- The Warmup by Kaizen

- Posts

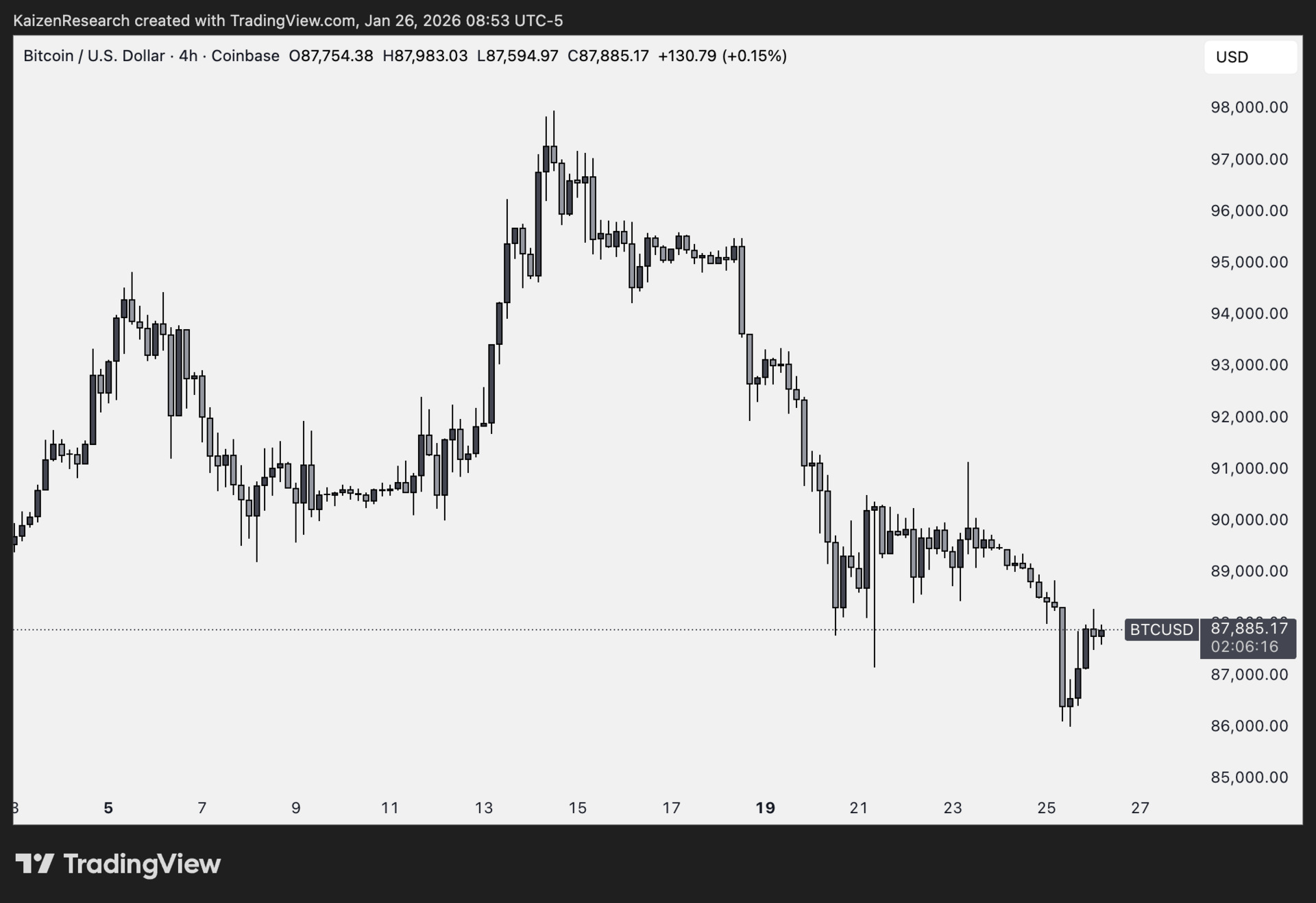

- Bitcoin Slips as Markets Flip Risk-Off

Bitcoin Slips as Markets Flip Risk-Off

PLUS: Ethereum and Optimism Are Future-Proofing

Welcome back to The Warmup.

This is me watching the crypto market proceed with its weekly Sunday nuke.

Here’s what we’re watching:

Market Snapshot

Ethereum and Optimism Are Future-Proofing

BTC Scalp Short (Risky)

Bitcoin Slips as Markets Flip Risk-Off

Calendar

Market: Crypto is red while stocks are mostly flat-to-green. Gold and VIX are up, DXY is down, signaling a mild risk-off tone.

Ethereum and Optimism Are Future-Proofing

What’s going on:

The Ethereum Foundation is moving early on post-quantum security.

