- The Warmup by Kaizen

- Posts

- Bitcoin’s Most Chaotic Weekend Yet

Bitcoin’s Most Chaotic Weekend Yet

PLUS: Coinbase’s Biggest Leak Yet?

Welcome back to The Warmup.

You’re out here trying to call the bottom with the same confidence you use to tell your friends you’re ‘five minutes away’.

Here’s what we’re watching:

Market Snapshot

Bitcoin’s Wild Crash-and-Rebound Weekend

Solana EMA200 Watch

Coinbase Might Be Loading Up Something Big

Calendar

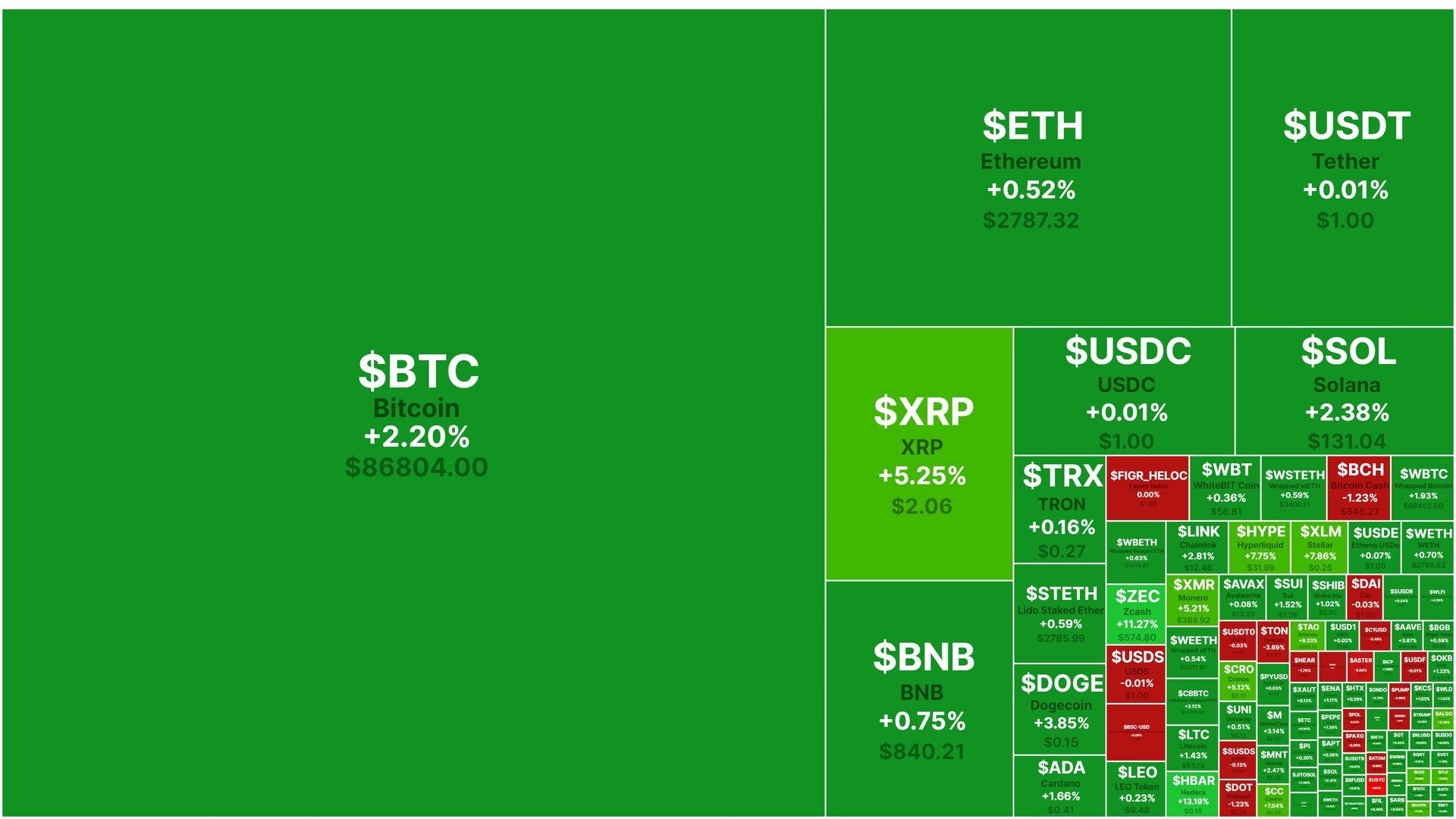

Market: BTC is stabilizing after the weekend rebound, ETH is showing early strength, and equities are carrying risk-on momentum while volatility keeps fading.

