- The Warmup by Kaizen

- Posts

- Hyperliquid Is Turning Into a Macro Perps Giant

Hyperliquid Is Turning Into a Macro Perps Giant

PLUS: Bitcoin Is Holding Up Better Than It Looks

Welcome back to The Warmup.

This is crypto holders while every other asset class pumps to ATHs.

Here’s what we’re watching:

Market Snapshot

Hyperliquid Is Turning Into a Macro Perps Giant

ETH EMA200 Pullback

Bitcoin Is Holding Up Better Than It Looks

Market: Risk-on tone. ETH is leading crypto higher, gold is catching a bid, and a flat DXY with low VIX keeps conditions supportive.

Hyperliquid Is Turning Into a Macro Perps Giant

What’s going on:

Hyperliquid’s HYPE token ripped ~35% as HIP-3 adoption accelerated.

HIP-3 lets builders launch new perpetual markets by staking HYPE, expanding Hyperliquid beyond crypto into tokenized stocks, metals, and macro assets.

The growth has been fast.

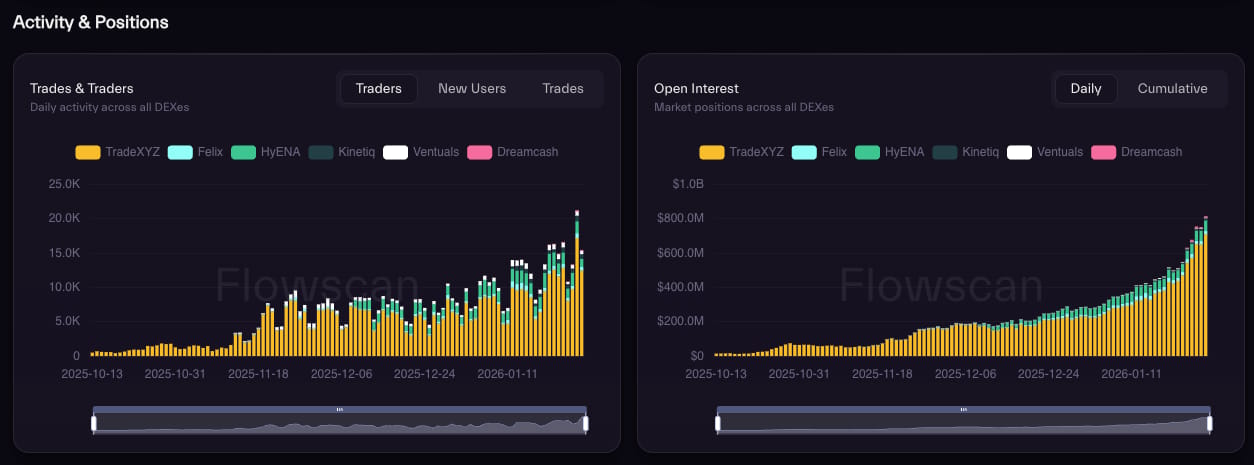

HIP-3 markets have already driven $24B+ in cumulative volume. Daily trading recently pushed $1.4–$1.5B, while open interest jumped to ~$790M, up from ~$260M just a month ago.

Silver alone did over $1.3B in one day.

Rising usage feeds directly into HYPE demand, since builders must stake the token and higher volume increases protocol fees.

What it means:

Hyperliquid is evolving from a crypto perps venue into a “trade everything” exchange.

With gold and silver ripping, onchain traders want macro exposure without leaving crypto rails. Hyperliquid is capturing that flow.

For HYPE, the flywheel is simple: more markets → more volume → more fees → more buybacks.

And the market is starting to notice.

ETH EMA200 Pullback

What’s going on:

ETH is running into the 4H EMA200, a key dynamic resistance. After a sharp bounce, odds favor a healthy pullback rather than immediate continuation.

Key levels we’re watching:

Resistance: $3,070–$3,100 (EMA200)

Support: $3,000 → first reaction

Deeper support: $2,960

Directional Bias: Short-term pullback expected.

What we’re waiting for:

Rejection at EMA200 and a clean reaction at support for better R/R entries.

Bitcoin Is Holding Up Better Than It Looks

What’s going on:

