- The Warmup by Kaizen

- Posts

- Bitcoin Just Got Smacked

Bitcoin Just Got Smacked

PLUS: NYSE Goes Onchain With 24/7 Tokenized Trading

Welcome back to The Warmup.

Happy Monday. This is me, getting shaken out right before a generational pump after showing up every day for 3.5 years.

Here’s what we’re watching:

Market Snapshot

Bitcoin Just Got Smacked

BTC EMA200 Relief Play

NYSE Goes Onchain With 24/7 Tokenized Trading

Calendar

Market: Risk-off across crypto as BTC, ETH, and SOL slide alongside a spike in the VIX, while gold catches a bid suggesting investors are rotating into safety amid rising macro uncertainty.

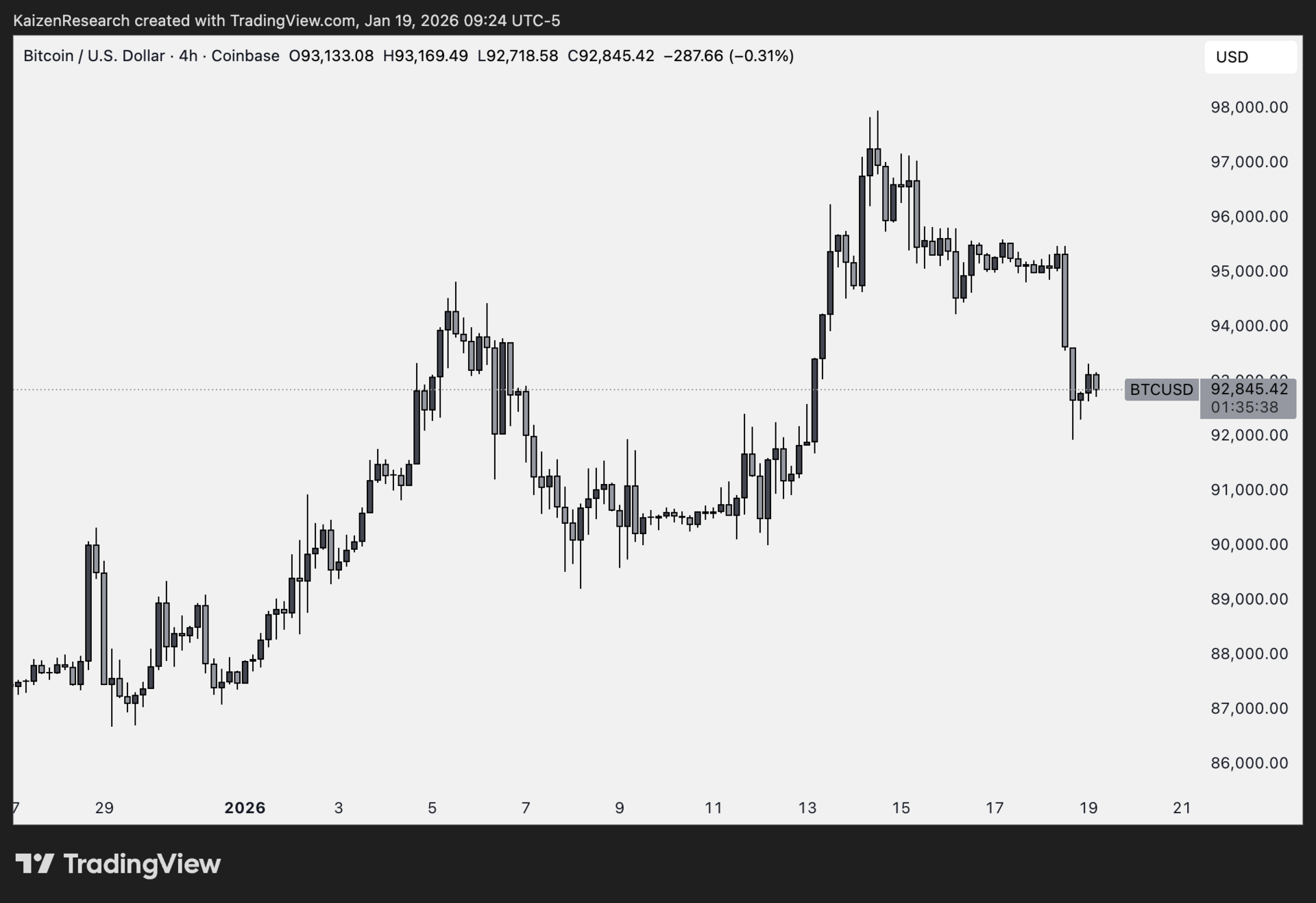

Bitcoin Just Got Smacked

What’s going on:

Bitcoin dropped below $92,500, falling about 3% in a few hours. ETH and majors followed, and over $750M in long positions were liquidated fast.

