- The Warmup by Kaizen

- Posts

- The Perfect Setup for Crypto?

The Perfect Setup for Crypto?

PLUS: BlackRock Thinks 2026 Is a Risk-On Year

Welcome back to The Warmup.

Lost $600k on perps, still got charged for guac. If that isn’t peak Friday energy, I don’t know what is.

Here’s what we’re watching:

Market Snapshot

BlackRock Thinks 2026 Is a Risk-On Year

BTC Hidden Divergence Setup

When The Money Printer Meets The Robot Revolution

Market: Crypto red while stocks and gold hold steady suggesting rotation not panic.

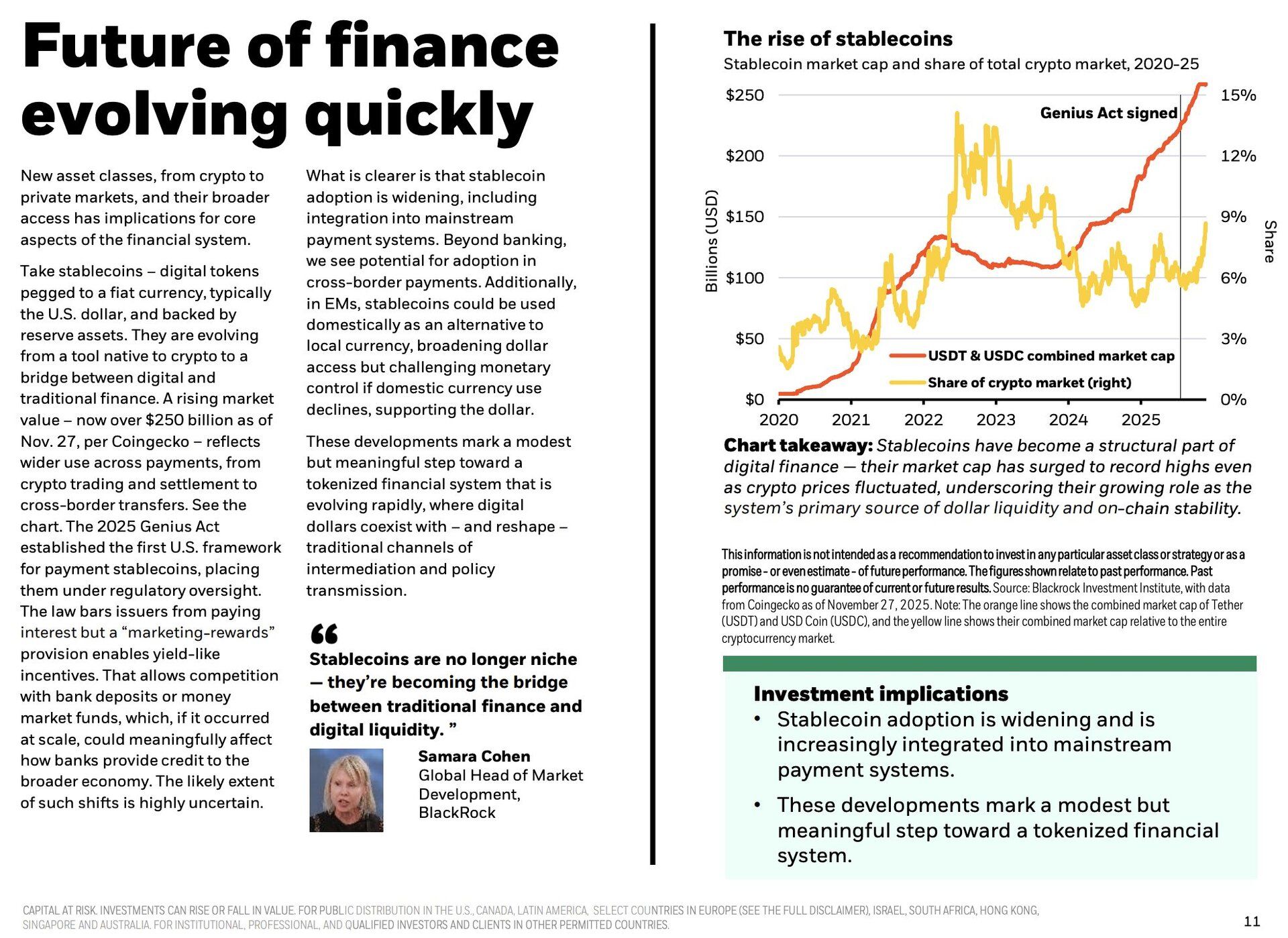

BlackRock Thinks 2026 Is a Risk-On Year

What’s going on:

BlackRock just published its 2026 outlook and they are clearly positioned for upside rather than defense.

The firm prefers equities instead of long term bonds and expects the next wave of returns to come from structural innovation rather than passive diversification.

Two themes dominate their thesis. AI as the main engine of productivity and digital finance as the new architecture of money.

Stablecoins are now named as part of this financial evolution and not a fringe experiment. BlackRock expects households and businesses to increasingly move value across digital rails for payments, yield and liquidity.

The takeaway is straightforward. Broad index exposure may underperform while capital concentrates into the sectors leading transformation.

What it means:

This kind of positioning benefits crypto directly. If capital rotates into innovation, digital assets sit in the center rather than at the edge of it.

Stablecoins and tokenization are now treated as real financial infrastructure, not speculation.

A world that favors growth and technology is a world where crypto gains relevance, attention and allocation.