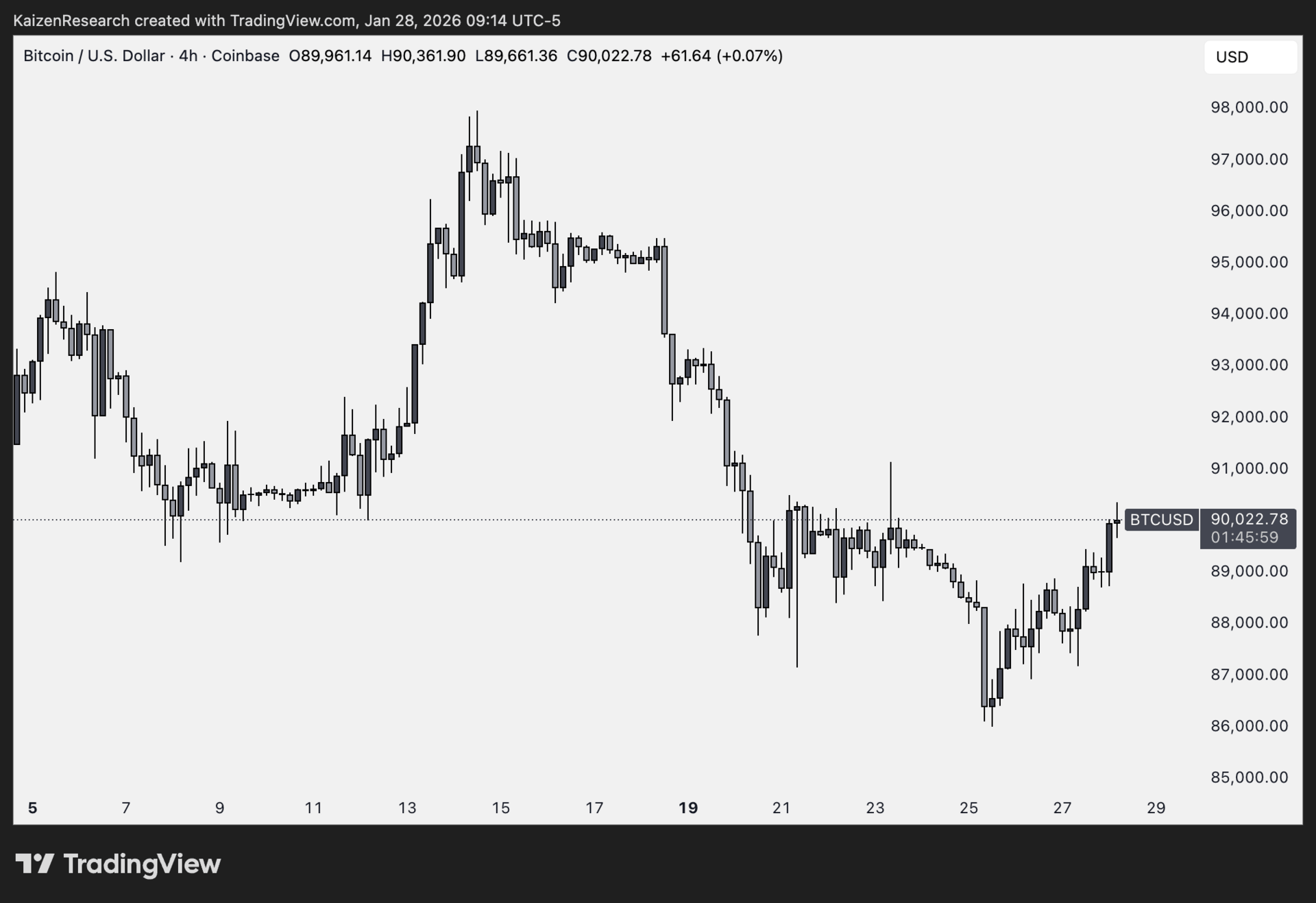

Two very different signals are pointing to the same conclusion: Bitcoin is holding up better than it looks.

On the macro side, Arthur Hayes highlights rising stress in Japan. A weaker yen alongside higher long-term bond yields suggests structural pressure that could force U.S. intervention.

If liquidity is injected to stabilize markets, that would ease bond yields and support risk assets, including Bitcoin.

Inside crypto, a new report from Coinbase Institutional and Glassnode shows a healthier setup than past drawdowns.

Late-2025 flushed excess leverage, reducing liquidation risk. Large investors are hedging with options, and long-term holders are distributing slowly, not panic selling.

What it means:

Macro risks are still real, but Bitcoin is entering this phase with cleaner positioning, less leverage, and more disciplined investors.

That may not spark an immediate rally, but it does suggest a market that can absorb shocks instead of unraveling when pressure hits.

If you’re serious about staying private online, it’s time to meet Enigma.

Enigma is building a privacy-native network designed to eliminate metadata exposure at the infrastructure layer, meaning it protects how data moves, not just what it contains.

Why people are paying attention to Enigma:

EPN (Enigma Private Network): a private network that “never stops moving,” with no public IPs and constantly changing routes

Vault: a wallet built for stronger asset protection, including quantum-resistant positioning

Echo: messaging designed for metadata protection, built to run through Enigma’s privacy layer.

Under the hood is RAVID, Enigma’s continuously redeploying infrastructure that aims to avoid fixed endpoints and static servers.

Explore Enigma and get started today.

| ETH: |

| PENDLE: |

| CITREA: |

| BIRB: |

Is Hyperliquid becoming a “trade everything” exchange? |

The next wave in crypto won’t be driven by hype, but by real products solving real problems.

Institutions like Coinbase Ventures are leaning into sectors like stablecoins, prediction markets, and crypto-AI because they already show signs of product-market fit, not just narrative buzz.

At the same time, the classic four-year cycle is breaking down as institutions, regulation, and infrastructure reshape how capital flows into the space.

The edge now comes from being early to fundamentals, not late to narratives.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.