- The Warmup by Kaizen

- Posts

- Is This the Bottom... or the Trap?

Is This the Bottom... or the Trap?

PLUS: Terminal Finance Shuts Down Pre-Launch

Welcome back to The Warmup.

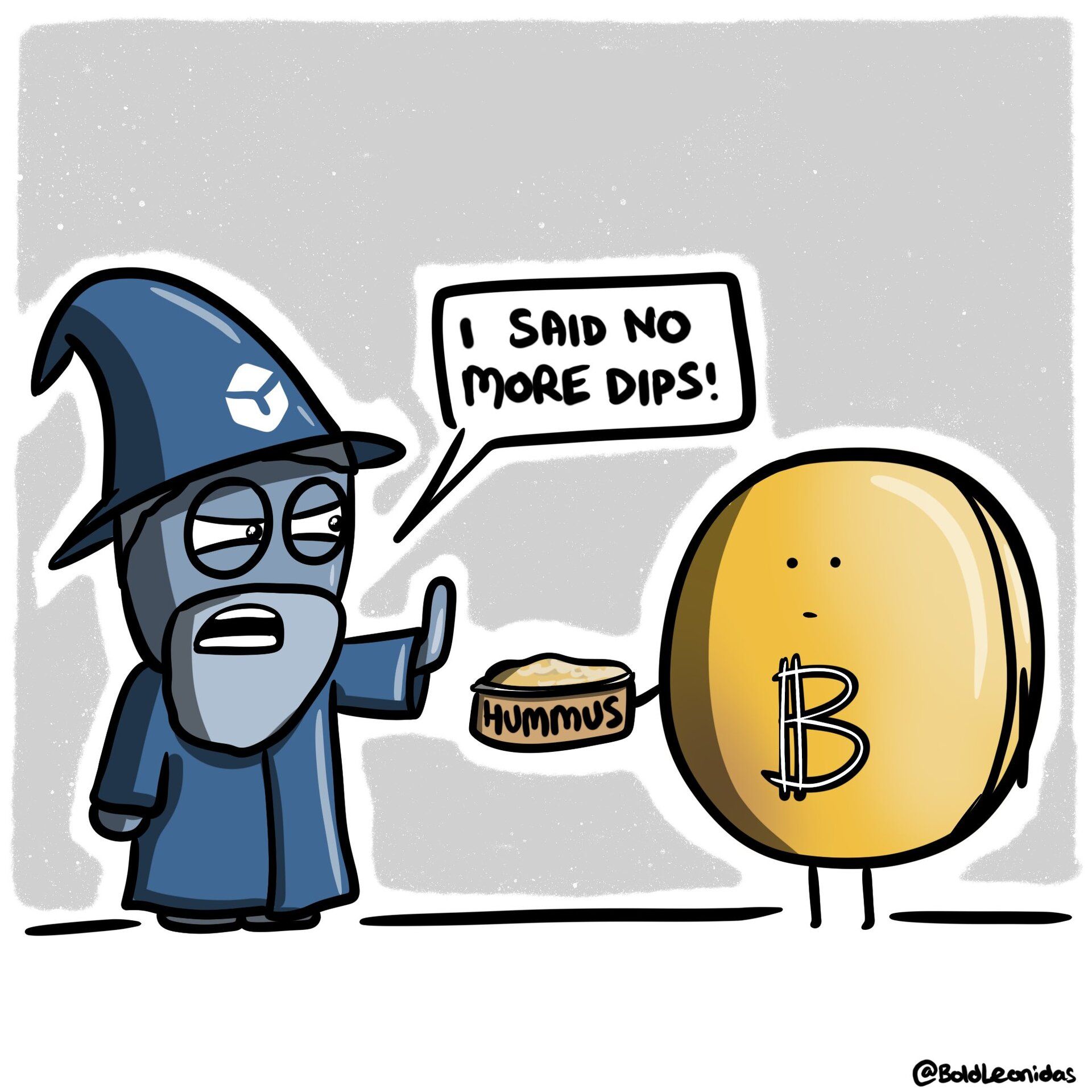

Starting the week and Bitcoin’s already offering dips like it’s running a snack bar.

