- The Warmup by Kaizen

- Posts

- Solana’s Wall Street Debut

Solana’s Wall Street Debut

PLUS: Western Union Is Going Crypto

Welcome back to The Warmup.

It’s Wednesday and somehow this week feels longer than waiting for MONAD to launch.

Here’s what we’re watching:

Market Snapshot

Solana ETF Mania Is Here

SOL Breakout Setup

Western Union Goes Onchain with Solana

Market: Stocks are green, gold’s climbing, and crypto’s cooling off as SOL holds near $200 after its ETF debut.

Solana ETF Mania Is Here

What’s going on:

The first spot Solana ETF just went live.

Bitwise’s BSOL began trading today on Nasdaq, making it the first staking-enabled crypto ETF in the U.S. The fund holds 100% spot SOL and participates in validator rewards, letting investors earn yield inside a regulated structure.

It’s part of a broader wave of altcoin ETFs launching this week including Grayscale’s Solana Trust and Canary Capital’s Litecoin and Hedera ETFs.

Solana enters ETF territory with strong momentum, trading near $200, sitting in the top 5 by market cap, and leading in daily transaction volume.

What it means:

This launch marks another milestone in crypto’s march into traditional finance.

The ETF gives institutions and retirement accounts access to SOL for the first time, boosting liquidity and legitimacy across the ecosystem.

If early performance holds up, this could spark the next wave of altcoin ETFs and position Solana as the third pillar alongside Bitcoin and Ethereum.

$56M in day-one trading volume says the demand is already here.

