- The Warmup by Kaizen

- Posts

- Bitcoin Erases the Trump Pump

Bitcoin Erases the Trump Pump

PLUS: Why Tokens Struggle to Build Real Value

Welcome back to The Warmup.

Happy Friday! Trump sends his regards.

Here’s what we’re watching:

Market Snapshot

Bitcoin Erases the Trump Pump

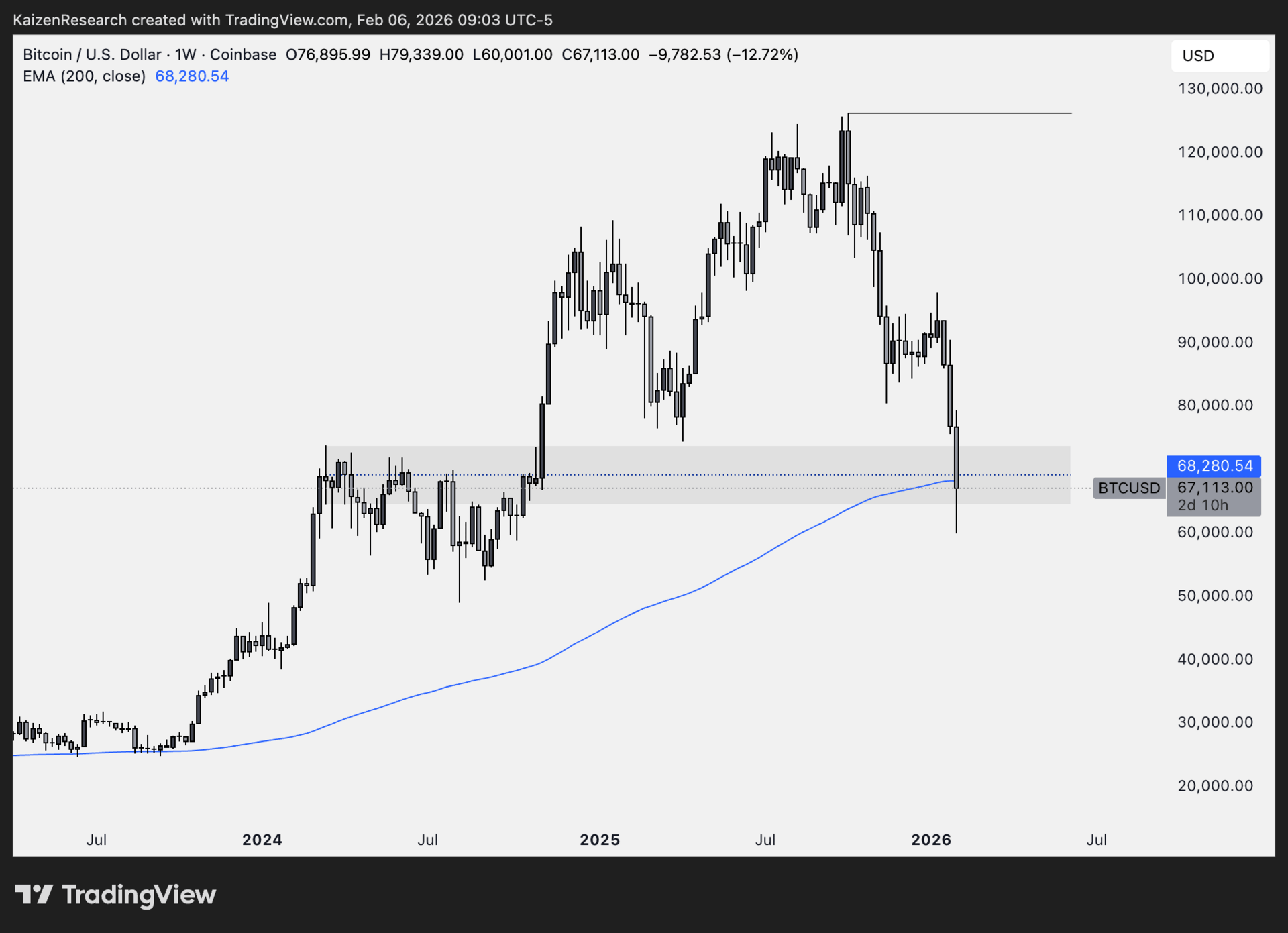

BTC Weekly EMA200 Decision Point

Why Tokens Struggle to Build Real Value

Market: Risk-off across crypto and equities as BTC, ETH, and SOL slide, while gold catches a bid and volatility cools.

