- The Warmup by Kaizen

- Posts

- Is $1.4M Bitcoin by 2035 Actually Possible?

Is $1.4M Bitcoin by 2035 Actually Possible?

PLUS: Novogratz Sounds the Alarm on XRP and ADA

Welcome back to The Warmup.

December 31st hits. You open your wallet. The $10,000 NFT from 2021 is still there. Watching.

Here’s what we’re watching:

Market Snapshot

Why Institutions Think Bitcoin Could Hit $1.4M

BTC Range Decision Setup

Novogratz Sounds the Alarm on XRP and ADA

Market: Crypto is mixed but resilient. BTC is flat, ETH and SOL show relative strength, while equities dip and the VIX ticks higher.

Why Institutions Think Bitcoin Could Hit $1.4M

What’s going on:

Bitcoin is no longer being analyzed like a speculative side bet. Institutions are now building full capital market assumption (CMA) frameworks around it. The same way they do for equities, bonds, and commodities.

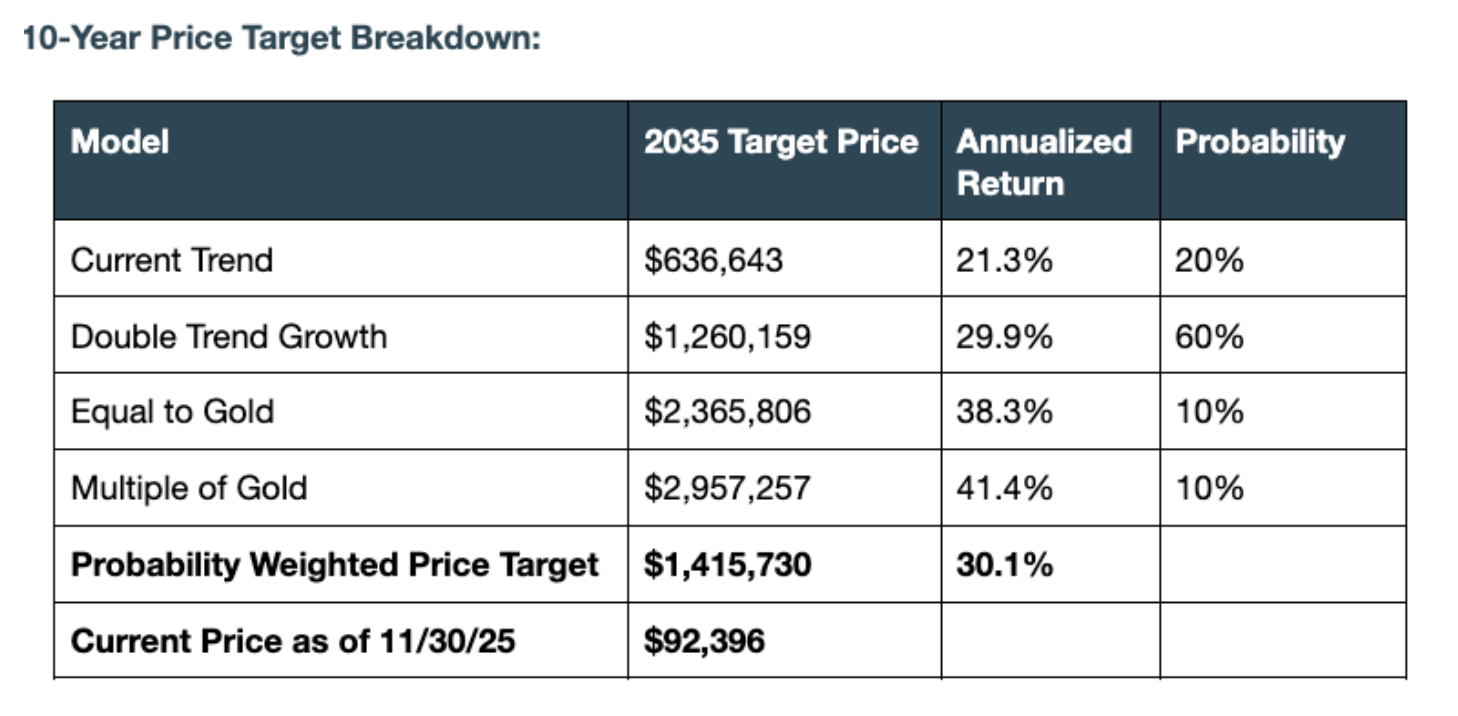

The framework combines three lenses:

Comparative valuation: Bitcoin monetizing as a global store of value, competing with gold and similar assets

Production economics: anchoring long-term value to mining costs, hashrate, energy prices, and issuance declines

Macro liquidity: modeling Bitcoin’s sensitivity to global money supply and policy cycles

Together, these models support a base-case target of $1.42M per BTC by 2035, assuming Bitcoin captures roughly 1/3 of the global store-of-value market.

At the same time, Bitcoin’s risk profile is changing.

Correlations with equities are projected to fall meaningfully, reinforcing Bitcoin’s diversification role in portfolios.

What it means:

Bitcoin is transitioning from a high-volatility, opportunistic trade into a strategic portfolio asset.

Even at 2–5% allocations, simulations show Bitcoin improves long-term risk-adjusted returns and expands the efficient frontier, thanks to high expected returns, falling volatility, and low correlations.

For institutions, the takeaway is clear: You don’t need to “bet the farm” on Bitcoin but ignoring it is increasingly a portfolio risk.

BTC Range Decision Setup

What’s going on:

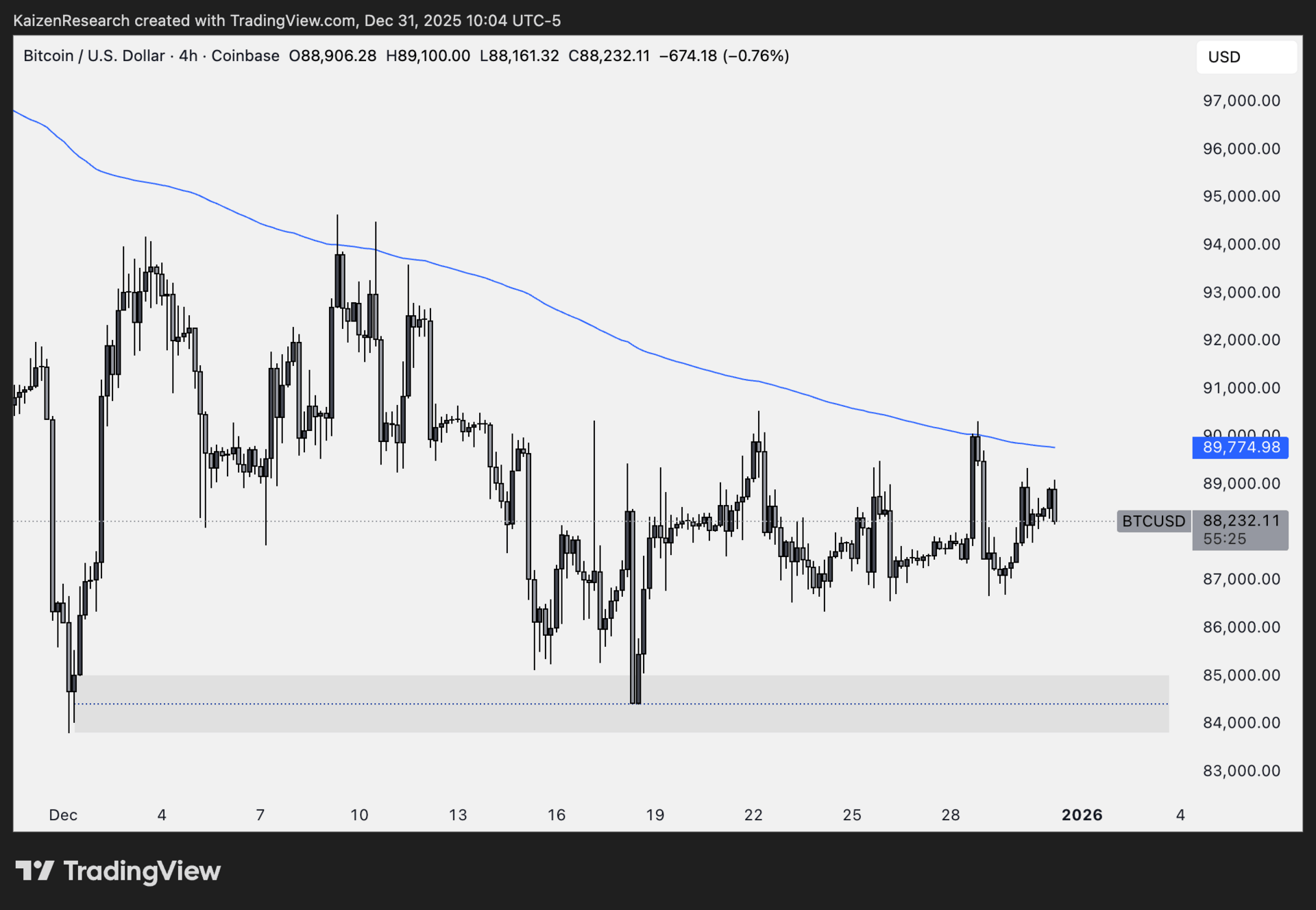

Bitcoin has made multiple attempts to reclaim the 200 EMA (blue), but every push has been rejected so far. That level continues to act as strong dynamic resistance.

Until the range resolves, price action is choppy and reactive. Not the environment to force trades.

Key levels we’re watching:

Resistance: 200 EMA → needs a clean reclaim

Support zone: Grey box below → primary area of interest

Breakdown risk: Loss of the support zone → downside should accelerate quickly

Bullish trigger: Break + hold above the 200 EMA, then long on retest

Directional Bias: Neutral

What we’re waiting for:

Strong reaction and defense at the grey support zone

Decisive reclaim of the 200 EMA

Clean retest for confirmation before entering

No forcing trades inside the range

