- The Warmup by Kaizen

- Posts

- Jupiter Is Building Its Own Dollar Engine

Jupiter Is Building Its Own Dollar Engine

PLUS: Wall St Just Put a Crypto Number on It

Welcome back to The Warmup.

Bitcoin pumps and suddenly I’m sprinting to check my portfolio like it owes me money.

Here’s what we’re watching:

Market Snapshot

Jupiter Is Building Its Own Dollar Engine

BTC EMA Retest Play

Wall St Just Put a Crypto Number on It

Market: Crypto is cooling short-term while equities push higher, with mild risk rotation rather than risk-off.

Jupiter Is Building Its Own Dollar Engine

What’s going on:

Jupiter just launched JupUSD, its native stablecoin, built using Ethena’s whitelabel infrastructure and backed ~90% by USDtb, which is itself backed by BlackRock’s tokenized money market fund (BUIDL).

The big move is liquidity.

Around $500M in USDC from Jupiter Perps LP will migrate into JupUSD, unifying dollar liquidity across perps, lending, limit orders, DCA tools, and the app under one balance. JupUSD becomes the unit of account across the entire Jupiter stack.

This is also Ethena’s first major B2B stablecoin rollout on Solana.

What it means:

Jupiter now owns the economics of its dollar, instead of relying on external stables. That improves liquidity, UX, and capital efficiency while keeping more value inside the ecosystem.

This isn’t just a stablecoin. It’s Jupiter turning its superapp into a vertically integrated stack.

