- The Warmup by Kaizen

- Posts

- Is This the Start of Crypto’s Q4 Rally?

Is This the Start of Crypto’s Q4 Rally?

PLUS: Is MegaETH About to Explode?

Welcome back to The Warmup.

Looks like Uncle Sam and China finally called a truce and the market’s celebrating like it’s Lunar New Year.

Here’s what we’re watching:

Market Snapshot

Is This the Start of Crypto’s Q4 Rally?

Ethereum Support Retest

MegaETH’s Public Sale Could Be the Next Big One

Market: Risk is back on. Ethereum’s leading with a 2% gain, Bitcoin’s steady, and stocks are climbing as trade optimism fuels a broad rally.

Is This the Start of Crypto’s Q4 Rally?

What’s going on:

Crypto markets are coming alive after reports that the U.S. and China made major progress toward a new trade deal. Negotiators are targeting a signing window in November with phased tariff rollbacks, easing recent tensions between Trump and Xi.

That optimism sent risk assets surging.

Bitcoin (BTC) reclaimed $115,000, up about 5% over the weekend

Ethereum (ETH) climbed back above $4,100

Solana (SOL) crossed $200

The total crypto market cap grew by $150B in 2 days

Treasuries sold off and gold cooled as investors rotated out of safe havens and back into risk.

This might be the start of a broader Q4 rally. Markets were positioned for escalation, not progress, meaning any easing is bullish. Bitcoin continues to trade like a high-beta macro asset, moving fast when liquidity improves.

What it means:

If trade progress continues and tariffs ease, liquidity could expand heading into year-end, pushing more capital toward crypto and equities.

There is still some selling pressure from long-term holders, but once that fades, bulls could take control again.

The setup for a Q4 rally is building, and crypto looks ready to lead it.

Ethereum Support Retest

What’s going on:

