- The Warmup by Kaizen

- Posts

- The Real Bull Market Is Happening Onchain

The Real Bull Market Is Happening Onchain

PLUS: Coinbase Is Making a Power Move

Welcome back to The Warmup.

Friday energy. Nobody’s online. Just us, a few charts, and the people still bullish on crypto in 2026.

Here’s what we’re watching:

Market Snapshot

The Real Bull Market Is Happening Onchain

XRP Descending Triangle Play

Coinbase Is Making a Power Move

Market: Stocks up, volatility down. Crypto still range-bound and waiting for a catalyst.

The Real Bull Market Is Happening Onchain

What’s going on:

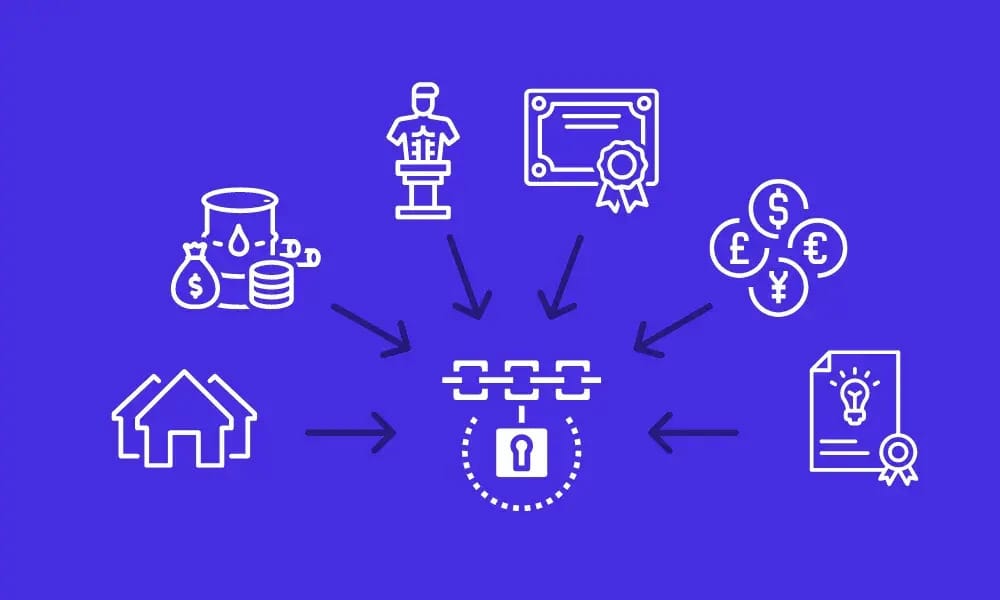

While crypto markets have been noisy and emotional, traditional finance is quietly pushing tokenization forward.

Visa just greenlit USDC settlements on Solana for U.S. banks, with Cross River and Lead Bank already live.

JP Morgan launched a tokenized money market fund on Ethereum, seeded with $100M and aimed squarely at institutions.

The DTCC, one of the most important pieces of global market plumbing, partnered with Canton Network to tokenize assets under its custody.

What it means:

TradFi isn’t asking if tokenization works. They’re deciding where and how fast to deploy it.

Stablecoins, tokenized funds, and onchain settlement are becoming part of the financial system’s backbone, not a side project.

While retail sentiment swings, institutions are laying tracks for the next decade of markets.

Tokenization is moving forward, with or without crypto hype.

XRP Descending Triangle Play

What’s going on:

XRP has been trading lower inside a descending triangle on the weekly chart for the past couple of months. Price is now sitting near a potential support zone around $1.75, a level that’s only been tested once before.

Momentum remains bearish, with weekly RSI near 37, but downside pressure is fading. Volume has declined as price moved lower, which often signals seller exhaustion rather than aggressive distribution.

Key levels we’re watching:

Support: $1.75 → must hold for a bounce setup

Resistance: Top of the triangle → breakout level to watch

Upside target: $3 if breakout confirms

Breakdown risk: Close below $1.6 opens downside

Directional Bias: Neutral → leaning cautiously bullish if support holds

What we’re waiting for:

Confirmation that $1.75 holds as support before considering longs

A clean breakout above the triangle with volume

Strict risk management due to ongoing bearish structure

Coinbase Is Making a Power Move

What’s going on:

Coinbase just flipped the script on what a “crypto exchange” is supposed to be.

In a single night, they dropped years’ worth of products aimed at turning Coinbase into a true everything app for finance.

Stocks and ETFs now live next to crypto

Prediction markets, equity perps, and futures are coming inside the same app

Solana tokens can be swapped directly through Jupiter

Users can borrow against their BTC and ETH without selling.

At the same time, Coinbase pushed Base globally, rolled out business payment tools, expanded stablecoin infrastructure, and introduced an AI assistant to help users manage it all.

What it means:

Coinbase isn’t just competing with Binance or Kraken anymore. It’s stepping into the ring with brokerages, fintech apps, banks, DeFi protocols, and prediction markets all at once.

If this strategy works, Coinbase becomes the front door to trading everything: stocks, tokens, derivatives, and stablecoins.

The borrow feature and tokenized assets could be especially powerful for long-term holders and institutions.

Bottom line: Coinbase wants to be the place where all markets meet.

| ONDO: |

| MegaETH: |

| Kalshi: |

| MetaMask: |

What do you think comes next for crypto? |

This pullback was driven by macro and liquidity, not by crypto breaking.

Those pressures are easing as rate cuts are in, QT is over, and forced selling has mostly cleared.

The bigger economic setup still looks positive heading into 2026.

That doesn’t mean prices explode tomorrow, but it also means a long bear market is unlikely.

Stay patient, focus on the big picture, and don’t trade on emotion.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.