- The Warmup by Kaizen

- Posts

- The $60B Bitcoin Whale No One Was Watching

The $60B Bitcoin Whale No One Was Watching

PLUS: Aave Governance Tensions Are Cooling Down

Welcome back to The Warmup.

My crypto portfolio bouncing in 2026.

Here’s what we’re watching:

Market Snapshot

The $60B Bitcoin Whale No One Was Watching

ETH Momentum Reclaim Play

Aave Governance Tensions Are Cooling Down

Calendar

Market: Broad risk-on tone. Bitcoin and equities are higher, ETH steady, while SOL pauses after recent strength.

The $60B Bitcoin Whale No One Was Watching

What’s going on:

Markets have been focused on Venezuela’s massive oil reserves, but a much bigger story may be Bitcoin.

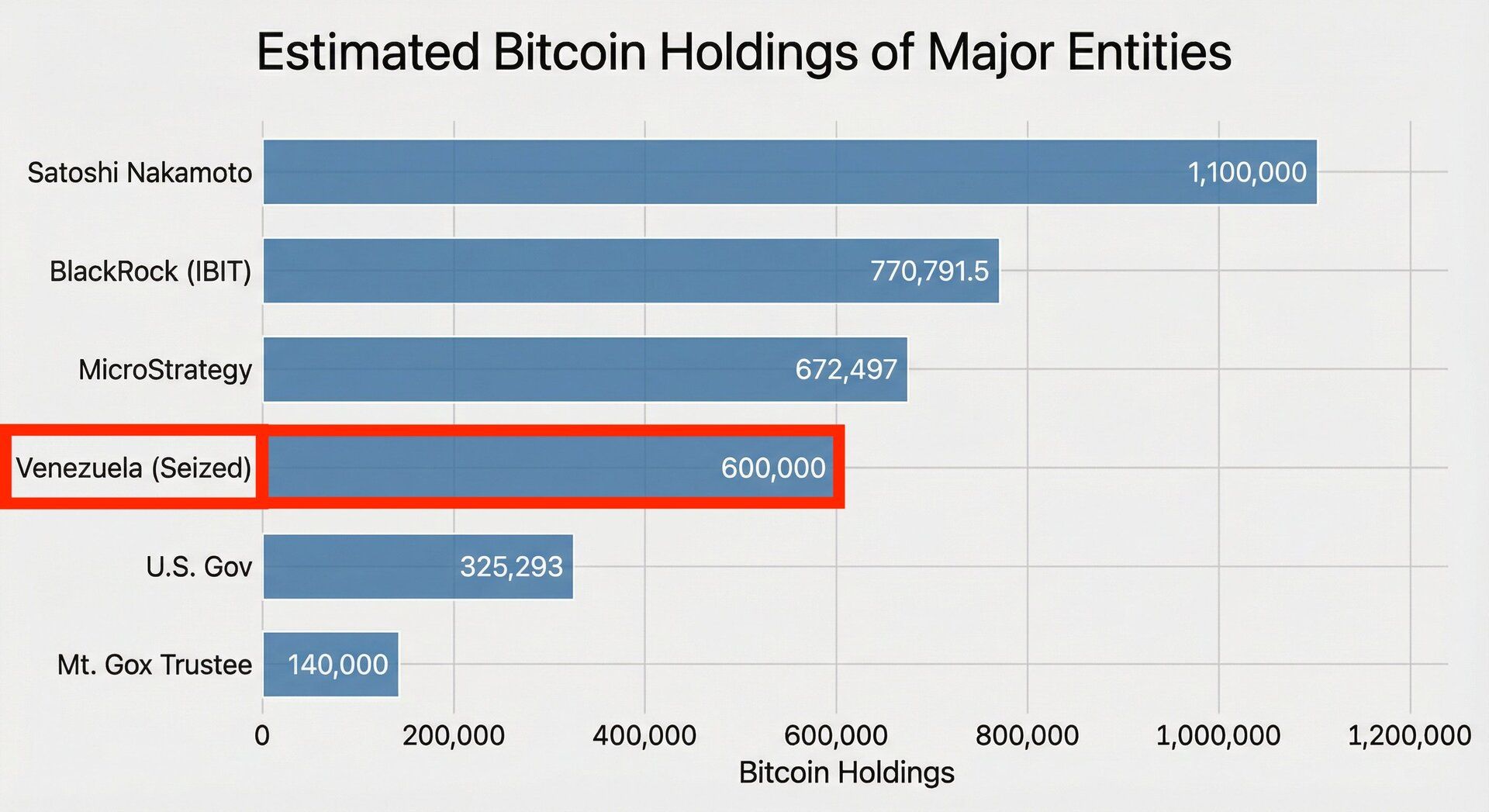

Intelligence reports suggest the Venezuelan regime accumulated a “shadow reserve” of Bitcoin worth roughly $56B–$67B, potentially holding 600,000+ BTC.

The stash was allegedly built through gold swaps starting in 2018 and later through oil exports settled in USDT, which was then rotated into Bitcoin to avoid sanctions and asset freezes.

That would put Venezuela among the largest Bitcoin holders globally, comparable in scale to MicroStrategy and major ETFs.

What it means:

If these assets are seized, they’re unlikely to hit the open market quickly.

Most scenarios point to the BTC being frozen in legal proceedings or held as a long-term sovereign asset, effectively removing a meaningful chunk of supply from circulation.

ETH Momentum Reclaim Play

What’s going on:

ETH reclaimed $3,100 and just closed above the 50-day SMA for the first time in ~3 months. RSI is trending higher, and past setups like this have led to 50%+ rallies.

Key levels we’re watching:

Support: $3,000–$3,050

Resistance: $3,400

Upside target: $3,500 if trend flips

Directional Bias: Cautiously bullish

A daily close above $3,400 would confirm trend reversal.

What we’re waiting for:

Hold above $3,000

Continuation above $3,100

Break and hold $3,400

Risk/reward is improving. Momentum favors higher if these levels stick.

Aave Governance Tensions Are Cooling Down

What’s going on:

Aave Labs is signaling a reset with AAVE holders.

After a heated governance debate, founder Stani Kulechov said Aave Labs is open to sharing non-protocol revenue with token holders. That includes revenue generated outside the core lending protocol, like independent products or branding-related income.