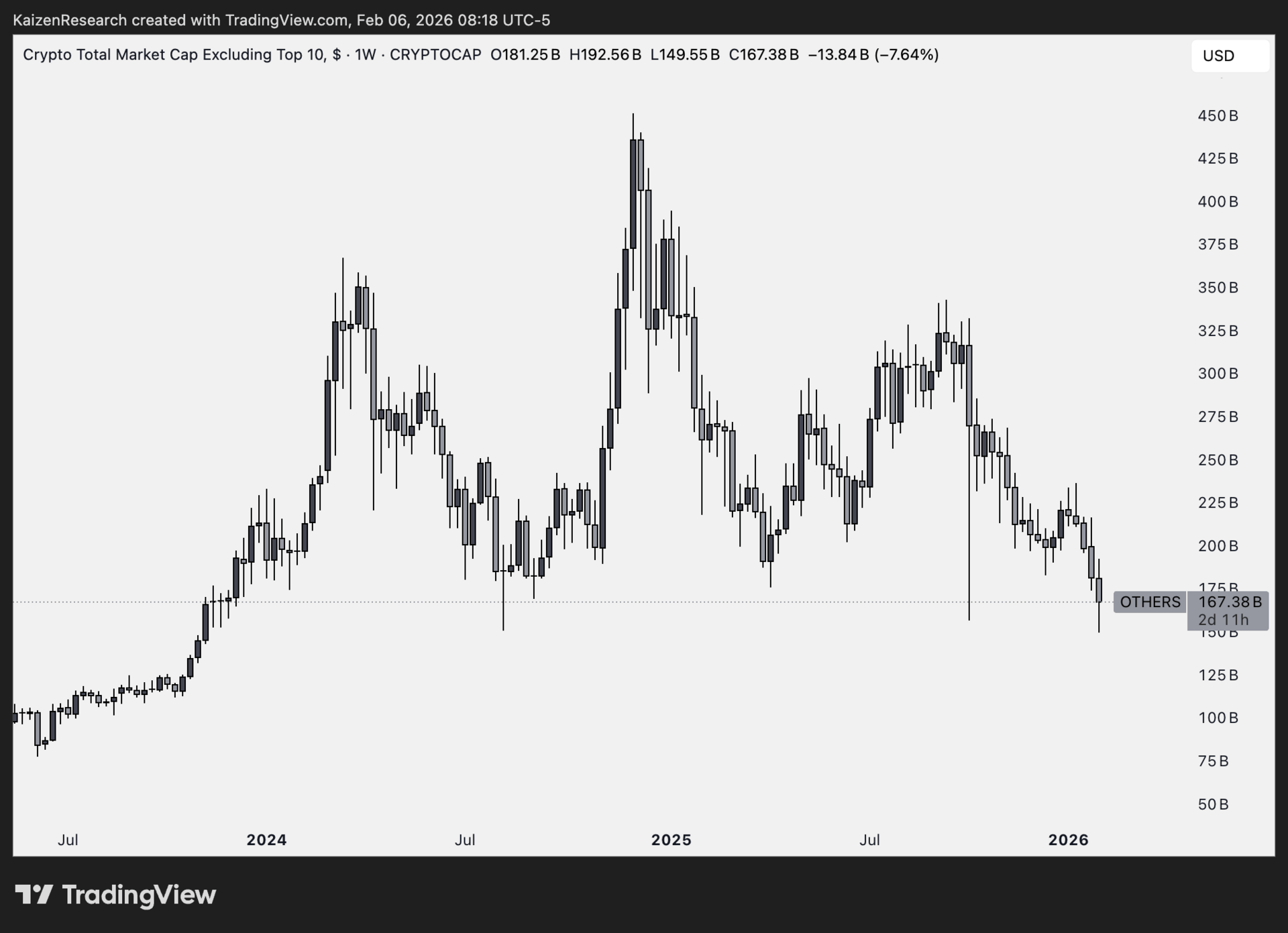

Bitcoin Erases the Trump Pump

What’s going on:

Bitcoin just had a brutal reset.

BTC fell 14% in a single day, briefly touching $60,000 and fully erasing all gains since Trump’s election. From the October peak near $126,000, that’s a 50% drawdown.

Liquidations surged past $2B across crypto, with $1.1B in Bitcoin derivatives alone. Fear & Greed collapsed to 5 extreme fear, a level not seen in years.

Altcoins were hit hard. XRP dropped over 20%, ETH fell 15% to around $1,750, and SOL slid to $69.

Adding fuel to the fire, Strategy reported a $12.4B Q4 loss. Bitcoin also slipped below Strategy’s $76K average cost, putting its BTC holdings underwater for the first time since 2023.

What it means:

This feels less like a correction and more like capitulation.

Key narratives are breaking at once. Gold is winning the macro hedge trade. AI is absorbing capital and attention.

The Trump trade has unwound. Institutions want stablecoins and RWAs, not tokens. With ETFs live and regulation improving, there’s no external villain left to blame.

But this is also the stress zone. Panic is rising, long-term holders are watching closely, and the “what’s going on with crypto?” texts are back.

No one can call the exact bottom, but at these levels, $60k-$50k looks much closer to the bottom than the top.

BTC Weekly EMA200 Decision Point

What’s going on:

Bitcoin broke below a major weekly support and is now trading under the weekly EMA200 (blue). This level usually separates bull and bear phases, so the next weekly close is critical.

Key levels we’re watching:

Support: Weekly EMA200 → must be reclaimed

Downside target: $50,000 if the weekly closes below EMA200

Upside scenario: 30–40% rally if BTC reclaims and closes back above EMA200

Directional Bias: Neutral

