- The Warmup by Kaizen

- Posts

- Coinbase Is Feeling the Pain

Coinbase Is Feeling the Pain

PLUS: BlackRock Went Full DeFi

Welcome back to The Warmup.

Happy Friday! This is the current sentiment on crypto twitter.

Here’s what we’re watching:

Market Snapshot

Coinbase Is Feeling the Pain

ETH Support Rebound Play

BlackRock Went Full DeFi

Market: Crypto is green across the board while equities chop and volatility cools.

Coinbase Is Feeling the Pain

What’s going on:

Coinbase just posted a rough quarter, showing how brutal a slow crypto market can be for trading-heavy businesses.

Q4 revenue came in at $1.78B, missing expectations, with a $667M net loss after large unrealized writedowns on its crypto and strategic investments.

Transaction revenue fell hard as volumes dried up, while costs stayed sticky. The stock is now down ~55% over the past six months.

But it’s not all bad under the hood.

Full-year trading volume jumped 156% YoY

Global market share doubled

Stablecoin revenue grew 61%

Coinbase One is nearing 1M subscribers

The company is sitting on $11.3B in cash

The short-term outlook is still tough though. Q1 guidance points to weaker subscription revenue, and trading activity hasn’t bounced yet.

What it means:

Coinbase is transitioning from a pure trading business into crypto infrastructure.

That shift is painful in down markets, but it’s the bet they’re making for the next cycle.

COIN remains a leveraged crypto play. Huge upside if activity returns, real downside while it doesn’t.

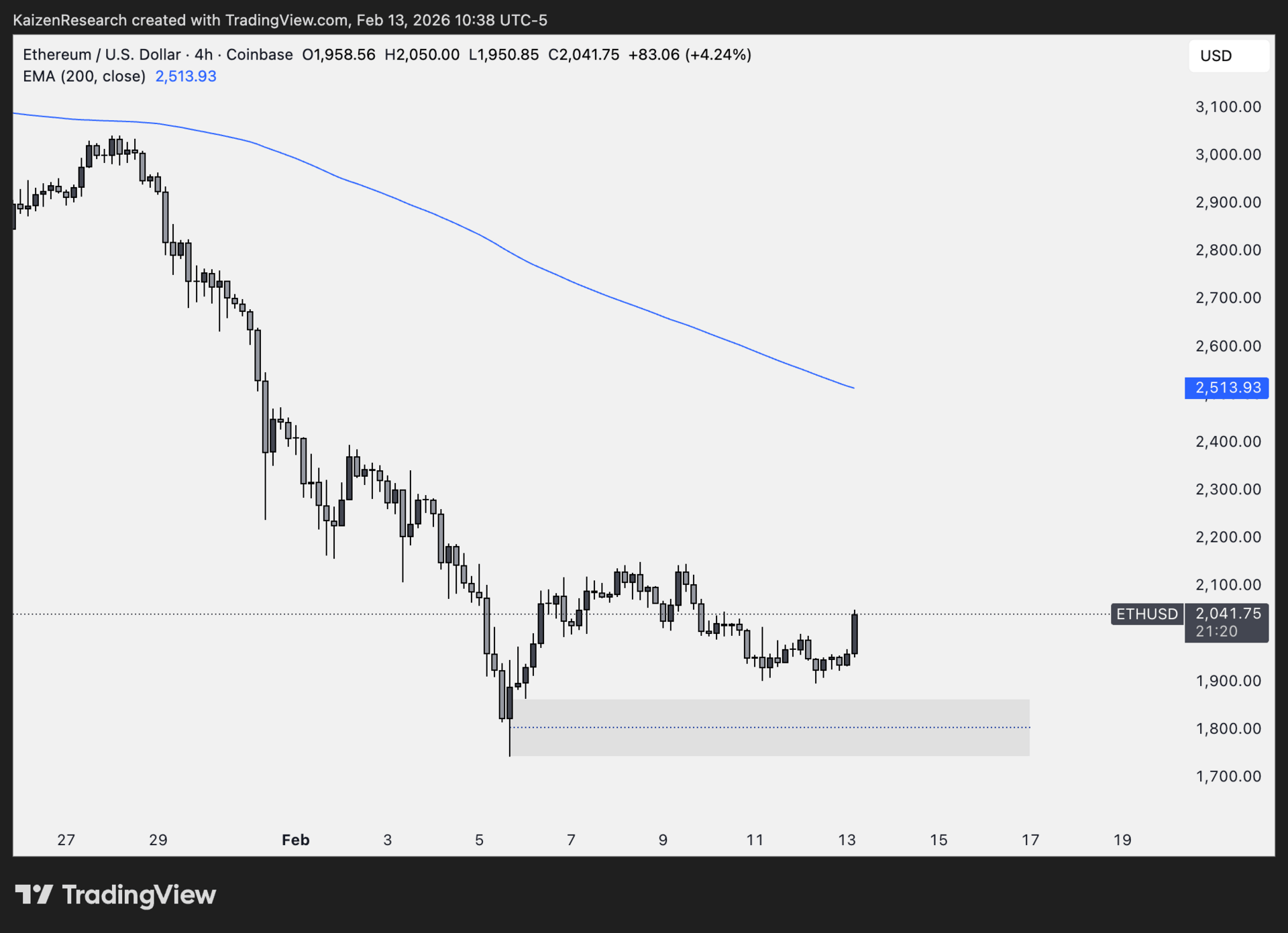

ETH Support Rebound Play

What’s going on:

ETH is still in a 4H downtrend, but price is holding a clear demand zone after the sharp selloff from $2.6K.

The $1.75K–$1.85K area has produced strong reactions, suggesting sell pressure is being absorbed and a short-term base may be forming.

This looks like a relief bounce setup, not a trend reversal.

Key levels we’re watching:

Support: $1.75K–$1.85K

Resistance: $2.05K–$2.10K

Bounce target: $2.10K–$2.20K

Breakdown risk: Close below $1.75K

Directional Bias: Cautiously bullish (counter-trend)

What we’re waiting for:

Support to continue holding

Higher lows on 4H

Clean break above $2.05K with volume

BlackRock Went Full DeFi

What’s going on:

BlackRock just took a real step into DeFi. Not a test. Not a pilot. Real capital, real rails.

They made a strategic move into Uniswap, buying UNI and placing their $2.2B tokenized treasury fund (BUIDL) directly on a decentralized exchange.

That means qualified investors can now swap tokenized U.S. Treasuries 24/7 using stablecoins.

UNI ripped over 40% on the news, but price isn’t the main story.

What it means:

BlackRock didn’t build a private chain. They didn’t spin up custom infrastructure.

They chose existing DeFi rails. That’s a massive vote of confidence in public, permissionless protocols.

Speed: TradFi settlement takes days. DeFi settles near instantly. Less idle capital, more efficiency.

Availability: Markets that never close beat markets that sleep.

Functionality: Tokenized treasuries can be used as collateral instantly, without lawyers or delays.

Gated treasuries are boring. But institutions don’t move boring assets onchain unless they’re testing the future.

This is how it starts.

| BTC: |

| SOL: |

| AAVE: |

| PUMP: |

Is COIN a buy at these levels, or does more pain lie ahead? |

This wasn’t a signal to panic, it was a signal that leverage, liquidity, and sentiment finally broke at the same time.

Capitulation is a process, not a candle, and the damage we’re seeing is more about market structure than fundamentals collapsing.

With liquidity slowly stabilizing and excess risk flushed out, the groundwork for the next phase is being laid quietly, not loudly.

The hardest part now isn’t surviving more downside, it’s having the patience to stay positioned while nothing feels good.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.