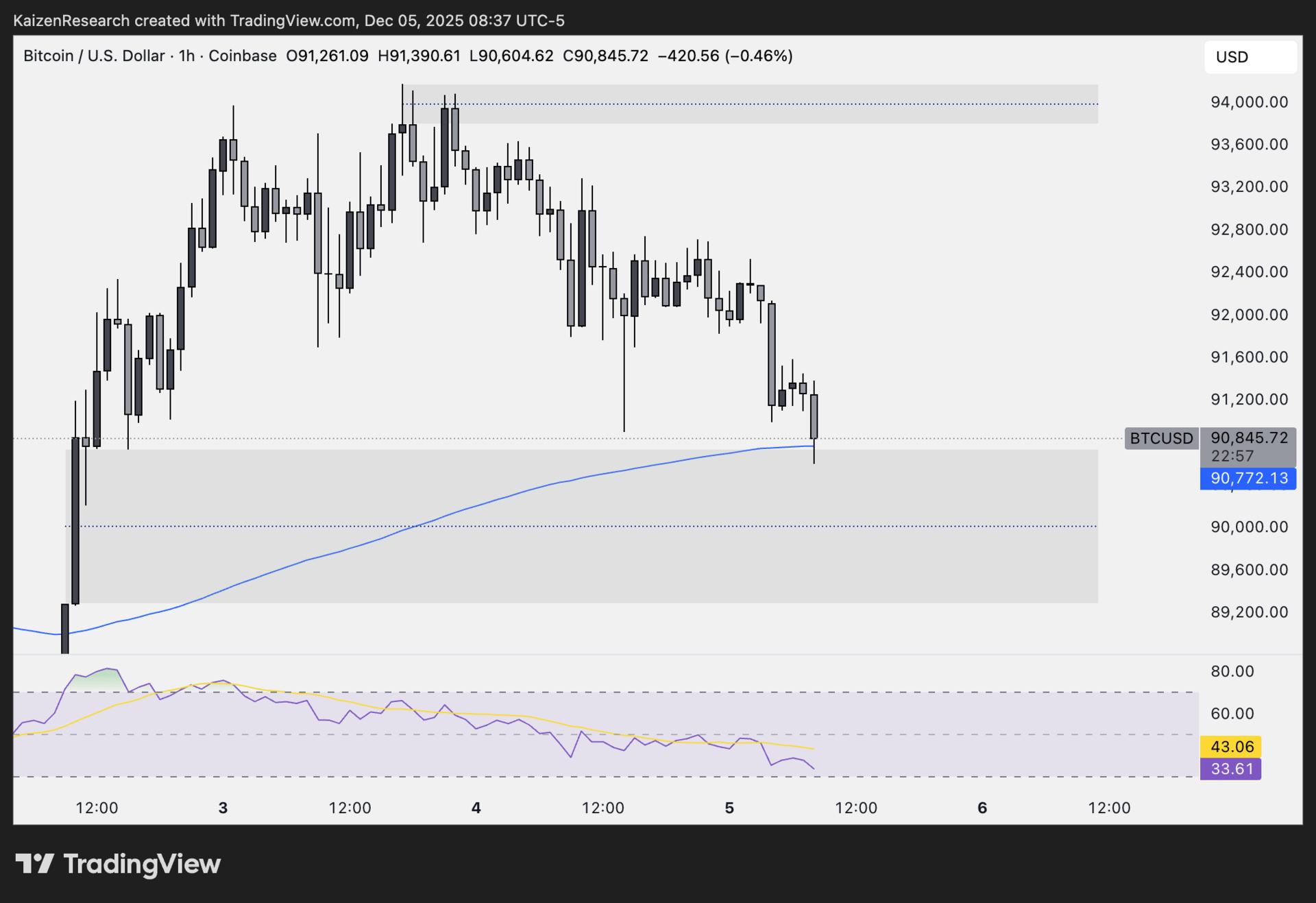

BTC Hidden Divergence Setup

What’s going on:

Bitcoin is holding its lower-timeframe support zone around 90K while the RSI (blue) prints hidden bullish divergence. Price remains above the EMA200 (purple), suggesting trend continuation is still in play as long as support holds.

Buyers stepped in off the demand block, signaling interest to defend structure.

Key levels we’re watching:

Support: 90,000 → strong LTF bid zone + EMA200 defense

Resistance: 93,500 to 94,000 → first reaction area to watch for profit-taking

Breakout target: 94,500+ if momentum confirms

Breakdown risk: Close below 89,000 invalidates setup

Directional Bias: Short-term bullish

Price has room to push into resistance if hidden divergence plays out. But bulls still need a clean break above 91K to open a smoother move into targets.

What we’re waiting for:

Strength above 91,000 with continuation volume

Momentum follow-through confirming the divergence push

BTC isn’t risk-free here, but the structure, RSI signal, and EMA hold make this a clean intraday setup with defined risk.