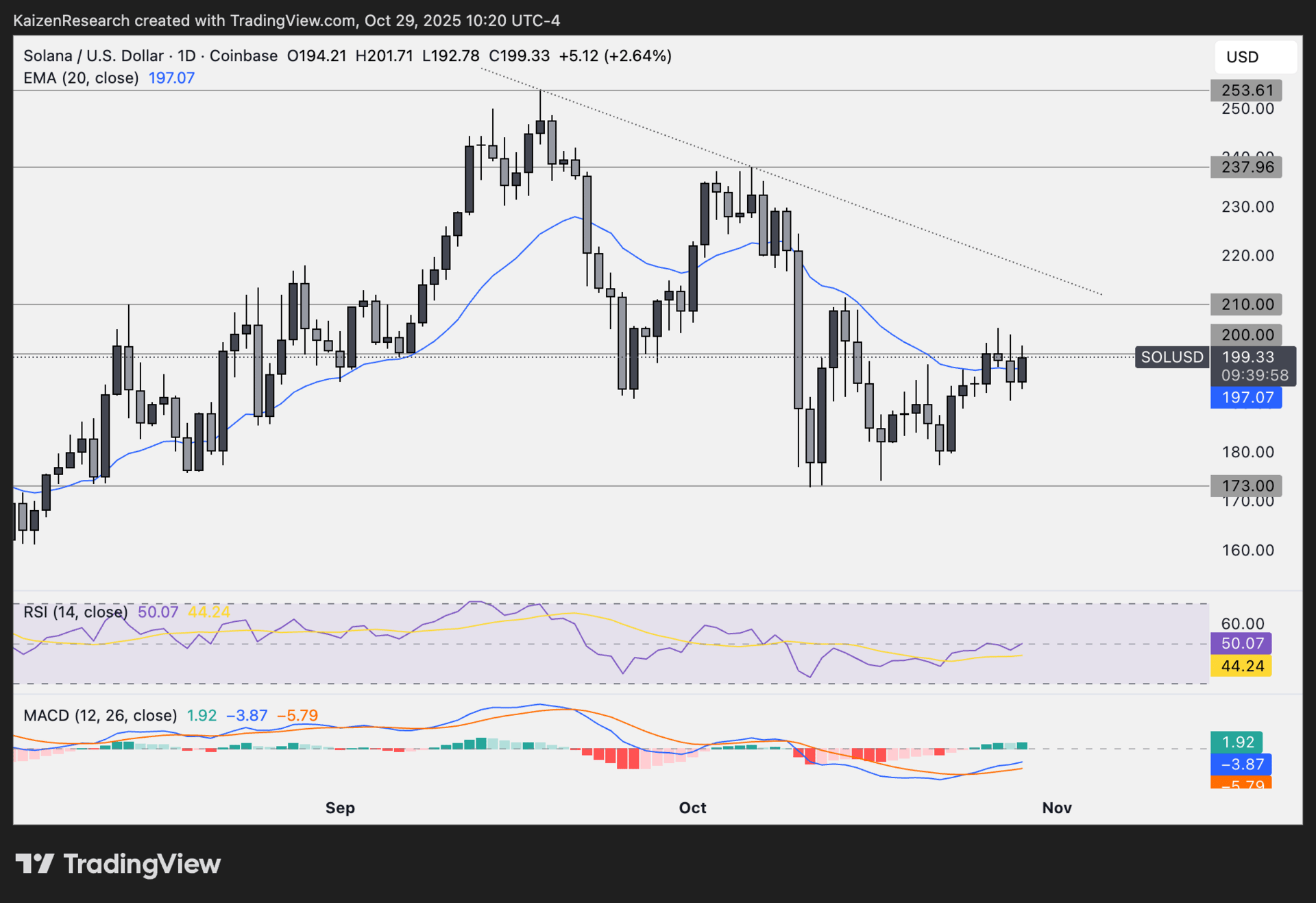

SOL Breakout Setup

What’s going on:

SOL is showing strength into its ETF launches. After reclaiming the 20-day EMA (blue), price is now pressing against descending trendline liquidity that’s been resting since mid-September.

Momentum is shifting. RSI at 51 and a bullish MACD crossover signal growing upside pressure, setting the stage for a potential breakout attempt if broader market conditions remain supportive.

Key levels we’re watching:

Support: $200 → short-term buyer interest zone

Breakout trigger: $210 → close above could confirm breakout

Targets: $238 → first upside target, $254 → secondary

Invalidation: Breakdown below $173

Directional Bias: Cautiously bullish

Momentum is building, and the ETF narrative could be the catalyst that sends SOL through resistance. Bulls need a daily close above $210 to confirm the move and open room to the upside.

What we’re waiting for:

Volume confirmation on any breakout attempt

Sustained closes above the trendline liquidity

Macro tailwinds from ETF inflows and overall market strength

SOL’s setup looks constructive, but traders should watch for false breakouts if momentum stalls. If confirmed, this could mark the start of Solana’s next leg higher.