Bitcoin’s Wild Crash-and-Rebound Weekend

What’s going on:

Friday was a wipeout. Bitcoin broke below 86K, then 81K, triggering more than 1.7B in liquidations. It was one of the biggest flushes of the year.

But instead of spiraling lower, buyers stepped in.

Through Saturday and Sunday, BTC pushed back above 87K, ETH steadied, and even beaten-down alts bounced.

Current 30-day moves:

Bitcoin: 86,000 (-23%)

ETH: 2,800 (-29%)

XRP: 2.05 (-20%)

BNB: 840 (-25%)

Solana: 129 (-33%)

It is shaping up to be one of the worst months since 2022, but the weekend showed demand is still alive.

What it means:

This reset was violent but healthy. Buyers are still out there, and they proved it fast.

If prices hold steady this week, we might have just seen a local bottom.

If selling restarts, the market could be hinting at something bigger ahead.

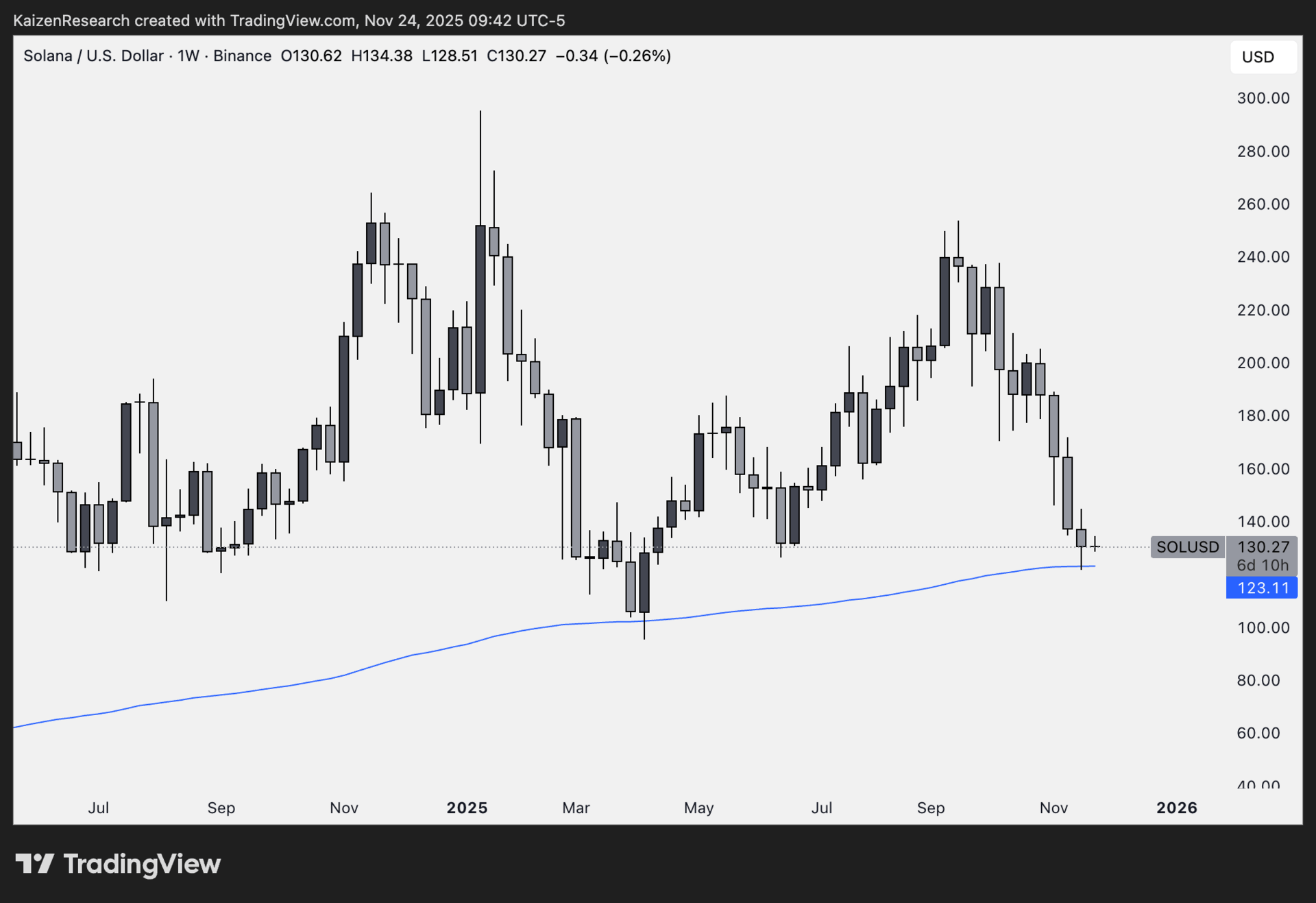

Solana EMA200 Watch

What’s going on:

Solana is sitting right on the weekly EMA200 around $123. This level is acting as the main battlefield where buyers and sellers are fighting for the next major move.

Hold it, and SOL may be carving out a bottom. Lose it, and the chart opens up to lower levels fast.

Key levels we’re watching:

Support: $123 → weekly EMA200 and current line in the sand

Downside zone: $95–$100 → next major demand area if EMA200 fails

Reclaim target: $135+ → first sign of strength on any bounce

Breakdown risk: Weekly close below $123 increases the chance of a deeper move

Directional Bias: Neutral

There is no confirmation yet. SOL is sitting at a pivotal level, but momentum hasn’t picked a side.

What we’re waiting for:

A weekly close above the EMA200

Volume confirmation on any move away from $123

Evidence of spot accumulation or strong bids returning

Until then, this is an observation zone. Any decisive break will dictate Solana’s next big move.