The immediate trigger was renewed U.S.–EU trade war fears after Trump threatened tariffs on several European allies over Greenland negotiations. Europe signaled possible retaliation, spiking geopolitical uncertainty.

But this move didn’t come out of nowhere. Crypto was already weak. While equities held up, crypto lagged. Add stalled U.S. crypto regulation, fading risk appetite, and months of post-ATH consolidation, and the market was primed to break.

Technically, BTC slipping below the 50-week moving average kicked off algorithmic selling. ETF outflows and declining futures open interest only added fuel.

What it means:

This doesn’t look like a classic crypto winter. The market is more mature, and long-term regulation still trends constructive.

Until liquidity and confidence return, crypto likely keeps underperforming.

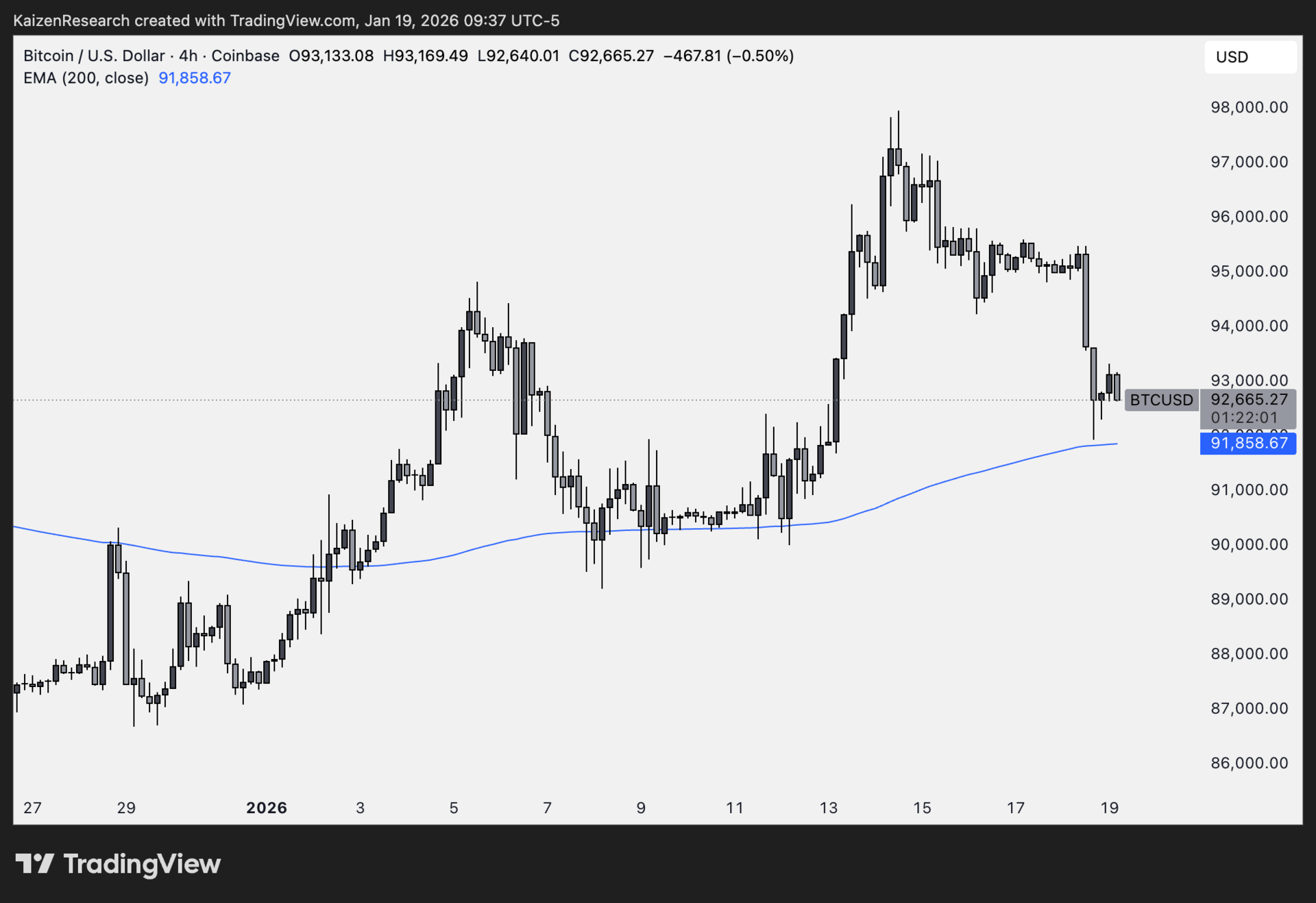

BTC EMA200 Relief Play

What’s going on:

BTC swept downside liquidity into the 4H EMA200, a key dynamic support. That flush sets up a potential short-term relief bounce, not a trend flip.

Key levels we’re watching:

Support: $92,000 → EMA200 zone and DCA entry area

Invalidation: $91,000 → clean break below EMA200 kills the setup

Target 1: $94,000 → first reclaim of prior value

Target 2: $95,000 → upper range resistance

Directional Bias: Cautiously bullish (short-term)

The bias stays constructive as long as BTC holds above the EMA200. A reclaim of $94k would confirm the relief move and open room toward $95k.

What we’re waiting for:

Hold above EMA200

Follow-through buying

Move stops to break-even after TP1

NYSE Goes Onchain With 24/7 Tokenized Trading

What’s going on:

The New York Stock Exchange is building a platform for tokenized U.S. stocks and ETFs, pending regulatory approval.

The system would allow 24/7 trading, fractional shares, dollar-based orders, and instant onchain settlement using tokenized capital and stablecoins. It combines NYSE’s Pillar matching engine with blockchain-based post-trade infrastructure and is designed to work across multiple blockchains.

Tokenized shares would be fully fungible with traditional equities, meaning investors keep the same dividend and governance rights as usual.

