- The Warmup by Kaizen

- Posts

- Crypto Is Melting Down Fast

Crypto Is Melting Down Fast

PLUS: The DAT Crash Has Begun

Welcome back to The Warmup.

It’s Friday, but with Bitcoin faceplanting, the party hats are staying in the drawer.

Here’s what we’re watching:

Market Snapshot

Market Fear Is Spiking

Bitcoin Oversold Breakdown

The DAT Meltdown Is Getting Ugly

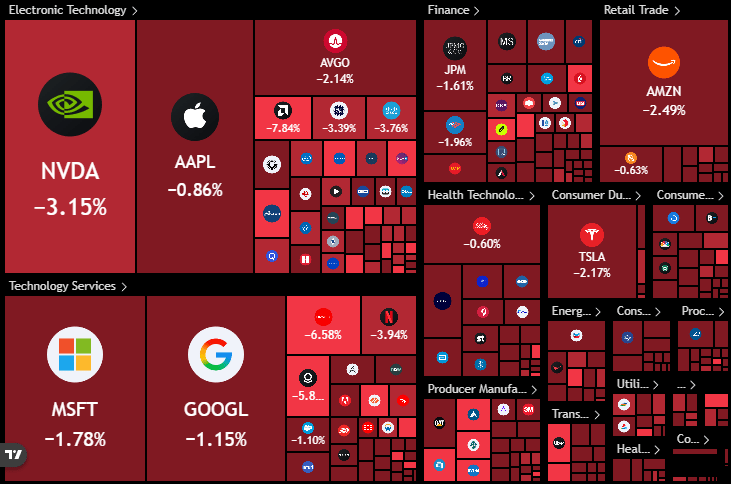

Market: Crypto is getting smoked across the board while equities are slightly red, and gold is the only major asset showing strength today as investors rotate into safety.

Market Fear Is Spiking

What’s going on:

Markets are in full risk-off mode.

Margin debt is at record highs, extreme leverage is everywhere, and fear has exploded even with the S&P only 5% off all-time highs.

Margin debt hit $1.13T, the highest ever

Five-times-levered ETFs are being proposed

The Fear and Greed Index has crashed to 7

A data blackout from the government shutdown is keeping uncertainty high

AI-driven disruption is adding even more intraday volatility

In crypto the pain is even worse.

Positions are being unwound at high speed, liquidity is thin, and rumors of impaired market makers are spreading.

It looks and feels like past panic periods: BTC fell 56% in four weeks in 2021, ETH fell 62%, SOL 68%, and then everything ripped to new highs soon after.

We are extremely oversold, but the sell-off has not eased yet.

What it means:

This looks like a classic short-term fear spike, not the start of a meltdown. The S&P 500 is still up 11% year-to-date and 35% since April.

Market sentiment is simply stretched, leverage is amplifying every move, and uncertainty from missing data is shaking confidence.

Once fresh economic data starts flowing again, volatility should cool off. Big picture? We’re likely in a brief correction before the next leg higher.

Bitcoin Oversold Breakdown

What’s going on:

