- The Warmup by Kaizen

- Posts

- The Weekend Bloodbath

The Weekend Bloodbath

PLUS: Inside Tether’s $10B Money Machine

Welcome back to The Warmup.

Happy Monday! This is how it feels when your portfolio went to zero and you don’t have to worry about the crypto market anymore.

Here’s what we’re watching:

Market Snapshot

Inside Tether’s $10B Money Machine

The Weekend Bloodbath

Calendar

Market: After the weekend selloff crypto is grinding higher with SOL leading, equities steady, and VIX falling, signaling improving risk appetite despite a slightly firmer dollar.

Inside Tether’s $10B Money Machine

What’s going on:

Tether generated $10B+ in net profit in 2025, cementing its position as one of the most profitable private companies in the world.

USDT supply surged by $50B+ last year, pushing total circulation to $186B, backed by $193B in assets and $6.3B in excess reserves.

Most of that backing sits in $122B of U.S. Treasurys, making Tether one of the largest holders of U.S. government debt globally.

The company also holds ~140 tons of gold and continues investing into bitcoin mining, AI, and payments, while rolling out its U.S.-based stablecoin, USAT.

What it means:

Tether isn’t just a stablecoin issuer anymore. It’s a global liquidity engine.

As stablecoins scale, Tether keeps quietly compounding power, profits, and influence across crypto and traditional markets alike.

The Weekend Bloodbath

What’s going on:

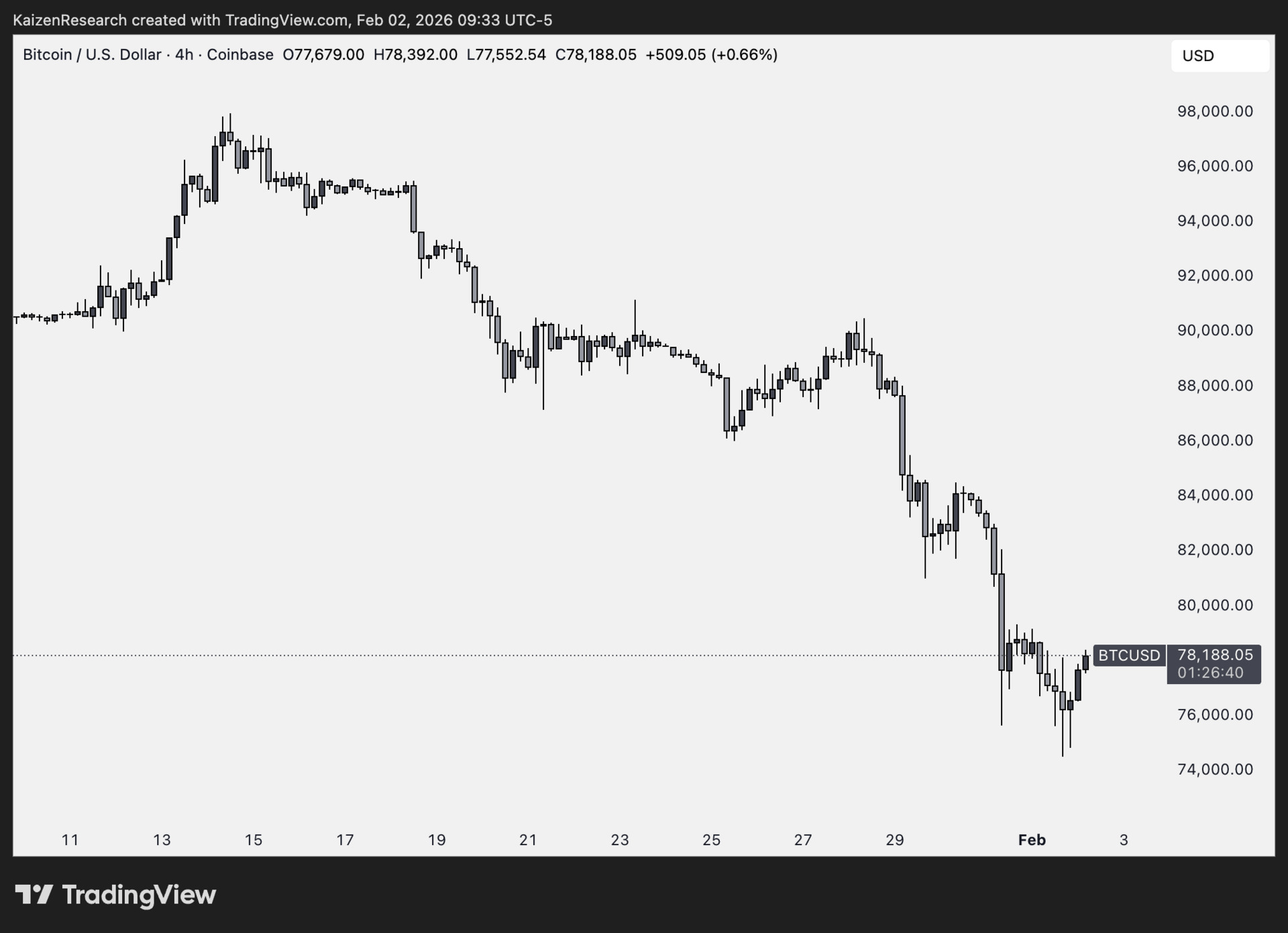

Bitcoin fell 7%+ over the weekend, dropping from ~$84K to $75.5K before bouncing near $78K. The move pushed BTC below its True Market Mean ($80.5K) for the first time in ~30 months.

Liquidations followed hard. Around $5B was wiped out, almost entirely longs.

Ethereum took the biggest hit with $1.15B in liquidations after falling as much as 17%.

Solana saw nearly $200M liquidated and lost the $100 level.

Catalysts included renewed hawkish fears after Trump’s Kevin Warsh nomination, geopolitical jitters from reports near Iran’s Bandar Abbas port, and brief U.S. government shutdown uncertainty.

But zooming out, this looks a lot like the 4-year crypto cycle playing out.

What it means:

This was the largest liquidation cascade since October, driven less by a single shock and more by overcrowded longs.

The irony? Institutions aren’t backing off. Surveys show most still see BTC undervalued and are willing to hold or add on dips.

Near term, the trend looks bearish, and it likely gets worse before it gets better. The next few days should tell us whether this was just a flush or something deeper.

| HYPE: |

| Polymarket: |

| JUP: |

| Rainbow: |

Key Events this Week

Major token unlocks:

Hyperliquid (HYPE): ~$305M unlock on Feb 6 (~2.8% of supply)

Berachain (BERA): ~$64M unlock on Feb 6 (~41% of supply)

Macroeconomic data calendar:

Mon (Feb 2):

January ISM Manufacturing PMI: Factory activity snapshot → above 50 signals expansion; below 50 points to contraction and slowing growth. (Institute for Supply Management)

Tue (Feb 3):

December JOLTS Job Openings: Measures labor demand → fewer openings suggest cooling labor markets and easing wage pressure. (Bureau of Labor Statistics)

Thu (Feb 5):

Initial Jobless Claims: Weekly labor stress check → rising claims = weakening labor market.

Fri (Feb 6):

January Jobs Report: Payrolls, unemployment rate, and wages → the key input for Fed expectations and risk sentiment.

Major Earnings Releases:

Mon (Feb 2): Palantir

Tue (Feb 3): PayPal, Galaxy, AMD

Wed (Feb 4): Uber, Alphabet, UBS

Thu (Feb 5): Amazon, Iren, Strategy

After this weekend’s liquidation flush, what happens next? |

Markets feel broken, but the damage isn’t structural, it’s liquidity starvation.

BTC and SaaS sold off not because the cycle died, but because U.S. liquidity was temporarily drained by shutdowns, TGA rebuilds, and a gold liquidity grab.

As those hurdles clear and policy shifts toward easing, the same forces that crushed price will reverse.

This is a time game, not a price game and patience is the edge before the liquidity cavalry arrives.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.