Here’s what we’re watching:

Market Snapshot

Crypto Tried to Bounce… Then Got Slammed

Terminal Finance Shuts Down Pre-Launch

Calendar

Market: Crypto is taking a heavy hit across the board while equities grind higher, signaling a clear divergence in risk appetite as capital continues favoring stocks over digital assets.

Crypto Tried to Bounce… Then Got Slammed

What’s going on:

Last week finally gave the market a breather. After months of selling, whales started buying again across every major cohort.

The largest holders (those with 10,000+ BTC) flipped into net accumulation for the first time since August. Mid-tier whales followed, and retail wallets under 1 BTC posted their strongest buying since midsummer.

ETF flows helped too, with BTC bringing in $70M and ETH grabbing a huge $312M in net inflows.

That combination pushed crypto majors up almost 10% on the week. It looked like momentum was turning.

Then Sunday night happened.

Bitcoin dropped from nearly $92,000 to the mid-$86,000s in hours, wiping out most of the gains and triggering more than $650M in liquidations.

What it means:

The market is at an important inflection point.

If whales keep buying and ETFs continue seeing inflows, last night’s plunge could end up being a quick reset. But if that demand dries up, Bitcoin likely revisits the $80k area or worse.

This week will tell us whether last week’s bounce was the start of a real recovery or just another dead-cat rally.

Terminal Finance Shuts Down Pre-Launch

What’s going on:

Terminal Finance, the Ethena-incubated MetaDEX that pulled in $280M in pre-launch deposits, is shutting down before going live.

The Converge blockchain it was built for never launched, and there’s no indication it will anytime soon.

Terminal explored multiple pivots, but each had major limitations, so the team decided not to force a weak product into the market.

All deposits remain fully backed and can be withdrawn immediately, and Pendle users will keep earning all rewards.

What it means:

Funds are safe, but the shutdown signals deeper uncertainty around Converge and Ethena’s chain plans.

Terminal will open-source its audited codebase, leaving the door open for other teams to build on the tech.

| HYPE: |

| ETH: |

| JUP: |

| MegaETH: |

Key Events this Week

Major token unlocks:

Ethena (ENA): ~$10M unlock on Dec 2 (~0.5% of supply)

EigenLayer (EIGEN): ~$37M unlock on Dec 1 (~11% of supply)

Macroeconomic data calendar:

Mon (Dec 1):

November ISM Manufacturing PMI: Tracks factory activity. Readings above 50 signal expansion, below 50 indicate contraction.

Tue (Dec 2):

September JOLTS Job Openings: Measures labor demand. Rising openings suggest a tight job market, falling openings point to cooling conditions.

Wed (Dec 3):

November ADP Nonfarm Employment: Private-sector hiring indicator. Strong gains imply solid labor momentum.

November S&P Global Services PMI: Snapshot of service-sector activity. Above 50 = expansion, below 50 = slowdown.

November ISM Non-Manufacturing PMI: Another key services-sector gauge, closely watched for inflationary pressures.

Thu (Dec 4):

Initial Jobless Claims: Weekly unemployment claims. Lower claims indicate labor strength, rising claims hint at softening.

Fri (Dec 5):

September PCE Inflation: The Fed’s preferred inflation measure. Higher PCE increases the likelihood of tighter policy.

December Michigan Consumer Sentiment: Measures consumer confidence and spending outlook. Higher sentiment supports economic resilience.

Major Earnings Releases:

Wed (Dec 3): Macy’s

Thu (Dec 4): TD Bank

After the Sunday night dump, where do you think BTC goes next? |

Markets are choppy and crypto is struggling to keep up, but the long-term trend of the world moving onchain hasn’t changed.

Capital is rotating into AI for now, yet that money eventually comes back to the strongest crypto assets.

The best move is still to focus on quality, zoom out, and extend your time horizon while the dust settles.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.