This is a classic wait-and-react setup. Let price choose direction, then execute.

Novogratz Sounds the Alarm on XRP and ADA

What’s going on:

Mike Novogratz is questioning whether Ripple and Cardano still deserve their current valuations.

In a recent conversation with Alex Thorn he argued that crypto is moving out of its hype era and into a fundamentals-driven phase: where usage, revenues, and real adoption matter more than narratives and community size.

That’s where things start to look shaky.

XRP sits at a $112B market cap with just 16,000 active addresses

Cardano has a $12B market cap with 19,000 active addresses

Solana (by contrast) has a $69B market cap and 7M daily active addresses

What it means:

The gap between valuation and real usage is getting harder to ignore.

Novogratz’s warning is simple: communities alone won’t be enough anymore. As the market matures, tokens are increasingly being judged like businesses. Who’s using the product, how often, and at what scale.

The days of “number go up” without fundamentals are slowly (but clearly) ending.

| SEA: |

| AEVO: |

| INX: |

| LIT: |

Novogratz says XRP & ADA valuations don’t make sense. You agree? |

The biggest lesson from this cycle is that crypto is no longer moving on autopilot, the old four-year script is breaking down, and macro liquidity now matters more than ever.

2025 wasn’t a failure year, it was a transition year where institutional flows replaced speculative mania and forced a reset in expectations.

If 2026 plays out as expected, the real bull run won’t be driven by hype, but by regulation, ETFs, stablecoin adoption, and a return of global liquidity.

Altseason isn’t dead, it’s delayed and when it arrives, it will likely be sharper, more selective, and far more macro-driven than past cycles.

The takeaway is simple: patience and positioning matter more than prediction, because the biggest moves usually happen right after consensus gives up.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.