- The Warmup by Kaizen

- Posts

- Bitcoin Demand Is Cracking

Bitcoin Demand Is Cracking

PLUS: Firedancer Is Finally Live

Welcome back to The Warmup.

It’s Monday, markets are open, coffee is mandatory, and I’m heading to my computer to try to 10x the $25 my grandma sent me for Christmas shopping.

Here’s what we’re watching:

Market Snapshot

Firedancer Is Finally Live

Solana False Breakdown Play

Bitcoin Demand Is Cracking

Calendar

Market: Stocks are pushing higher with volatility falling, gold is ripping, and crypto is consolid reminding us that this is rotation, not risk off.

Firedancer Is Finally Live

What’s going on:

After years of delays, Firedancer is now live on Solana mainnet.

Firedancer has already been running quietly on a small set of validators for ~100 days, producing 50,000 blocks without issues.

The core problem it tackles is downtime. Until now, Solana effectively relied on a single validator client. If that client failed, the whole network stalled. Firedancer introduces a second, independent client, meaning if one goes down, the other keeps the chain running.

On top of that, Firedancer is built to boost real-world throughput by 2–3x, even on a network that’s already among the fastest in crypto.

What it means:

This is a big credibility unlock for Solana.

Uptime and reliability are non-negotiables if Solana wants to attract TradFi-scale activity and position itself as the “onchain Nasdaq.” Firedancer materially reduces systemic risk while improving performance.

Bottom line: Solana just removed one of its biggest red flags. This makes the network far more investable, usable, and competitive long term.

Solana False Breakdown Play

What’s going on:

Solana just invalidated a short-term bearish setup after a false breakdown from a bear flag.

Price reclaimed the flag and is holding above $123–$125, likely squeezing shorts and setting up a near-term bounce.

Key levels we’re watching:

Support: $123–$125

Resistance: ~$143

Upside target: ~$150

Invalidation: Close below $120

Directional Bias: Short-term bullish

What we’re waiting for:

Hold above $125

Momentum toward $140–$149

Tight risk management

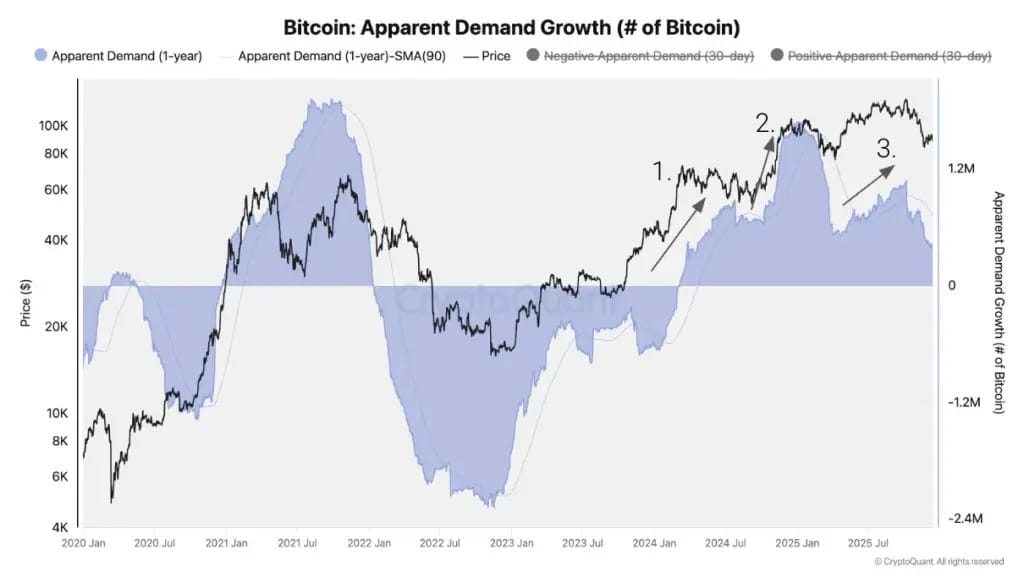

Bitcoin Demand Is Cracking

What’s going on:

Bitcoin demand has rolled over since October 2025, signaling a potential bear market phase.

Several indicators flipped bearish at once:

U.S. spot Bitcoin ETFs turned into net sellers

Institutional demand is cooling

Funding rates are declining

BTC fell below key technical support

The shift accelerated in mid-November, following the largest liquidation event in crypto history on Oct 10. Current downside scenarios point to $70K in the next 3–6 months, with $56K possible in H2 2026 if weakness persists.

What it means:

Bitcoin isn’t broken, but demand is fading.

This cycle’s main demand drivers are losing momentum, and large holders (100–1,000 BTC wallets) are growing below trend, a pattern last seen near the end of 2021.

With big buyers stepping back, upside becomes harder to sustain and price action turns into a grind.

This phase favors patience, discipline, and positioning, not chasing pumps.

Key Events this Week

Major token unlocks:

Plasma (XPL): ~$12M unlock on Dec 25 (~4.5% of supply)

Hyperliquid (HYPE): ~$250M unlock on Dec 29 (~2.5% of supply)

Macroeconomic data calendar:

Mon (Dec 22):

October PCE Inflation: The Fed’s preferred inflation gauge → softer prints ease policy pressure; hotter data keeps rates higher for longer.

Tue (Dec 23):

US Q3 2025 GDP: Measures overall economic growth → stronger growth supports risk assets; weakness raises slowdown concerns.

December CB Consumer Confidence: Tracks household sentiment → higher confidence signals resilient spending.

October New Home Sales: Snapshot of housing demand → strength supports construction and growth outlook.

Wed (Dec 24):

October Durable Goods Orders: Tracks big-ticket business spending → rising orders suggest capex strength; declines hint at caution.

Wed (Dec 25):

US Stock Market Closed: Merry Christmas 🎄

Firedancer is now live on Solana mainnet. What’s your take? |

We’re entering the messy middle of crypto, where everyone launches their own L1, their own stablecoin, and their own tokenized everything, all fighting for market share.

Price action has been brutal, even while adoption and fundamentals quietly keep improving.

That mismatch is the real test of conviction, whether you believe in the long-term thesis or you were just here for the chart.

The move from here is to stop gambling, avoid leverage, stick to majors, and let the macro and liquidity cycle rebuild into 2026.

And if tokenization ends up happening on banker chains with whitelists, we did not win, we just built nicer handcuffs, which is exactly why decentralization still matters.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.