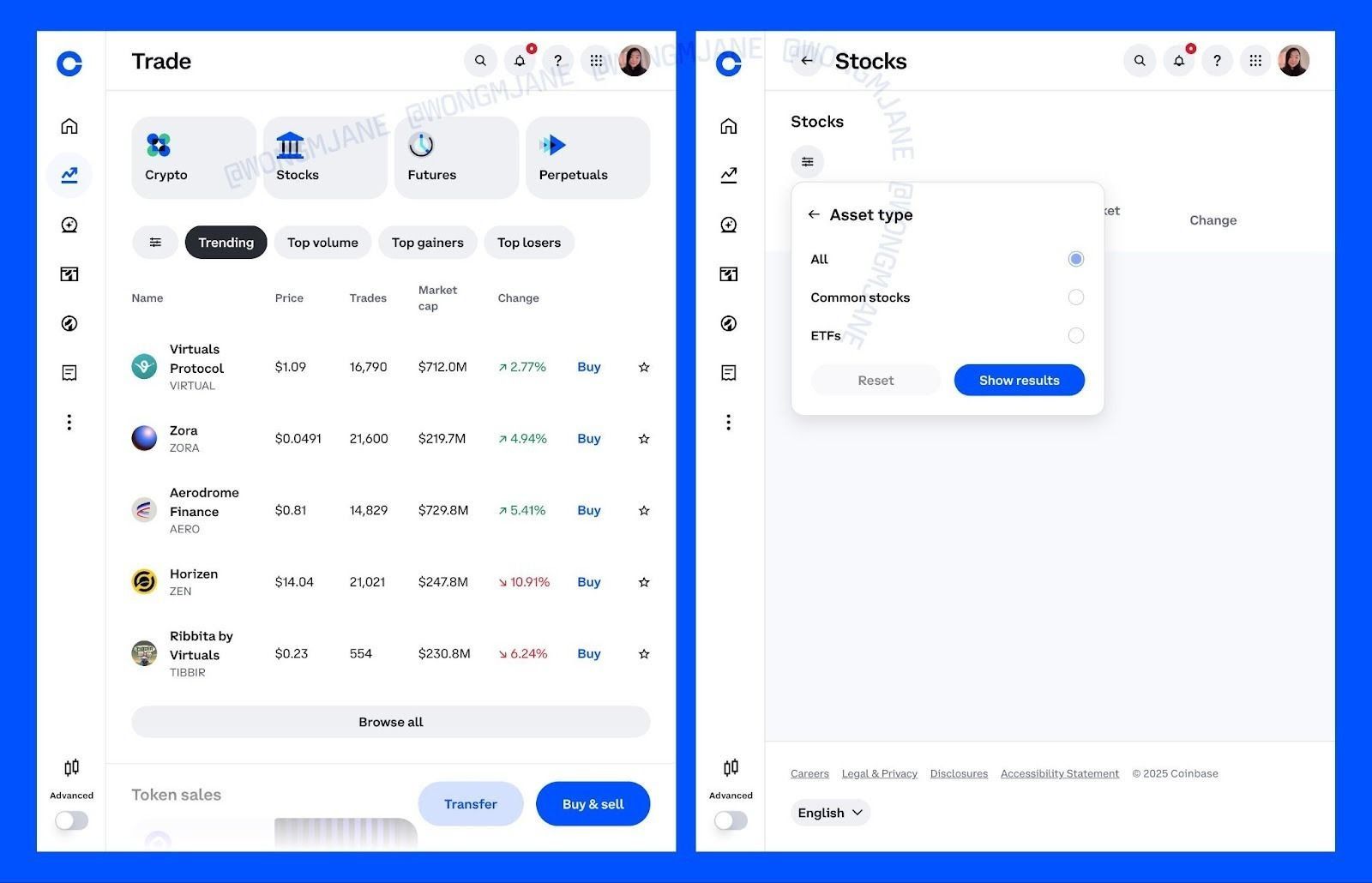

Coinbase Might Be Loading Up Something Big

What’s going on:

Three features from Coinbase’s December 17 event appear to have leaked, and they point to a major expansion.

Stock trading could be coming, and if it uses traditional exchanges, most equities would likely be available at launch.

Prediction markets also seem to be on the list, and with Coinbase’s huge user base, anything they release starts ahead of the pack.

And finally, an AI assistant that your dad will probably love more than you do.

The real standout here is stock trading.

Most investors still live in the equities world, and adding this puts Coinbase directly in the same lane as Robinhood, which has been crushing it this year.

What it means:

If these leaks are real, Coinbase is shifting from crypto exchange to all-in-one investing hub.

It opens the door to more users, more activity, and more revenue.

And it gives Coinbase a real shot at competing head-to-head with the platforms that dominate traditional finance.

| SOL: |

| COIN: |

| HYPE: |

| AERO: |

Key Events this Week

Major token unlocks:

Plasma (XPL): ~$18M unlock on Nov 25 (~4.7% of supply)

Jupiter (JUP): ~$13M unlock on Nov 28 (~1.7% of supply)

Macroeconomic data calendar:

Short but busy week ahead.

Tue (Nov 25):

September PPI Inflation Data: Producer-level inflation gauge → signals pipeline pricing pressure.

September Retail Sales Data: Measures consumer spending strength → key read on demand.

November CB Consumer Confidence: Tracks household confidence → rising confidence = stronger spending.

October Pending Home Sales: Forward-looking housing indicator → falling contracts suggest cooling demand.

Wed (Nov 26):

US Q3 2025 GDP Data: Broad measure of economic growth → strong GDP = stronger risk appetite.

September Durable Goods Orders: Captures big-ticket business spending → volatile but important for manufacturing outlook.

September PCE Inflation Data: Fed’s preferred inflation metric → critical for policy direction.

September New Home Sales: Tracks sales of newly built homes → sensitive to mortgage rates and housing demand.

Major Earnings Releases:

Tue (Nov 25): Dell

What do you think is the biggest unlock if the Coinbase leaks are real? |

Bitcoin works like a service that lets you store your wealth digitally without needing a bank or a government.

Its value grows as more people want that service, just like any product people rely on every day.

Over the last decade, interest has exploded as investors, endowments, and even countries look for a safer digital place to hold value.

And with the world getting more digital while government debt keeps rising, even more people will want what Bitcoin offers.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.