- The Warmup by Kaizen

- Posts

- MrBeast’s Financial App Isn’t Done Yet

MrBeast’s Financial App Isn’t Done Yet

PLUS: Robinhood Slips as Crypto Trading Cools

Welcome back to The Warmup.

Happy Wednesday! This is me seeing how high my crypto portfolio was 3 months ago.

Here’s what we’re watching:

Market Snapshot

MrBeast’s Financial App Isn’t Done Yet

BTC Scalp Long

Robinhood Slips as Crypto Trading Cools

Market: Crypto is selling off while TradFi stays flat, with gold and the dollar catching a bid.

MrBeast’s Financial App Isn’t Done Yet

What’s going on:

MrBeast’s company, Beast Industries, acquired Step, a fintech app for teens and young adults. The launch looked TradFi-only: savings, cashback, credit building, stock investing. No crypto mentioned.

But that likely isn’t the full story.

Beast Industries previously filed a “MrBeast Financial” trademark that explicitly includes cryptocurrency exchange services.

On top of that, Bitmine, an ETH-focused firm, invested $200M into the company. That’s an odd bet unless crypto rails are part of the long-term plan.

MrBeast’s audience is global, and scaling a financial app worldwide with TradFi rails takes years. Crypto shortcuts that problem.

What it means:

This looks like a trust-first rollout. Build the user base, then add crypto later.

If even a small portion of MrBeast’s audience touches crypto through this app, it could become the biggest youth onramp the space has ever seen.

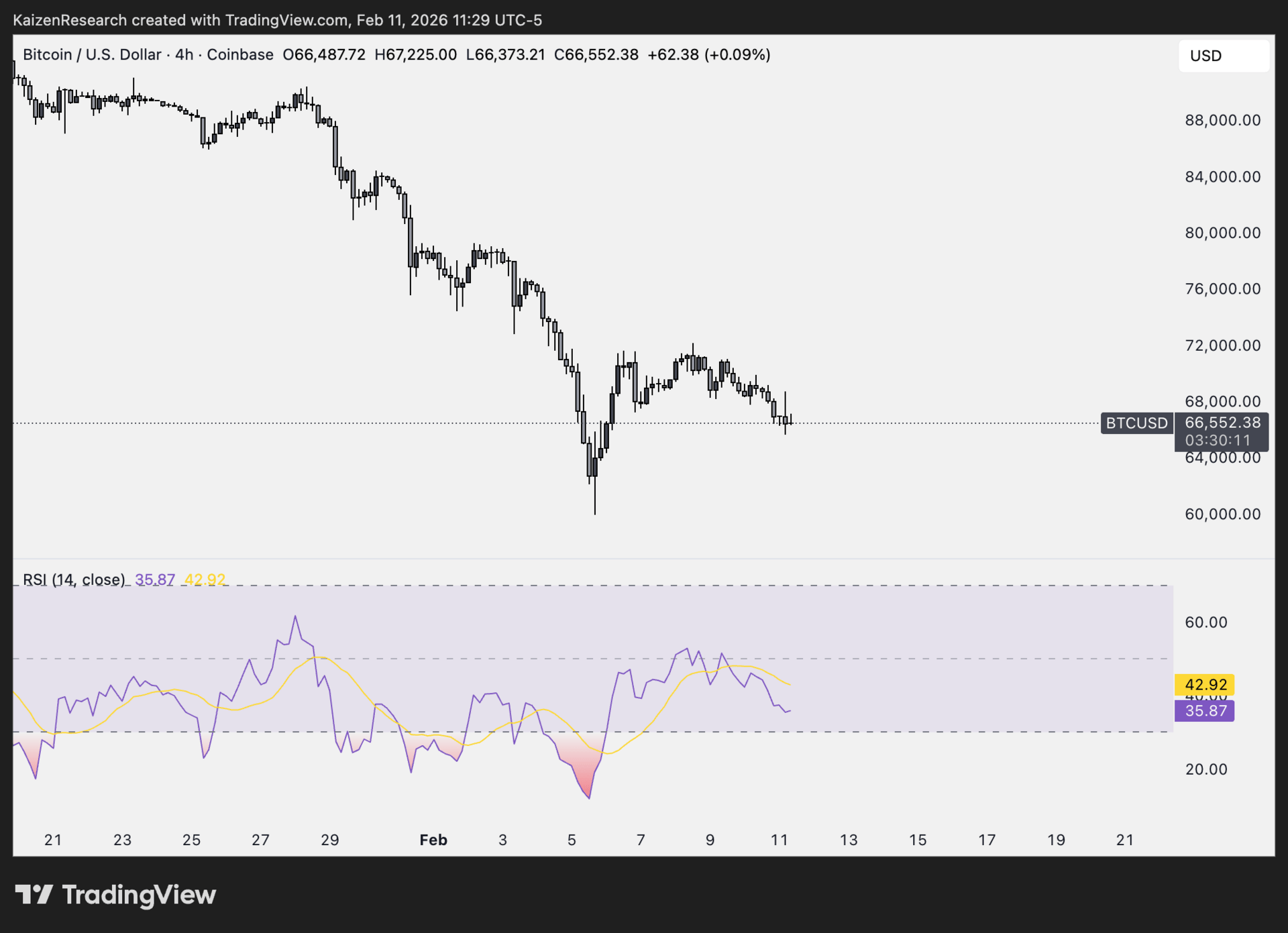

BTC Scalp Long

What’s going on:

BTC is trading into a clear demand zone around $60K–$61K after a sharp selloff.

RSI is oversold and starting to stabilize, setting up a short-term mean reversion bounce. This is a scalp, not a trend reversal.

Key levels we’re watching:

Support: $60,000–$61,000 → demand zone

Target: $70,000 → scalp objective

Breakdown risk: A strong close below $60,000 invalidates setup

Directional Bias: Cautiously bullish

What we’re waiting for:

Hold above demand and a clean push toward $70K. Tight risk, quick trade.

Robinhood Slips as Crypto Trading Cools

What’s going on:

Robinhood reported $1.28B in Q4 revenue, missing expectations of $1.35B despite growing 27% YoY.

The miss was driven by weaker crypto activity, with crypto transaction revenue falling to $221M, down from $268M last quarter and 38% lower YoY.

Net income also declined 33% YoY, coming in just under EPS expectations.

What it means:

Robinhood is still highly exposed to crypto cycles. When volatility fades, transaction revenue gets hit fast.

But the company is actively diversifying.

Between its Ethereum L2 (Robinhood Chain), tokenized stocks in Europe, and fast-growing prediction markets, it’s building new revenue engines beyond pure crypto trading.

Near-term pressure from weak crypto. Long-term upside if volumes return and new products scale.

| DOLO: |

| PENDLE: |

| BNKR: |

| MEGA: |

Is Robinhood too dependent on crypto cycles for earnings? |

This wasn’t just another Bitcoin drawdown, it was a structural reset that shook leverage, confidence, and weak hands all at once.

History shows these moments don’t end cycles, they quietly set the foundation for the next leg higher while sentiment stays broken.

As liquidity slowly improves and fear lingers, the biggest risk may not be another drop, but missing the re-accumulation phase entirely.

Just like 2021, the move doesn’t announce itself, it shows up fast after everyone has already tuned out.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.