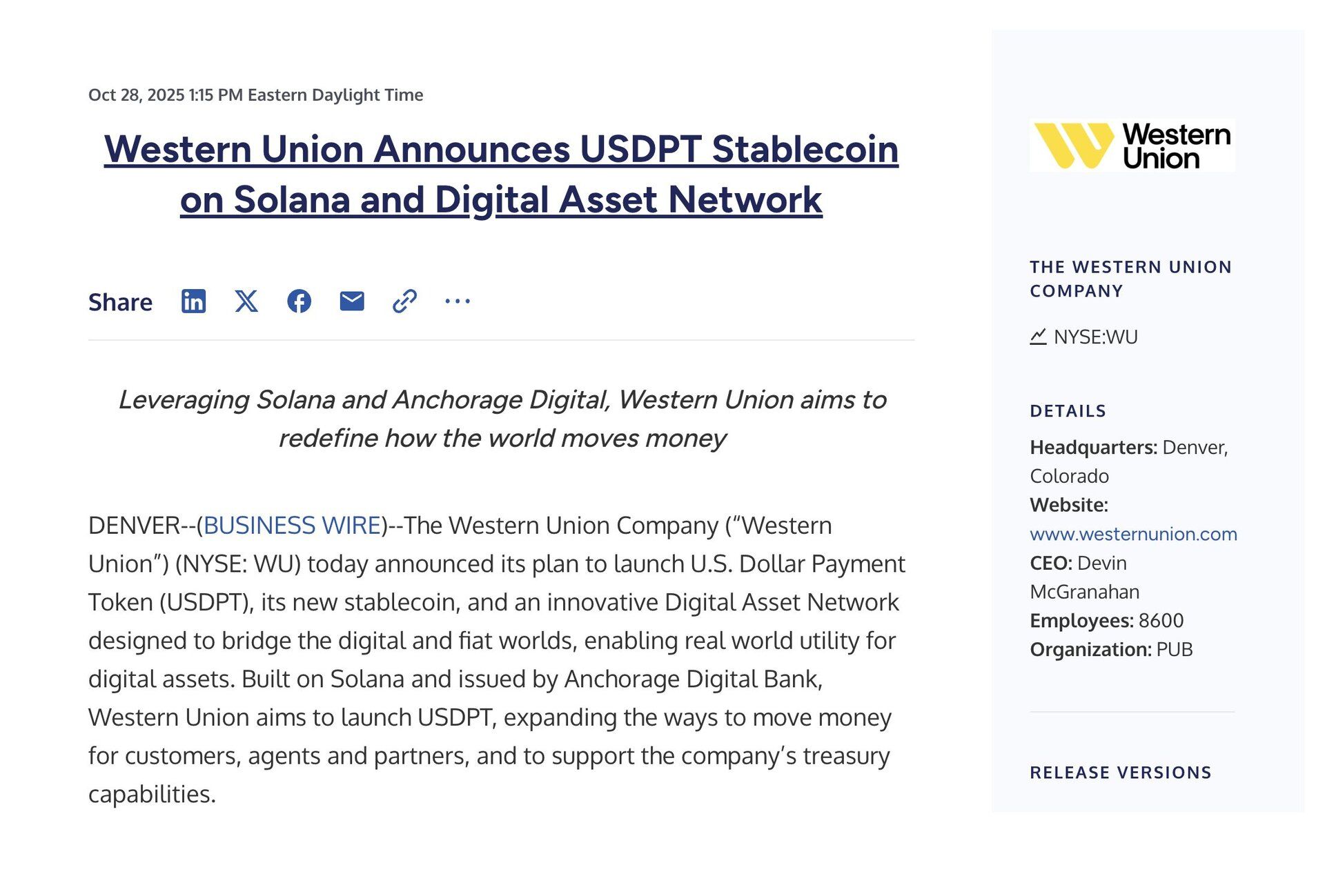

Western Union Goes Onchain with Solana

What’s going on:

Western Union just made its biggest leap in 175 years, it’s building a stablecoin on Solana.

The global payments giant plans to launch USDPT, a dollar-backed token that will run on Solana with custody provided by Anchorage Digital.

The rollout begins in 2026, targeting Latin America, Africa, and Southeast Asia, where stablecoins already power millions of real transactions daily.

Western Union will plug this new token into its existing fiat rails and 4,500+ money transfer corridors, allowing people to move dollars instantly across borders without banks or high remittance fees.

Even better, the company will keep its cash-in and cash-out network, effectively becoming a global on/off-ramp for the Solana ecosystem.

CEO Devin McGranahan summed it up: “We looked at most of the alternatives and came to the conclusion that Solana was the right choice for us.”

What it means:

This is a huge moment for Solana and for stablecoins.

Western Union handles over $150B in transfers each year, and bringing even a fraction of that volume onchain would mean billions flowing through Solana.

It also marks a turning point for crypto payments: real utility, global scale, and mainstream validation all in one move.

And with Bitwise’s Solana ETF already posting record launch volumes, the network is proving it can dominate both Wall Street and the real world.

| SOL: |

| Pudgy Penguins: |

| Abstract: |

| MegaETH: |

Solana’s ETF is live. What’s next? |

Gold’s rally isn’t bad news for Bitcoin, it’s the blueprint.

Central banks quietly accumulated gold for years before prices exploded, and Bitcoin’s ETF and corporate buyers are now following the same path.

Once the short-term sellers fade, supply tightens and the market can move fast.

Gold’s story shows what patience looks like before a breakout, and Bitcoin could be next.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.