This is part of a broader push by ICE, NYSE’s parent company, to modernize clearing and move markets closer to an always-on model.

What it means:

This is TradFi borrowing straight from crypto’s playbook.

If approved, U.S. equities could start trading like digital assets. Always on, faster settlement, and more global access. It also opens the door for deeper integration between stablecoins, tokenized deposits, and capital markets.

The line between crypto rails and traditional finance just got a lot thinner.

| ONDO: |

| PUMP: |

| LINK: |

| GLXY: |

Key Events this Week

Major token unlocks:

LayerZero (ZRO): ~$44M unlock on Jan 20 (~6.4% of supply)

Macroeconomic data calendar:

Mon (Jan 19):

US Markets Closed – MLK Day: Holiday closure → thinner liquidity and muted spot trading, but futures and global markets can still react to headlines.

Stock Market Futures React to Trump’s 10% EU Tariffs: Trade policy shock → can trigger risk-off sentiment, pressure equities, and increase volatility in globally exposed sectors.

Wed (Jan 21):

December Pending Home Sales: Forward-looking housing indicator → rising signings signal improving demand; weaker data points to continued housing slowdown.

Thu (Jan 22):

US Q3 2025 GDP (Revision): Broad economic growth measure → stronger growth supports risk assets; weaker prints raise slowdown concerns.

November PCE Inflation: Fed’s preferred inflation gauge → higher PCE increases rate-tightening pressure; softer data supports easing expectations.

Fri (Jan 23):

January S&P Global PMI (Flash): Business activity survey → readings above 50 show expansion; below 50 signal contraction.

Major Earnings Releases:

Tue (Jan 20): Netflix, Interactive Brokers

Thu (Jan 22): Intel

What do you think caused Bitcoin’s drop below $92.5K? |

Regulatory noise hasn’t stopped the system from quietly easing in the background, and that’s the part most people are missing.

Liquidity is sneaking back through less obvious channels, setting up conditions that historically favor risk assets like crypto.

While headlines focus on what isn’t passing in Washington, the plumbing underneath markets is slowly turning supportive.

If you’re only watching the news and not the flows, you’re likely underestimating how bullish this setup really is.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.