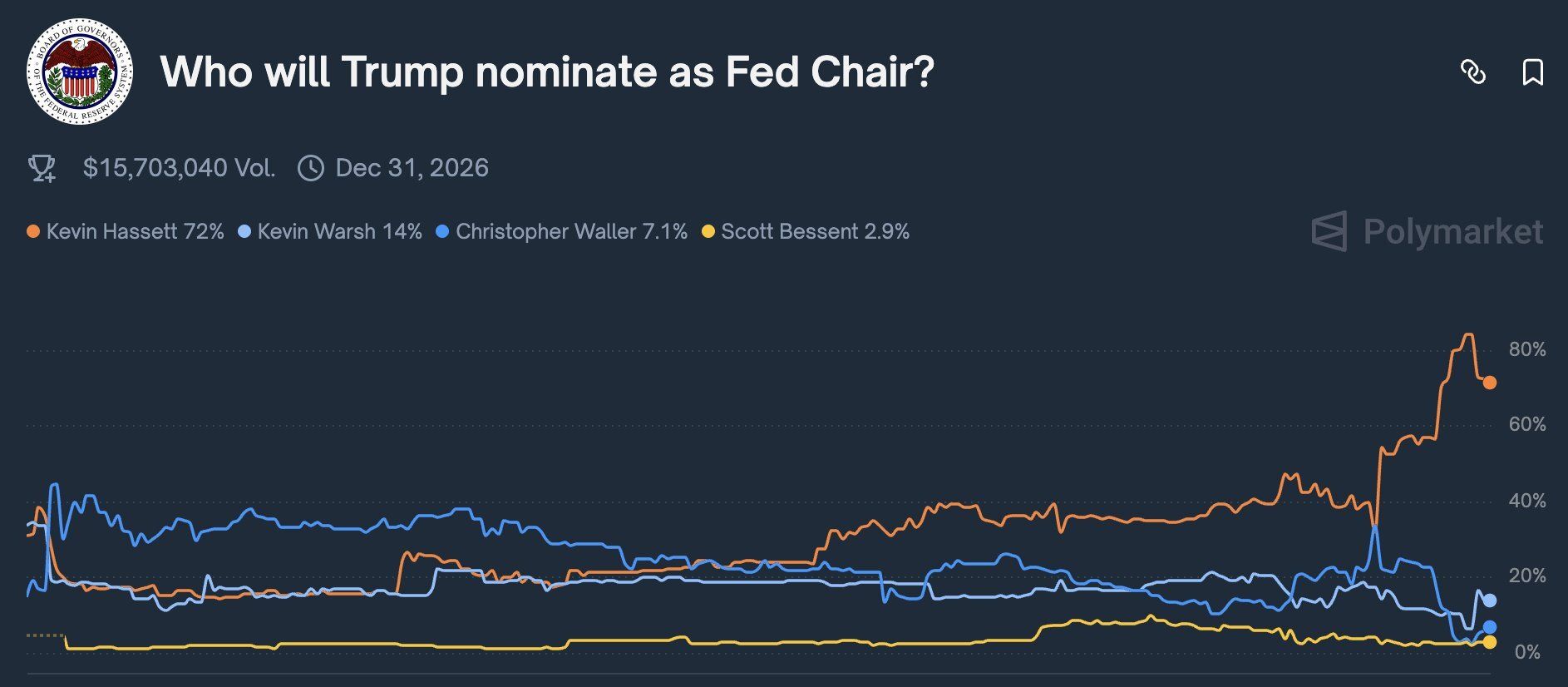

The Perfect Setup for Crypto?

What’s going on:

Washington is starting to hint at a very different market environment.

Trump has pointed to Kevin Hassett as the next Fed Chair and markets already assign him a +70% chance.

Hassett leans heavily toward rate cuts and prefers easy financial conditions. If he takes control in May, policy could swing from restrictive to supportive faster than expected.

Then comes the fiscal side.

Scott Bessent expects hefty tax refunds landing in Q1 2026 and Trump has openly entertained the idea of removing income tax altogether. That means more cash in circulation and historically more risk appetite from investors who suddenly feel flush.

And behind the scenes, the Genesis Mission is already setting the stage for America’s next tech bet.

After pushing AI, the government appears ready to accelerate robotics next and meetings with top industry CEOs are already happening. A formal robotics initiative could arrive as soon as 2026.

What it means:

Crypto historically thrives when liquidity expands, borrowing gets cheaper, and risk appetite increases.

A dovish Fed would support that. Tax refunds would fuel spending and speculation. A robotics boom could ignite a new tech cycle that attracts capital into growth assets across the board, including digital ones.

If policy, money, and innovation all move in the same direction, crypto does not just survive in that environment. It accelerates.

| Kraken: |

| Polymarket: |

| Bank of America: |

| SOL: |

Is DC accidentally bullish? |

If you bought during last week’s weakness, you didn’t just buy the dip, you potentially secured high quality entries that most people were too nervous to take.

Volatility is a core part of every bull cycle, and those who can stomach it often outperform those who trade emotionally.

Liquidity conditions and sentiment still lean constructive, which means fear-driven retracements may offer opportunity rather than risk.

Keep your eyes on the thesis instead of every candle, because conviction is often what separates passengers from winners.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.