- The Warmup by Kaizen

- Posts

- a16z Is Reloading

a16z Is Reloading

PLUS: 2026 Could Be Ethereum’s Year

Welcome back to The Warmup.

Happy Monday. Just a reminder to never copy trade people on CT.

Here’s what we’re watching:

Market Snapshot

a16z Is Reloading

IREN Breakout Setup

2026 Could Be Ethereum’s Year

Calendar

Market: SOL shows relative strength, BTC and ETH chop, volatility is rising, and gold is catching a bid.

a16z Is Reloading

What’s going on:

Andreessen Horowitz just pulled off one of the largest VC fundraises in recent years, raising $15B+ across multiple new funds.

This isn’t a one-off. a16z has been consistently deploying capital into crypto since 2018, scaling its commitment every cycle while others pulled back.

The new capital is spread across growth, apps, infrastructure, and “American Dynamism” funds, but the underlying theme is clear: Back the foundational layers that survive multiple cycles.

In crypto terms, that means:

Stablecoins and payments becoming real financial plumbing

Tokenized assets and settlement rails for institutions

Infrastructure that can onboard regulated capital at scale

Early positioning around crypto x AI convergence

As Ben Horowitz framed it, this is about shaping the next era of technology, not chasing short-term narratives.

What it means:

This is crypto maturing.

The next phase isn’t about flashy narratives. It’s about boring systems that quietly scale: stablecoins, tokenization, institutional infrastructure.

The most interesting optionality sits at the intersection of AI and crypto, where new primitives are still being defined.

Big money isn’t leaving crypto. It’s getting more selective, more patient, and more serious.