Not because quantum computers are here yet, but because upgrading cryptography across a global network takes years. Waiting until it’s urgent would be too late.

That’s why Ethereum just formed a dedicated post-quantum team and backed it with $2M in research incentives, testing, and new cryptographic tooling.

Justin Drake called it a top strategic priority. This is execution, not theory.

Optimism is aligned on the same long-term view. OP announced a 10-year roadmap to phase out today’s wallet signatures across its Superchain, including Base.

The plan moves users toward smart accounts that can support post-quantum security, without changing addresses or touching funds. Slow, coordinated upgrades instead of rushed fixes.

What it means:

Quantum risk isn’t urgent, but migrations are slow.

Ethereum and Optimism are buying time and optionality.

That’s what real infrastructure planning looks like.

BTC Scalp Short (Risky)

What’s going on:

BTC is getting rejected at the EMA 200 (blue) after a strong bounce. Momentum is fading near resistance, setting up a short-term pullback.

Key levels we’re watching:

Entry: CMP (Current Market Price)

Target: $86,800

Stop: $88,600

Directional Bias: Cautiously bearish (scalp)

What we’re waiting for:

Continued rejection below EMA 200

Quick move into $86.8K

Bitcoin Slips as Markets Flip Risk-Off

What’s going on:

Bitcoin started the week on the back foot as global tensions pushed investors into safe-haven mode.

BTC briefly slid to just above $86K, its lowest level this year, before stabilizing near $87.8K. ETH took a harder hit, dropping nearly 6% at the lows and still hovering near its weakest levels since mid-December.

This doesn’t look like a real bounce. More like a breather.

The trigger was a mix of macro stress. Trump floating new tariffs on Canada, Middle East tensions rising, US shutdown fears, and Japan potentially stepping into FX markets. Classic risk-off fuel.

The rotation is obvious. Gold just ripped past $5,100 and silver hit record highs. Crypto went the other way.

ETF flows didn’t help either. US spot Bitcoin ETFs saw $1.7B in outflows last week, adding extra sell pressure.

What it means:

Crypto is trading like a risk asset, not a safe haven.

Until macro uncertainty clears up, expect choppy price action and fragile rallies. This is a market waiting for clarity, not chasing upside.

| RIVER: |

| BIRB: |

| PUMP: |

| ME: |

Key Events this Week

Major token unlocks:

Kamino (KMNO): ~$10M unlock on Jan 30 (~3.6% of supply)

Sui (SUI): ~$62M unlock on Feb 1 (~1.15% of supply)

Macroeconomic data calendar:

Mon (Jan 26):

Core Durable Goods Orders (Dec): Measures business investment demand → stronger prints suggest resilient capex; weakness signals corporate caution.

Durable Goods Orders (Dec): Tracks big-ticket manufacturing demand → volatile data, but sharp downside surprises can pressure growth expectations.

Tue (Jan 27):

President Trump Speaks: Potential market-moving headlines → trade policy, tariffs, or geopolitical comments can spark volatility across risk assets.

CB Consumer Confidence (Jan): Sentiment gauge for household spending → higher confidence supports consumption-driven growth, declines raise slowdown risks.

Richmond Fed Manufacturing Index (Jan): Regional manufacturing activity → continued weakness reinforces industrial slowdown narrative.

Wed (Jan 28):

FOMC Rate Decision: Policy rate expected unchanged → focus shifts to forward guidance and tone.

FOMC Statement: Key signal for inflation and growth outlook → any shift toward easing rhetoric could support risk assets.

FOMC Press Conference (Powell): Market-defining event → language around inflation progress, labor market, and timing of cuts will drive rates, equities, and crypto.

Thu (Jan 29):

Initial Jobless Claims: High-frequency labor market data → rising claims suggest cooling employment; tight labor keeps inflation sticky.

Fri (Jan 30):

Core PPI (Dec): Producer-level inflation excluding food and energy → upstream price pressures feed into CPI expectations.

PPI (Dec): Broad wholesale inflation measure → hotter prints complicate the Fed’s easing path; softer data supports risk-on sentiment.

Major Earnings Releases:

Mon (Jan 26): Ryan Air

Wed (Jan 28): Tesla, Meta

Thu (Jan 29): Apple

What happens next for crypto? |

Liquidity, not narratives, is still the main driver of crypto’s next real move.

While the macro backdrop is improving and selling pressure from long-term holders has eased, the market hasn’t fully rebuilt the liquidity needed for a sustained breakout.

Recent upside has been helped by technical factors and forced short covering, not a fresh wave of capital.

Until liquidity truly returns, the focus is less about new money rushing in and more about existing capital simply stepping back into the space.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.