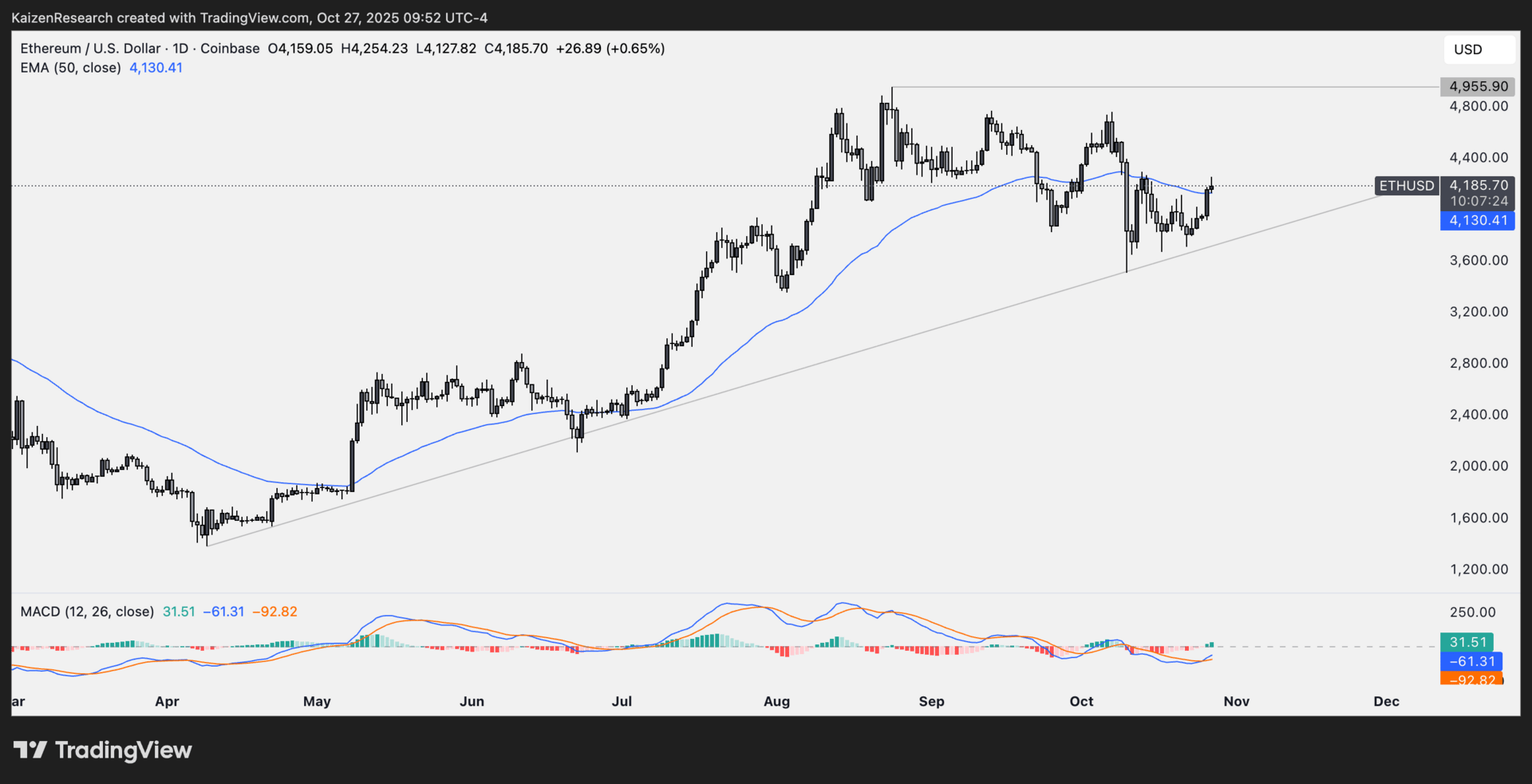

Ethereum is holding its trendline support strong on the daily chart while momentum indicators start flashing early bullish signs. The MACD is showing a potential cross-up, hinting that upside acceleration could be near.

Price is hovering just under the 50-day EMA, which remains the key battleground before momentum can expand.

Key levels we’re watching:

Support: $3,800 → critical trendline and buyer interest zone

Resistance: $4,200 → 50-day EMA and breakout trigger

Breakout target: $5,000 → ATHs

Breakdown risk: Close below $3,500 would weaken the setup

Directional Bias: Bullish

A breakout with volume could spark a push toward new highs.

What we’re waiting for:

MACD confirmation of a golden cross

Daily close above the 50-day EMA

Increasing spot demand and sustained volume

ETH looks poised for upside if the technicals align. Once that EMA flips into support, it could be game on for the next leg higher.

MegaETH’s Public Sale Could Be the Next Big One

What’s going on:

MegaETH is kicking off its public sale on October 27, and it’s shaping up to be one of the most anticipated launches of the year.

