- The Warmup by Kaizen

- Posts

- Metamask Levels Up With Polymarket

Metamask Levels Up With Polymarket

PLUS: Citi Bets Big on Crypto Custody

Welcome back to The Warmup.

It’s Wednesday and the market feels like it’s running on pure caffeine and bad decisions.

Here’s what we’re watching:

Market Snapshot

Metamask Integrates Polymarket

ETH 50-Day EMA Setup

Citi Plans Crypto Custody for 2026

Market: Risk assets are pushing higher midweek with Ethereum and Solana leading crypto gains, while equities climb across the board and gold extends its run, all as volatility drops sharply.

Metamask Integrates Polymarket

What’s going on:

Consensys’ flagship wallet Metamask is partnering with Polymarket to bring prediction market trading directly into the app.

The integration was first hinted at in an Oct. 8 blog post that also teased perpetual futures and a new rewards program, but it picked up traction after Metamask promoted it on X.

We're teaming up with the world's largest prediction market.

@Polymarket is coming to MetaMask.

🦊💙

— MetaMask.eth 🦊 (@MetaMask)

3:01 PM • Oct 14, 2025

What it means:

Wallets are evolving into full DeFi hubs.

With Phantom, Rabby, and now Metamask integrating products like Hyperliquid perps and Polymarket predictions, users no longer need to leave their wallet to access top protocols.

The timing is notable: prediction markets are surging ahead of the U.S. election, and speculation is growing around a potential $POLY token launch.

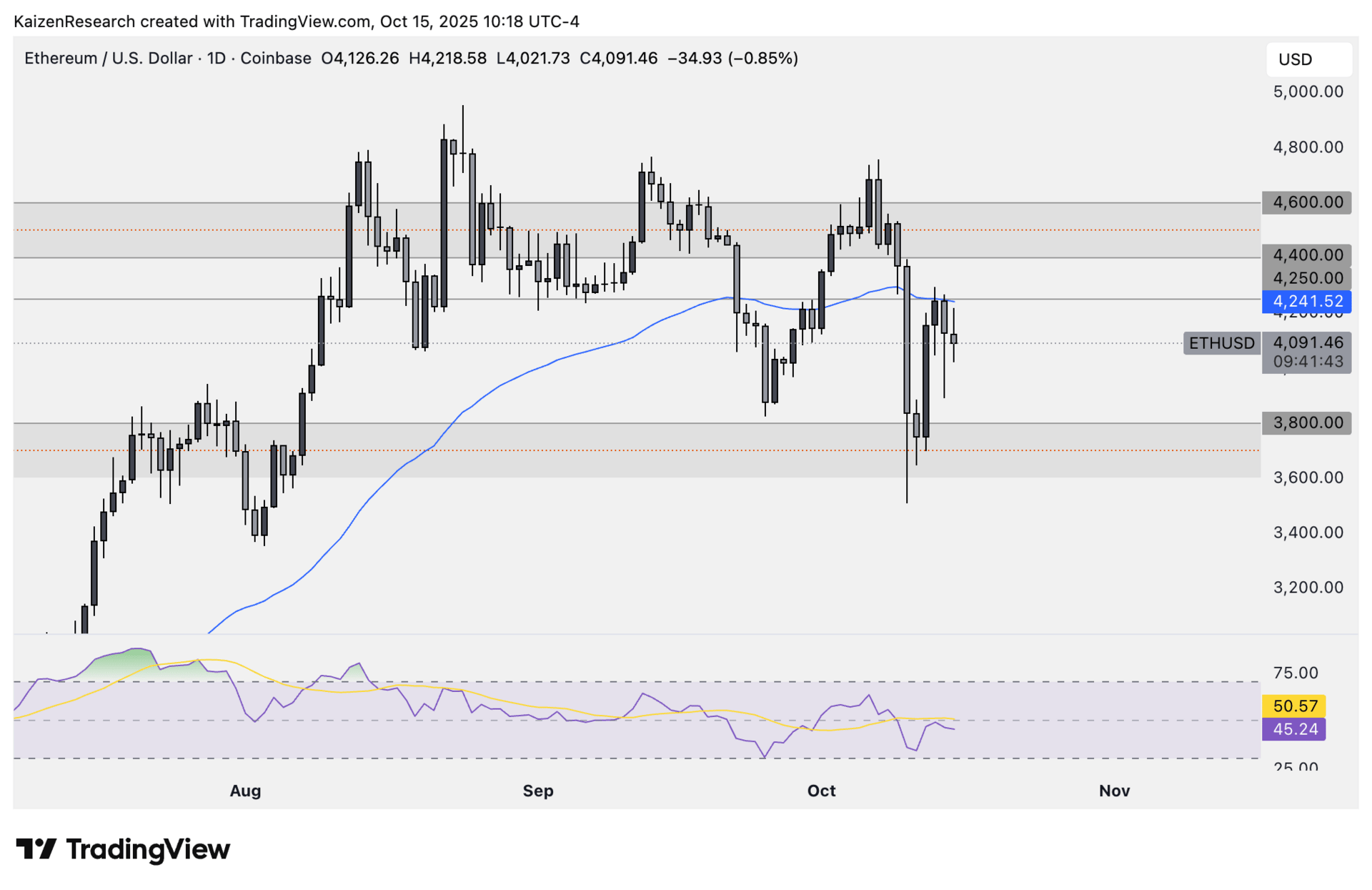

ETH 50-Day EMA Setup

What’s going on:

ETH has bounced strongly from the weekend selloff but is now stalling at the 50-day EMA. This moving average has become a key pivot: a clear reclaim with volume could set up a retest of the $4,400–$4,600 zone.

Failure to break above, however, has already shown signs of rejection and may confirm a breakdown from prior support, targeting the $3,800–$3,600 area. With RSI sitting near neutral, momentum hasn’t clearly shifted to bulls or bears yet.

Key levels we’re watching:

Support: $3,800 → first major downside target

Resistance: $4,250 → reclaim unlocks higher range

Breakout target: $4,400–$4,600 if momentum builds

Breakdown risk: Close below $3,800 signals more downside

Directional Bias: Neutral

What we’re waiting for:

A decisive reclaim of the 50-day EMA with volume → long setup

A clean rejection at the EMA → short setup toward $3,800–$3,600

RSI break from neutral to guide bias on momentum shift

ETH’s chart is offering a textbook setup in both directions. Watch the 50-day EMA closely, because whichever side it gives way to will likely define the next move.

Citi Plans Crypto Custody for 2026

What’s going on:

Citi, the second-largest U.S. bank, has been quietly developing a crypto custody platform and is now targeting a 2026 launch.

The service will begin with institutional clients such as asset managers, providing secure storage and strict controls.

Alongside custody, Citi is also working on tokenized deposits and evaluating stablecoin-related services as part of a broader digital money strategy.

What it means:

TradFi is moving deeper into crypto with clear timelines.

Citi’s plan shows that the biggest banks are preparing to meet institutional demand for digital assets, with custody as the foundation.

If successful, this rollout could accelerate the creation of bank-driven crypto products and push digital assets further into the mainstream financial system.

| HYPE: |

| SOL: |

| BNB: |

| KMNO: |

Will Metamask’s integration of Polymarket push DeFi adoption forward? |

Crypto’s flash crash on Friday was dramatic but ultimately just noise, with nothing fundamental to the long-term thesis changing.

No major players collapsed, the technology held up under stress, and professional investors barely reacted.

Zooming out, bitcoin is still up over 620% this cycle.

The bull market remains intact, and once liquidity returns the focus will shift back to fundamentals.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.