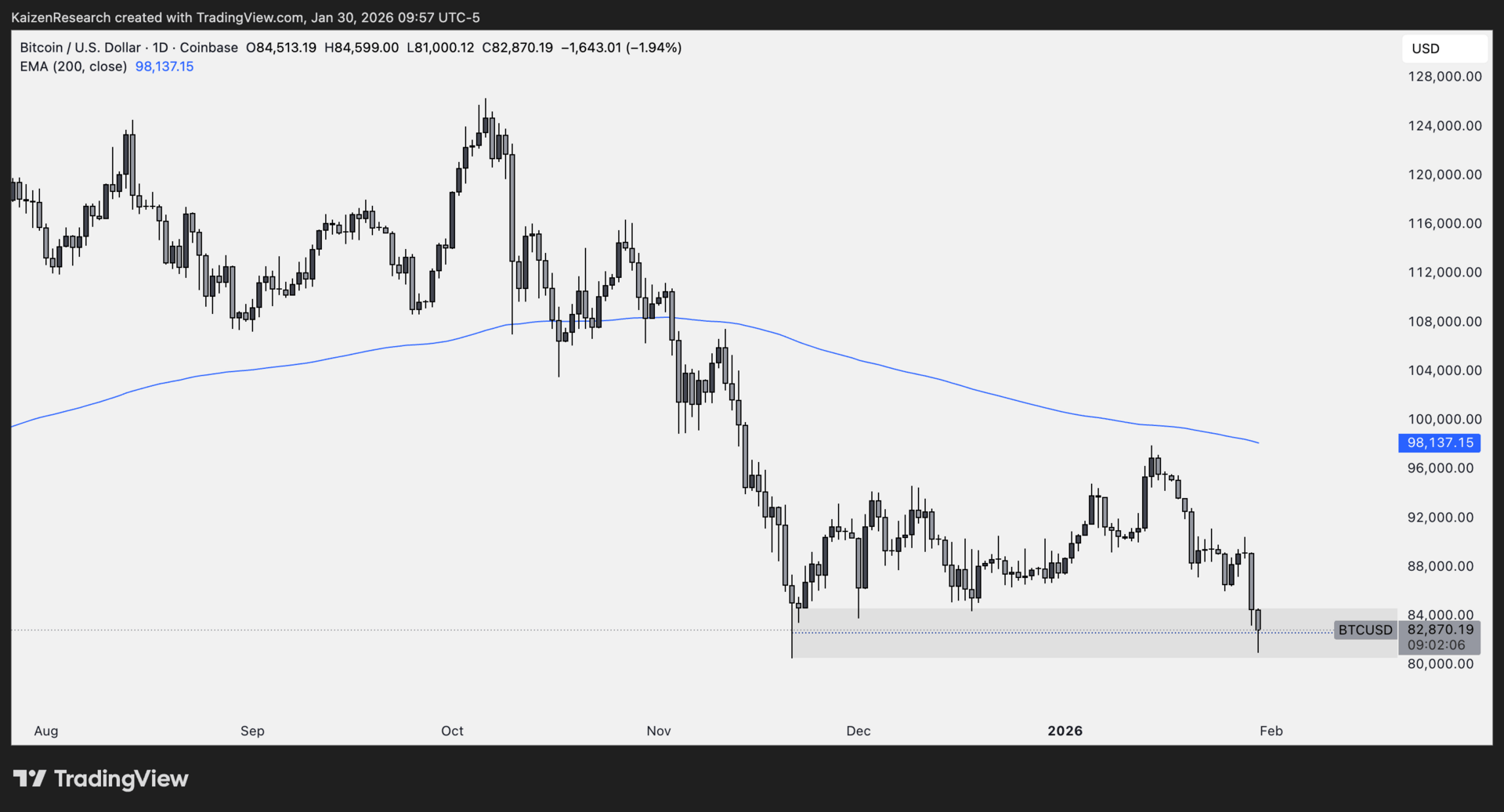

Bitcoin is trading near $83K and heading into a major demand zone after failing to reclaim the daily EMA200 (~$98K). The $79K–$82K area is the main point of interest.

Key levels we’re watching:

Support: $79K–$82K

Resistance: $88K–$90K

Major resistance: $98K (EMA200)

Risk: Loss of $79K = more downside

Directional Bias: Neutral → cautiously bearish until support holds.

What we’re waiting for:

Lower-timeframe reversal signals and a strong reaction at $79K–$82K before considering longs.

When Will the Fed Cut Rates Again?

What’s going on:

The Fed did exactly what everyone expected: nothing.

Rates were left unchanged, with markets pricing less than a 5% chance of a cut going into the meeting.

Powell acknowledged some improvement in the labor market and called inflation “modestly positive,” but made it clear the Fed isn’t ready to declare victory yet.

The key line was subtle but important: “It’s not our base case that the next move will be a rate hike.”

Translation: cuts are still on the table, just not right now.

Inflation is still above target, but Powell framed much of the recent stickiness as tariff-driven and likely a one-time effect that’s now passing through. Meanwhile, jobs data has stabilized just enough to keep the Fed in wait-and-see mode.

Under the hood, the Fed is increasingly split. Two voting members dissented and pushed for a 25bps cut, reinforcing the idea of a more divided, less unified central bank.

What it means:

The rate-cut cycle isn’t dead, it’s paused.

Markets are still pricing the first cut around June or July, likely after Powell exits, with a second cut later in the year but far from guaranteed. Until inflation breaks lower or the labor market cracks again, Powell is content to coast.

The bigger story is what comes next.

With only two meetings left in Powell’s term, attention is already shifting to the incoming Fed Chair and what they’ll signal. Once that happens, Powell may stop mattering altogether.

| COIN: |

| BNB: |

| HYPE: |

| MEGA: |

When does the Fed actually cut rates? |

This isn’t just a metals rally, it’s a signal that something deeper is breaking in global finance.

When bonds stop acting like a safe haven and currencies quietly lose credibility, capital naturally flows toward what can’t be printed or promised away.

Japan is showing us the endgame early, but the pressures it faces aren’t unique.

In a world of rising debt and policy uncertainty, owning real assets isn’t a trade, it’s risk management.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.