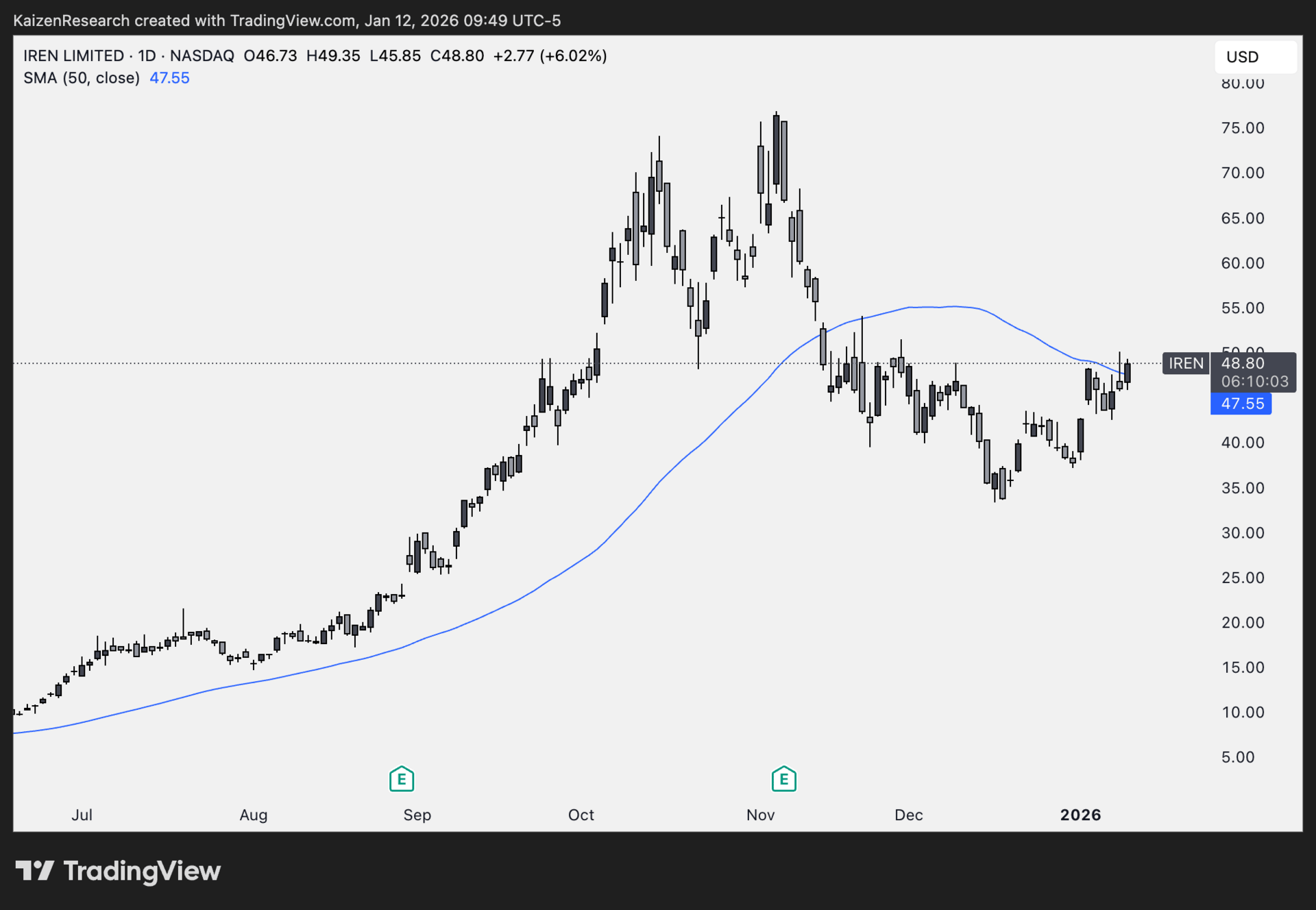

IREN Breakout Setup

What’s going on:

IREN is pressing into the 50-day SMA, a key resistance that’s capped price since November. Since the December low, it’s been printing higher lows and forming a rounded base, signaling sellers are getting absorbed.

A daily close above the 50-day SMA would flip the short-term trend bullish and likely attract momentum buyers.

Key levels we’re watching:

Support: $42–43

Resistance: $47–48 (50D SMA)

Breakout target: $55

Extension: $78 (Nov highs)

Invalidation: Close below $42

Directional Bias: Cautiously bullish

What we’re waiting for:

Daily close and hold above the 50-day SMA

Follow-through volume on the breakout

Tight risk management given nearby invalidation

2026 Could Be Ethereum’s Year

What’s going on:

Standard Chartered says 2026 will be the year of Ethereum.

The bank argues ETH’s relative fundamentals are improving, even as weaker Bitcoin performance weighs on the broader market. Ethereum continues to dominate stablecoins, tokenized real-world assets, and DeFi, with more than half of activity already settling on its network.

Usage is accelerating too.

Ethereum transaction counts are at new all-time highs, driven largely by stablecoins (now ~35–40% of transactions). Ongoing upgrades are boosting Layer 1 throughput, which has historically supported higher valuations.

Institutional flows also look better for ETH than BTC, with continued accumulation from Ethereum-focused treasury players.

What it means:

Standard Chartered trimmed near-term targets but raised long-term conviction.

ETH is projected at $7,500 in 2026, with upside toward $30k–$40k by 2029–2030.

| PUMP: |

| INX: |

| COIN: |

| Rain: |

Key Events this Week

Major token unlocks:

Ondo (ONDO): ~$777M unlock on Jan 18 (~57% of supply)

Official Trump (TRUMP): ~$275M unlock on Jan 18 (~12% of supply)

Macroeconomic data calendar:

Mon (Jan 12):

Markets React to Trump’s Call for a 10% Credit Card Rate Cap: Policy rhetoric risk → could impact banks, consumer credit, and broader financial stocks if taken seriously by markets.

Tue (Jan 13):

December CPI Inflation Data: Key inflation gauge → critical for rate expectations, USD, bonds, and risk assets. Higher CPI = stickier inflation narrative.

October New Home Sales: Measures demand for newly built homes → strength signals housing resilience; weakness points to higher-rate pressure on buyers.

Wed (Jan 14):

November PPI Inflation Data: Tracks producer-level price pressures → early signal for future CPI trends and corporate margin stress.

US Supreme Court Tariff Ruling (Expected): Trade policy wildcard → potential implications for inflation, supply chains, and global risk sentiment.

Thu (Jan 15):

January Philly Fed Manufacturing Index: Regional manufacturing activity survey → readings above zero suggest expansion; weakness signals slowing industrial momentum.

Major Earnings Releases:

Tue (Jan 13): JP Morgan

Wed (Jan 14): Wells Fargo, Citi, Bank of America

Thu (Jan 15): Morgan Stanley, Goldman Sachs, BlackRock

Fri (Jan 16): PNC, State Street

What part of a16z’s $15B raise matters most for crypto? |

Crypto in 2026 is shifting from speculation to execution.

Token launches like Lighter, enterprise moves from players like Walmart, and massive capital raises signal that infrastructure and real-world integration now matter more than hype.

Capital is concentrating around teams that can scale, comply, and actually ship.

The next phase won’t reward narratives alone, it will reward builders turning crypto into something users and institutions genuinely rely on.

— The Warmup Team

Always do your own research. This newsletter is supplemental material to help educate readers as they make their own decisions. Projects mentioned here are provided to give a potential early-mover advantage.