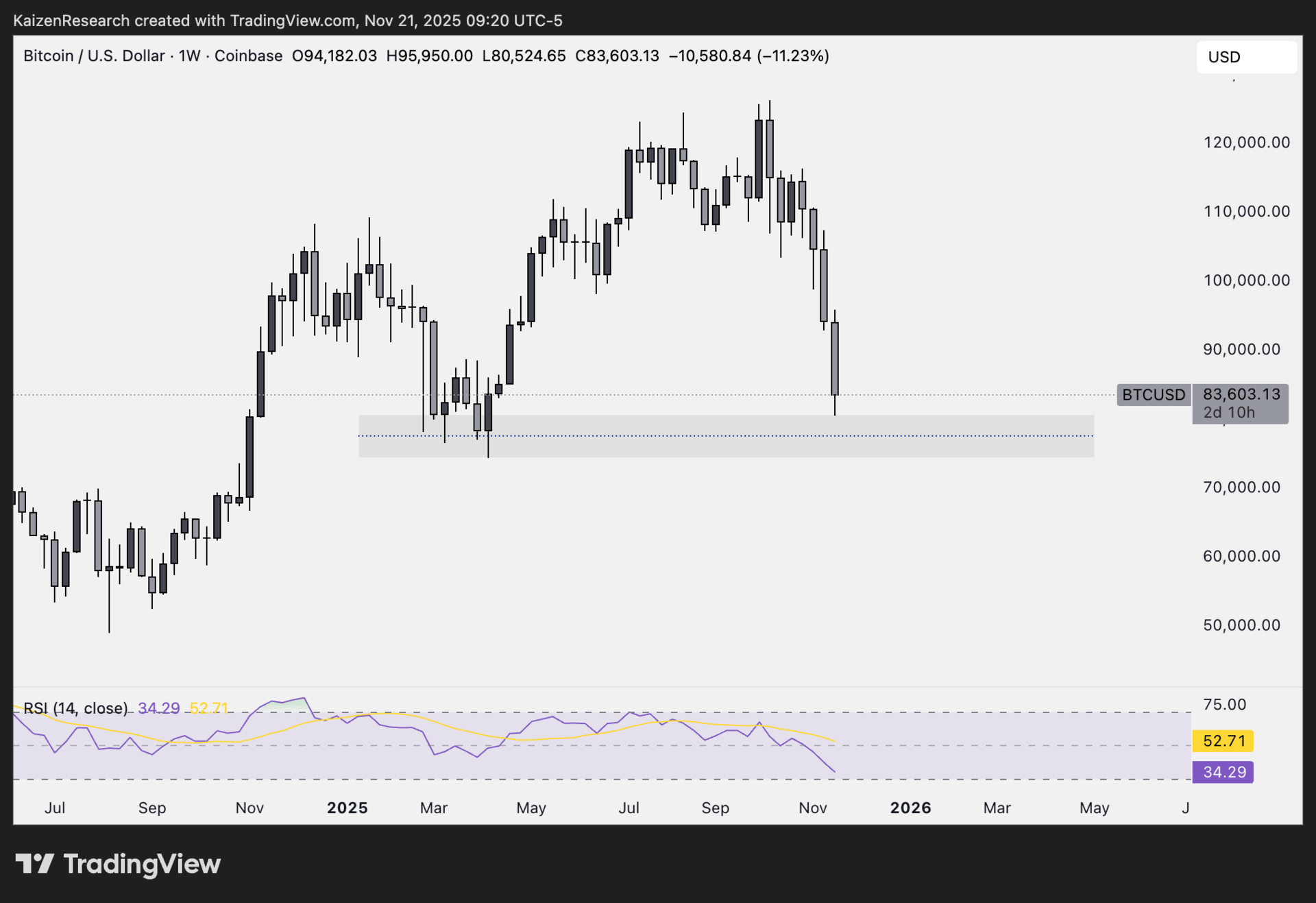

Bitcoin’s weekly chart is flashing rare signals. Price is sliding toward the major weekly support around $75,000, and momentum is collapsing so fast that the weekly RSI is now approaching the same levels we saw at the bottom of the 2022 bear market.

Key levels we’re watching:

Support: $75,000 → Major weekly support. A bounce is expected here if buyers step in.

Resistance: $88,000–$90,000 → First real hurdle to flip if the trend wants to recover.

Breakdown risk: A weekly close below $75K opens the door to deeper downside.

Directional Bias: Cautious

Cautiously bearish short-term due to weekly momentum collapse, but structurally bullish long-term because oversold weekly RSI signals tend to mark generational opportunities.

What we’re waiting for:

A weekly candle showing seller exhaustion (long wick, slowing momentum)

RSI stabilization with bullish divergence on lower timeframes

Spot accumulation picking up again

Clear reclaim of $88K+ to confirm reversal

The DAT Meltdown Is Getting Ugly

What’s going on:

Crypto majors are down, but DATs are getting crushed. The latest drop in BTC and ETH has slammed the public companies built entirely on holding them.

Here’s the damage:

Strategy (MicroStrategy) is down about 60% from its yearly high

Metaplanet is down close to 80%

SharpLink is down about 90%

BitMine is down roughly 80%

Some DATs have already started selling:

Investors are worried this could trigger more forced selling.

What it means:

DATs are now trading below the value of their underlying crypto. That means the market is no longer willing to pay a premium for “just buy more BTC and ETH” strategies.

Smaller or exotic-token DATs will likely keep selling or unwinding

Some may get acquired

The biggest players like Strategy, BMNR, and SBET will survive, but they could still face more pain if prices keep dropping

mNAV compression below 1 was always the endgame for DATs. It just came faster than expected.

Now the question is whether BTC and ETH stabilize, and whether new buyers still believe in the DAT model after this drawdown.

| Hyperbeat: |

| Debridge: |

| NVDA: |

| HYPE: |

What Happens Next for the DATs? |

Crypto has taken some hits this year, but the macro backdrop still supports a bigger move ahead.

Bitcoin looks like it is simply lagging as it shifts from old holders to institutions, which takes time.

Most altcoins remain uninvestable, and the lack of clear regulation is slowing broader adoption.

But the strong projects will have their moment, and the bull market is still alive. It is only a matter of time before crypto catches up.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.