- The Warmup by Kaizen

- Posts

- BitMine Goes MrBeast

BitMine Goes MrBeast

PLUS: Goldman Eyes Tokenization & Prediction Markets

Welcome back to The Warmup.

Happy Friday! Are we gonna see BTC reach $100K next week?

Here’s what we’re watching:

Market Snapshot

BitMine Goes MrBeast

HYPE Reversal Setup

Goldman Eyes Tokenization & Prediction Markets

Market: Mild risk-off, crypto and equities red while DXY and VIX tick up. Likely consolidation, not a breakdown.

BitMine Goes MrBeast

What’s going on:

Instead of the usual DAT playbook (raise capital → buy ETH → sit on it), BitMine is using its ETH-backed balance sheet to fund a consumer-facing fintech product with massive distribution (200M+ users).

The platform is expected to blend traditional finance with crypto rails and DeFi, leveraging BitMine’s infrastructure and liquidity. This comes as ETH is already up ~12% to start the year.

What it means:

This is a real shift in strategy.

You’re not just getting ETH exposure anymore. You’re getting ETH plus a moonshot tied to mainstream adoption.

BitMine isn’t playing defense in 2026. It’s going on offense.

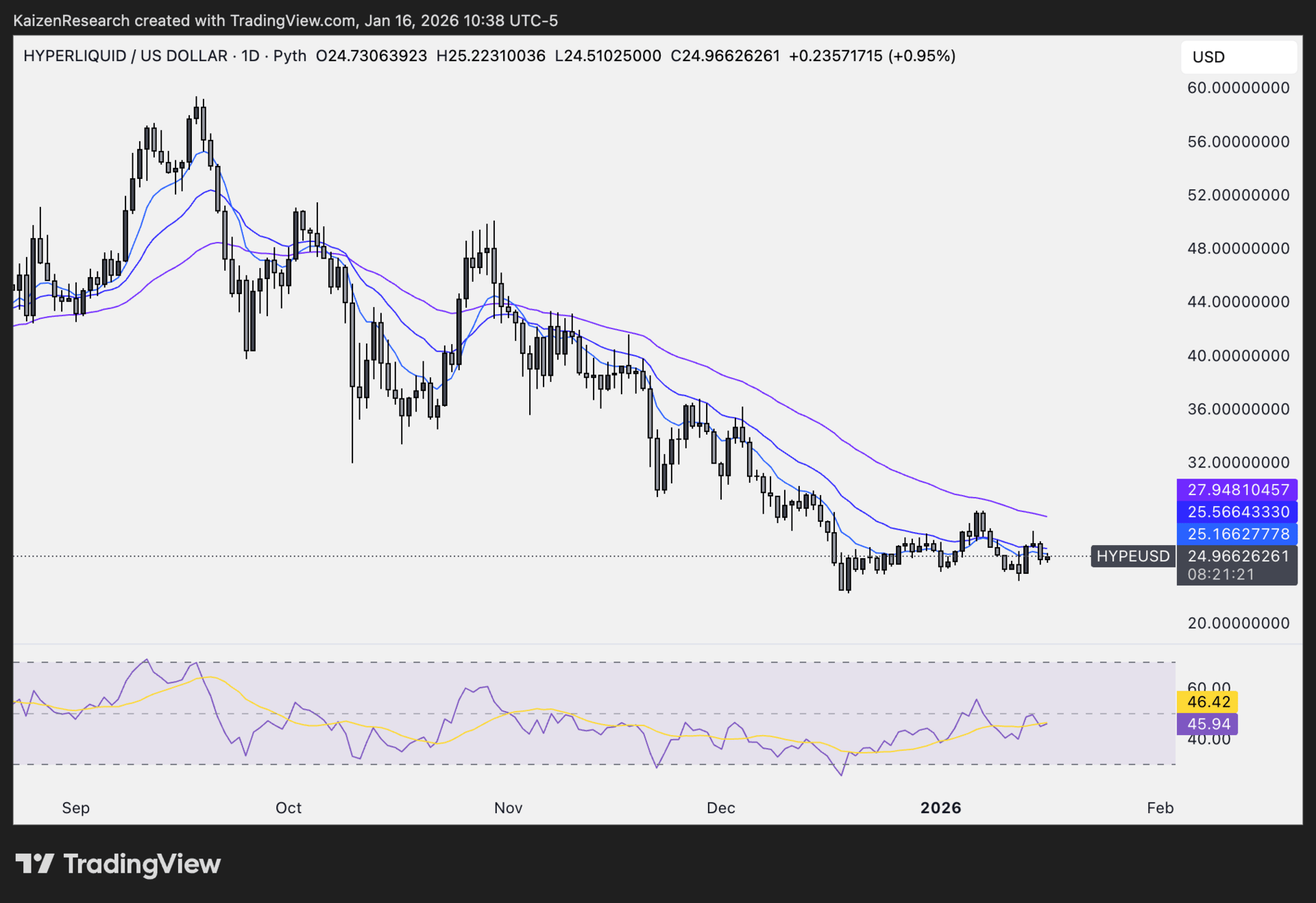

HYPE Reversal Setup

What’s going on:

HYPE corrected ~60% from its highs ($59 → $22) and is now showing early signs of stabilization. Price is hovering around the 9D & 21D EMAs and RSI is trending higher, suggesting selling pressure is easing.

Key levels we’re watching:

Support: $25

Resistance: $28 (50D EMA)

Target: $30+

Invalidation: Lose $25 → risk back to low $20s

Directional Bias: Cautiously bullish

What we’re waiting for:

Acceptance above $28 and continued RSI strength. Risk/reward is improving, but confirmation is still needed.

Goldman Eyes Tokenization & Prediction Markets

What’s going on:

Goldman Sachs CEO David Solomon says the firm is actively exploring tokenization, stablecoins, and prediction markets as U.S. crypto regulation starts to take shape.

On the bank’s Q4 earnings call, Solomon said large internal teams are testing where these technologies could fit into Goldman’s existing businesses, especially as market structure legislation evolves.

Goldman is also studying prediction markets, focusing on CFTC-regulated products that resemble derivatives. Solomon noted he’s met directly with major platforms, but stressed that real adoption will likely move slower than headlines suggest.

What it means:

This is another signal that Wall Street is preparing, not rushing.

Goldman isn’t trying to be first, but it wants optionality once regulation is clear. Tokenization, stablecoins, and prediction markets are now officially on the radar of one of the most influential banks in the world.

Quietly bullish for crypto’s long-term integration into traditional finance.

| KAITO: |

| ONDO: |

| Football dot Fun: |

| FOGO: |

Is BitMine’s $200M bet on a MrBeast-led fintech platform bullish or risky? |

The uncomfortable truth is that 2026 doesn’t magically become bullish just because the calendar flips.

Demand has weakened, key metrics are flashing caution, and the catalysts people are counting on look smaller than expected.

That doesn’t mean crypto is dead, it means this phase will reward patience, selectivity, and discipline.

The real opportunity won’t come from hype, but from positioning early while most people are still waiting for confirmation.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.