- The Warmup by Kaizen

- Posts

- Bitcoin Slides to 95K

Bitcoin Slides to 95K

PLUS: XRP ETF Launch Shocks the Market

Welcome back to The Warmup.

Where the market’s melting down but XRP still pulled off a record-breaking ETF debut like it’s bull season again.

Here’s what we’re watching:

Market Snapshot

Bitcoin Slides to 95K as Markets Search for a Bottom

XRP ETF Launch Shocks the Market

What We’re Watching

Market: Crypto and equities are both deep in the red today, and the VIX spike shows fear is finally hitting everything at once.

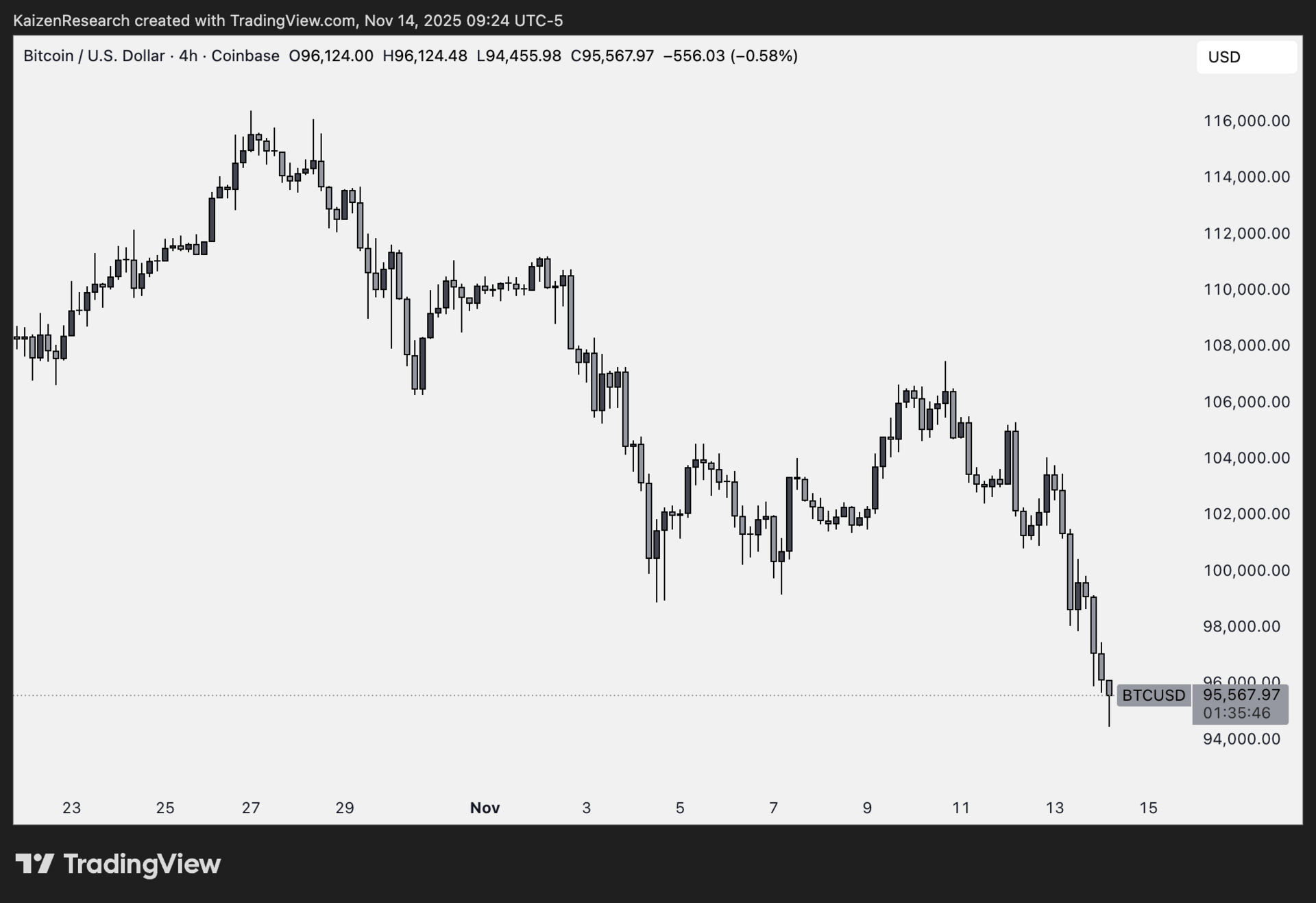

Bitcoin Slides to 95K as Markets Search for a Bottom

What’s going on:

Bitcoin broke below 100K again and slipped to 95K, sparking another wave of red across crypto and crypto-related equities.

While BTC ETFs saw $867M in outflows, the biggest day since February. Crypto stocks felt the squeeze too, with names like MicroStrategy, Coinbase and Robinhood all posting sharp declines.

Derivatives markets remain thin, and Bybit estimates it could take up to two quarters to rebuild the $19B in open interest wiped out during October’s liquidation.

Sentiment is sitting in Extreme Fear, levels not seen consistently since 2022, and the market feels fragile after multiple failed holds of the 100K level.

Despite the near-term pain, the long-term backdrop hasn’t changed. The macro setup still points to easing, institutional adoption continues to build, regulatory clarity is improving and stablecoin usage keeps growing.

Even gold’s rally is setting up a rotation narrative for Bitcoin.

What it means:

Nobody knows if the market finds its bottom this weekend or needs more pain to shake out weak hands.

What matters is remembering that the long-term drivers for crypto remain intact and stronger than ever.

Short-term volatility doesn’t change the structural story playing out. Stay focused on the big picture instead of the last few candles.

XRP ETF Launch Shocks the Market

What’s going on:

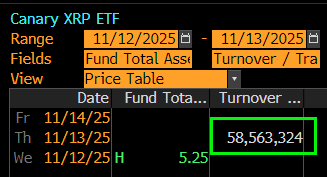

In the middle of a brutal market sell-off, Canary Capital’s new spot XRP ETF (XRPC) just delivered the biggest ETF debut of the entire year, pulling in $58M in day-one trading volume.

It even edged out Bitwise’s Solana ETF launch, which previously held the crown at $57M dollars.

XRPC did $26M in its first hour of trading, only XRP and Solana are playing in this league, with every other ETF debut this year trailing by more than $20M.

What it means:

ETF success runs on conviction, not consensus. As Bitwise CIO Matt Hogan said, ETFs die from apathy, not disagreement.

XRP’s fanbase isn’t just loud, they show up with real volume.

With the government reopened, updated SEC guidance in place, and more spot ETFs lined up, another wave of ETF-driven flows could hit the market soon.

| SUI: |

| LDO: |

| JUP: |

| AERO: |

Are We Near the Bottom? |

If you want the kind of returns crypto can deliver, you have to accept the reality that most of the year will feel like chop or drawdowns, not new highs.

The big moves only happen in short bursts, and everything in between tests your patience.

The real skill is understanding what you own and why you’re invested so you don’t get shaken out during the boring or scary parts.

Do that, and the long-term outcome becomes a lot clearer.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.