What we’re waiting for:

Weekly close relative to EMA200

Acceptance above EMA200, not just a wick

Follow-through to confirm this was a liquidation event, not trend failure

Why Tokens Struggle to Build Real Value

What’s going on:

This drawdown is exposing a hard truth in crypto. Tokens don’t compound the way equities do.

Equities grow because profits are reinvested. Management allocates capital, expands cash flows, and value builds on itself over time.

Most tokens don’t have that engine. Fees get distributed, not reinvested. No retained earnings. No compounding flywheel. A dollar earned today doesn’t create more dollars tomorrow.

That was intentional. Tokens were designed to avoid being treated like equity. The tradeoff is they also avoid behaving like equity.

What it means:

Crypto rewards timing, not patience. Equity rewards ownership and time.

That’s why capital is drifting toward crypto-enabled companies instead of tokens. Businesses can use crypto rails to cut costs and reinvest savings. Tokens mostly pass value through.

The tech is powerful. The economics aren’t there yet. Until they are, equities will keep compounding while most tokens won’t.

| HYPE: |

| BTC: |

| Gemini: |

| RNBW: |

Where do you think Bitcoin goes next? |

The real shift isn’t about being bearish on crypto, it’s about being realistic on where value can actually stick.

Infrastructure alone rarely captures the upside, the winners are the businesses that turn that infrastructure into recurring cash flow and reinvest it intelligently.

Until tokens evolve beyond pass-through economics, most of the compounding will happen off-chain, not inside protocols.

The next cycle won’t reward conviction alone, it will reward structures that can grow value even when narratives fade.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.