- The Warmup by Kaizen

- Posts

- The Tokenization Switch Just Flipped

The Tokenization Switch Just Flipped

PLUS: Tether Going After Juventus

Welcome back to The Warmup.

If the market’s been rough, don’t worry. You’re not broke, you’re just illiquid.

Here’s what we’re watching:

Market Snapshot

The Tokenization Switch Just Flipped

Bitcoin Decision Zone

Crypto Is Buying Legacy Institutions

Calendar

Market: Broad risk-off move. Crypto and stocks are red, VIX is up, gold is bid.

The Tokenization Switch Just Flipped

What’s going on:

After years of telling crypto to sit tight, U.S. regulators just made their clearest move yet toward bringing tokenized assets into the mainstream.

The SEC quietly issued a no-action letter that allows certain firms to launch tokenized equity products without immediate enforcement risk. That’s not an endorsement, but it is a green light to start building.

At the same time, the OCC approved national bank charters for crypto-native firms like Circle and Ripple, officially pulling stablecoins and crypto infrastructure into the U.S. banking system.

This isn’t happening in a vacuum. Tokenized stocks, stablecoins, and real-world assets are already gaining traction across Ethereum, Solana, and emerging hybrid platforms. Regulation is now catching up to reality.

What it means:

Tokenized equities unlock real advantages traditional markets can’t match. Always-on trading, global access, faster settlement, and programmable ownership aren’t features, they’re structural upgrades.

On the stablecoin side, OCC approval means regulated money, direct banking access, and a narrowing gap between TradFi and DeFi. Once crypto becomes part of financial plumbing, it’s very hard to reverse.

For investors, this shifts the question from if tokenization happens to who benefits most.

That’s where the next wave of demand will concentrate.

Bitcoin Decision Zone

What’s going on:

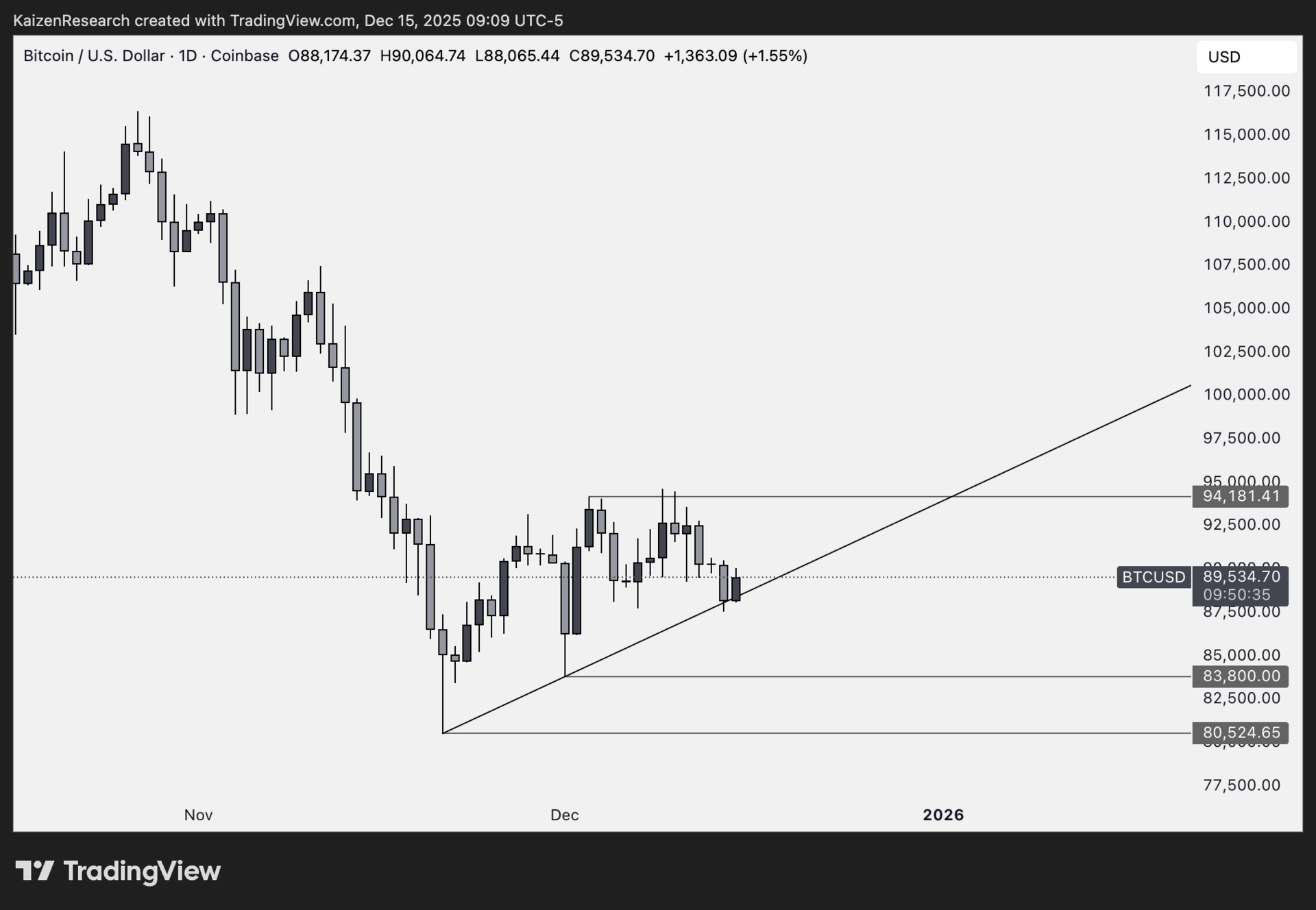

Bitcoin is compressing into a key inflection point as price trades around $90K, stuck between a descending trendline from the ATH and rising support from the $80K lows.

This kind of squeeze usually resolves with a liquidity sweep before the next directional move. With equities still weak, downside risk remains in the short term.

The chart shows clear liquidity resting below current price, making a downside probe more likely before any sustained upside attempt.

Key levels we’re watching:

Support: $84K–$80K → major structural support and rising trendline confluence

Resistance: $94K → range high and key reclaim level

Upside target: $100K → psychological level and relief rally objective

Breakdown risk: Daily close below $80K would invalidate the structure

Directional Bias: Neutral to cautiously bullish

BTC is at decision time. A clean liquidity sweep into support followed by a strong reaction would improve risk/reward significantly.

What we’re waiting for:

Spot buying or low-leverage longs after a sweep into $84K–$80K

Reclaim of $94K to confirm strength

Patience and tight risk management while BTC remains in compression

Let the market show its hand before committing.

Crypto Is Buying Legacy Institutions

What’s going on:

Tether, the issuer of USDT and arguably the most profitable crypto company in the world, has submitted an all-cash bid to acquire Exor’s entire controlling stake in Juventus Football Club.

This isn’t a random headline grab. Tether already bought a minority stake earlier this year, and now it’s moving to take full control, pending regulatory approval.

If the deal goes through, Tether says it’s ready to inject €1B into the club’s development. For context, Juventus is one of Europe’s most recognizable football brands, with partnerships including Adidas, Jeep, and Allianz.

Tether has generated over $10B in profits in the first three quarters of this year, and it’s clearly looking to deploy that capital beyond crypto-native bets like AI and gold.

What it means:

This is crypto capital stepping fully into legacy power structures.

Buying a club like Juventus isn’t about short-term ROI. It’s about brand, legitimacy, and global influence.

Owning a cultural institution that predates Bitcoin by more than a century puts Tether in a completely different conversation with regulators, institutions, and the public.

| Kalshi: |

| HYPE: |

| COIN: |

| SOL: |

Key Events this Week

Major token unlocks:

Arbitrum (ARB): ~$19M unlock on Dec 16 (~2% of supply)

LayerZero (ZRO): ~$38M unlock on Dec 20 (~7% of supply)

Macroeconomic data calendar:

Tue (Dec 16):

October Retail Sales: Tracks consumer spending → strong data signals resilient demand; weakness points to slowing growth.

November Jobs Report: Measures labor market health → cooling jobs data eases inflation pressure; strength keeps policy restrictive.

Thu (Dec 18):

November CPI Inflation: Core inflation gauge → key input for Fed policy. Higher CPI = tighter financial conditions; softer CPI supports easing expectations.

December Philly Fed Manufacturing Index: Regional activity survey → positive readings signal expansion; negative readings imply contraction.

Fri (Dec 19):

October PCE Inflation: The Fed’s preferred inflation metric → critical for rate-cut timing and policy direction.

November Existing Home Sales: Measures housing market demand → higher sales show stabilization; declines signal ongoing pressure.

Michigan Inflation Expectations: Gauges future inflation outlook → rising expectations complicate Fed easing.

Michigan Consumer Sentiment: Measures household confidence → stronger sentiment supports consumption and growth.

Major Earnings Releases:

Thu (Dec 18): Nike

Tether trying to buy Juventus is… |

A new Fed chair, easier financial conditions, and regulatory clarity all point in the same direction.

Whether growth stays strong or something breaks, the policy response is likely more liquidity.

History shows Bitcoin thrives in both scenarios. Different paths, same trade.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.