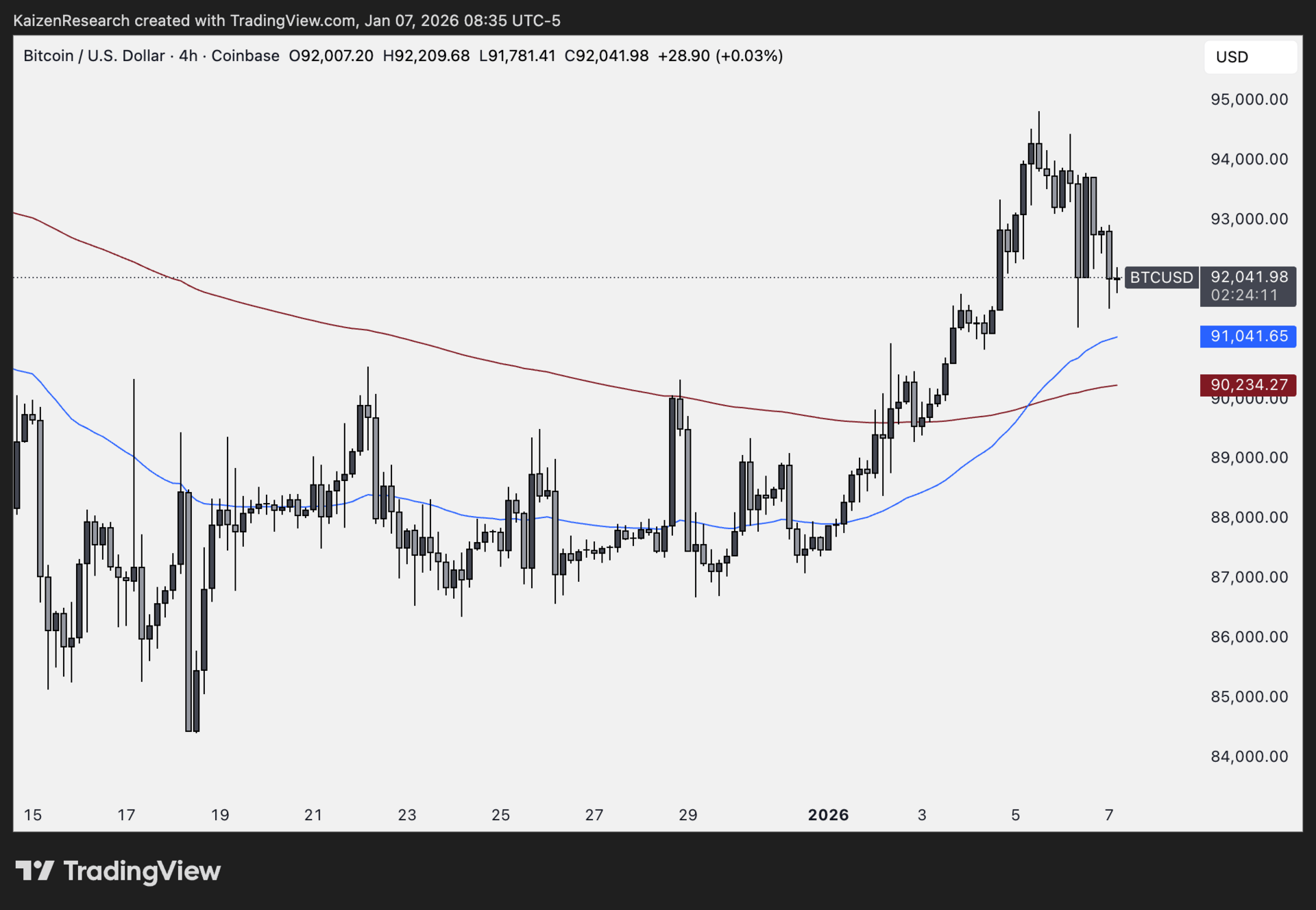

BTC EMA Retest Play

What’s going on:

Bitcoin is pulling back into a high-confluence support zone, where the EMA50 (blue) and EMA200 (red) align with prior structure.

This looks like a healthy retrace after a strong push higher, not a trend breakdown.

Key levels we’re watching:

Support: 90,100 – 91,000 → DCA zone at EMA confluence

Resistance: 93,000 → first take-profit area

Extension target: 95,000 if momentum resumes

Invalidation: Close below 89,500 breaks the setup

Directional Bias: Cautiously bullish

What we’re waiting for:

Price to hold above the EMA50/200 cluster

Controlled pullback with no aggressive sell volume

Continuation reclaim toward 93K+

Wall Street Just Put a Crypto Number on It

What’s going on:

Bank of America is officially backing a 1%–4% crypto allocation for wealth clients, ending long-standing restrictions that stopped advisers from proactively recommending crypto.

Starting Jan 5, 2026, BoA’s CIO will also initiate coverage of spot Bitcoin ETFs from BlackRock, Fidelity, Bitwise, and Grayscale.

This unlocks crypto exposure across Merrill, Private Bank, and Merrill Edge, effectively activating 15,000+ advisers who were previously sidelined unless clients explicitly asked for crypto.

BoA now joins peers:

Morgan Stanley: 2%–4% for opportunistic portfolios

BlackRock: 1%–2% Bitcoin allocation

Fidelity: 2%–5%, higher for younger investors

Even Vanguard recently reversed its hard no-crypto stance by allowing select crypto ETFs.

What it means:

Crypto just crossed another institutional line.

This isn’t about price. It’s about policy. Once allocation frameworks exist, crypto stops being “speculative” and starts becoming standard portfolio construction.

A 1%–4% allocation across the largest advisory networks in the US means structural, recurring demand, not hype-driven flows.

| Wasabi: |

| Ranger: |

| MEGA: |

| HYPE: |

What do you think becomes the new “standard” crypto allocation for portfolios? |

Institutions aren’t waiting for headlines or retail hype, they’re quietly building the rails for the next crypto cycle.

ETFs, stablecoins, and tokenization aren’t “narratives,” they’re plumbing, and plumbing is what lasts.

2026 won’t be about loud pumps, it’ll be about who positioned early while attention was elsewhere. Retail usually shows up when the product is polished and the upside is smaller.

If history rhymes, the real move is happening now, not when everyone agrees it’s bullish.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.