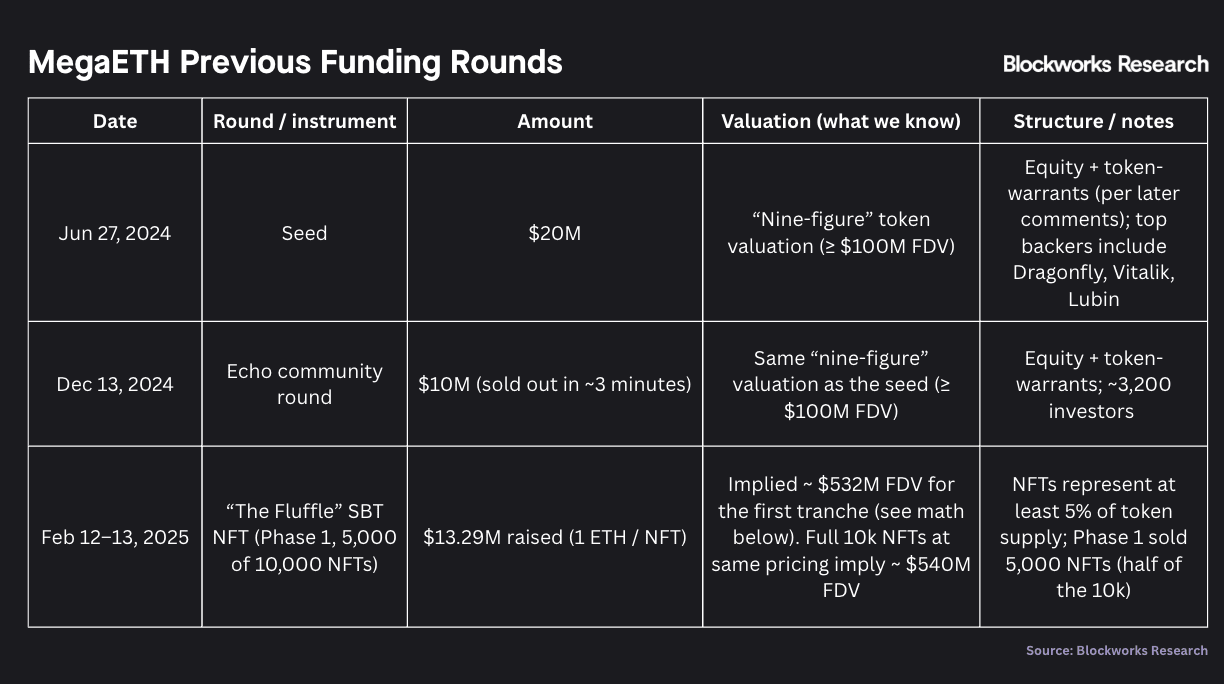

This is the third community round, following the Echo round (priced alongside early VC investors like Dragonfly and Vitalik) and the Fluffle NFT round, which implied a $532M fully diluted valuation (FDV).

Here’s what you need to know:

Date: Oct. 27–30 (72 hours)

Payment: USDT on Ethereum

Total Supply: 10B MEGA (5% allocation = 500M tokens)

Format: English Auction (FDV range roughly $1M to $999M)

Bid Limits: $2,650 to $186,282

Lock-up: One-year mandatory for US investors with a 10% discount; optional for others

While the auction starts at an FDV as low as $1 million, the market clearly expects much more.

On Hyperliquid, MEGA’s premarket perpetual is already trading around a $5B FDV with $17M in volume.

On Polymarket, traders see an 89% chance it trades above $2B FDV and a 50% chance it crosses $4B FDV within 24 hours of launch.

What it means:

MegaETH isn’t underpricing by accident. Projects using English or Dutch auctions often end up overvalued at launch and crash once trading begins. By starting lower, MegaETH is giving its community a fairer entry point and a reason to stay long term.

It’s a move similar to Plasma’s $500M FDV launch, where early participants benefited from strong post-launch sentiment and community alignment.

If MegaETH’s fair value really sits near $5B, a launch close to $1B could offer one of the best setups we’ve seen in months.

| AAVE: |

| MON: |

| ETH: |

| SOL: |

Key Events this Week

Major token unlocks:

Jupiter (JUP): ~$23M unlock on Oct 28 (~1.7% of supply)

Sui (SUI): ~$115M unlock on Nov 1 (~1.2% of supply)

Macroeconomic data calendar:

Data remains limited amid the government shutdown.

Earnings Season Continues (~20% of S&P 500): Around one-fifth of S&P 500 companies report this week, including Big Tech, giving crucial insight into profits and Q4 momentum.

Wed (Oct 29):

Fed Interest Rate Decision: Markets await the Fed’s next move on rates, a key driver for liquidity and risk assets.

Fed Chair Powell Press Conference: Investors will listen closely for clues on future policy direction.

Microsoft, Alphabet, Meta Earnings: Big Tech results could set the tone for the market’s Q4 outlook.

Thu (Oct 30):

President Trump Meets President Xi: A high-stakes meeting that could shift trade sentiment and geopolitical risk.

Apple, Coinbase and Amazon Earnings: The final wave of Big Tech reports, key for reading consumer demand and cloud performance.

Major Earnings Releases:

Tue (Oct 28): PayPal, SoFi, Visa

Wed (Oct 29): Meta, Microsoft, Alphabet

Thu (Oct 30): Amazon, Apple, Coinbase, Startegy

How will $MEGA trade after launch? |

Trade peace means risk back on, and crypto’s feeling it first.

If this momentum holds, liquidity could keep flowing into BTC and ETH through November.

Watch for follow-through after the Fed and Trump–Xi meeting this week, that’s your confirmation signal.

Stay positioned, but stay sharp… the market’s finally waking up.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.