The discussion started after concerns surfaced around frontend fees being redirected away from the DAO, reopening broader questions about alignment, ownership, and value capture across the Aave ecosystem.

Stani emphasized a permissionless protocol where independent teams can build freely, while the protocol and token holders benefit from increased usage and long-term growth.

What it means:

This is an important step toward realignment.

If formalized, AAVE holders could gain exposure to new revenue streams while Aave pushes into real-world assets and institutional lending.

Cleaner alignment usually comes before the next leg of growth.

| LIT: |

| KAITO: |

| JUP: |

Key Events this Week

Major token unlocks:

Hyperliquid (HYPE): ~$329M unlock on Jan 6 (~3.5% of supply)

Aptos (APT): ~$22M unlock on Jan 11 (~1% of supply)

Macroeconomic data calendar:

Mon (Jan 5):

Markets React to Venezuela Situation: Geopolitical and energy-market implications → potential volatility in oil, EM assets, and broader risk sentiment.

Tue (Jan 6):

December ISM Manufacturing PMI: Gauge of factory activity → readings above 50 signal expansion; below 50 point to contraction and slowing growth.

Wed (Jan 7):

December ADP Nonfarm Employment: Private payrolls snapshot → early signal for labor market momentum ahead of Friday’s jobs report.

November JOLTS Job Openings: Measures labor demand → falling openings suggest cooling labor demand and easing wage pressures.

Fri (Jan 9):

December Jobs Report (NFP): Key labor market data → key driver of rate-cut expectations, USD, bonds, and risk assets.

January Michigan Consumer Sentiment: Tracks household confidence → stronger sentiment supports consumer spending and growth outlook.

What happens to Venezuela’s alleged 600K+ BTC stash? |

The real story of 2026 isn’t price action, it’s plumbing.

While narratives come and go, the winners are quietly building rails that make crypto faster, cheaper, and easier to use at scale.

Stablecoins, bridges, identity, and distribution are turning crypto from a speculative asset into real financial infrastructure.

If this cycle rewards anything, it won’t be the loudest token, it’ll be the projects that actually make the system work.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.